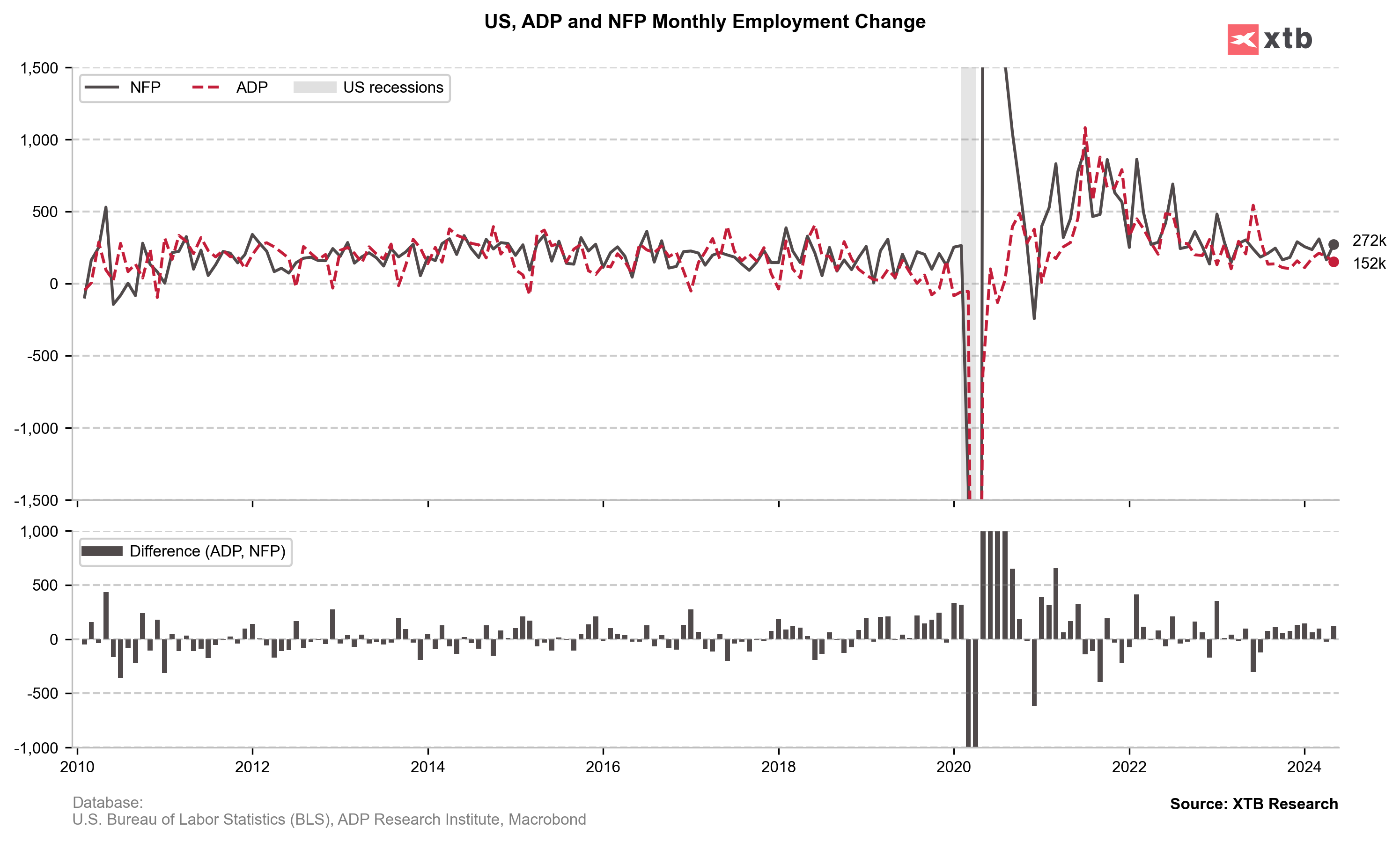

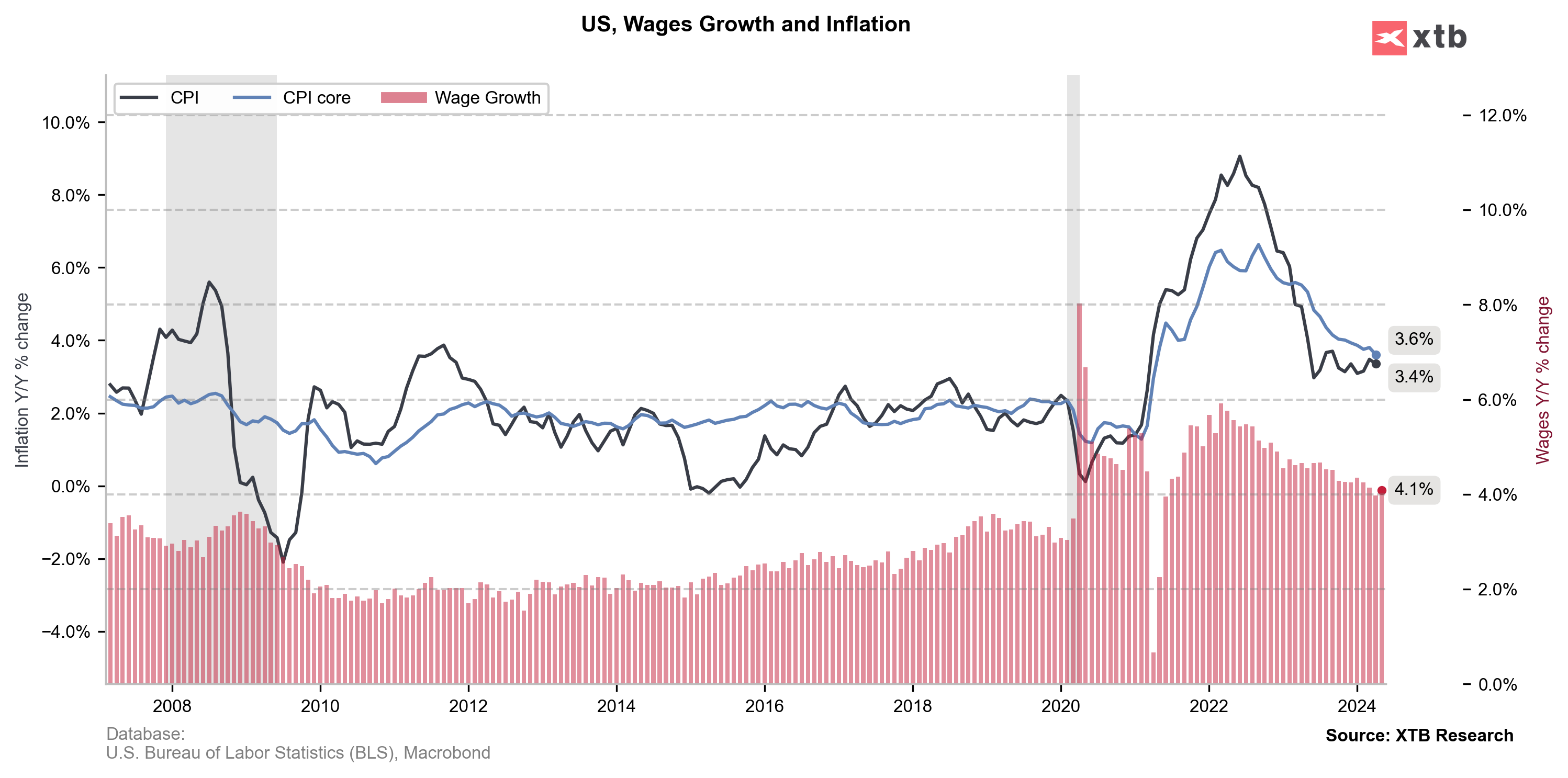

NFP report for May was a key macro release of the day. US jobs market data was released at 1:30 pm BST and was expected to show a slightly higher increase in employment than April's report. Annual wage growth was expected to remain unchanged at 3.9% YoY, but monthly wage growth was seen slowing from 0.5% MoM in April to 0.3% MoM in May.

Actual data turned out to be a hawkish surprise - employment growth turned out to be stronger-than-expected and wage growth unexpectedly accelerated. Such a reading makes it less likely for Fed to sent a dovish message on the next week's meeting. Markets reaction was hawkish as well - USD gained while US index futures dropped.

Money markets now pricing in around-55% chance of Fed cutting rates in September, down from aorund 70% before NFP report release.

US, NFP report for May

- Non-farm payrolls: 272k vs 185k expected (175k previously)

- Private payrolls: 229k vs 170k expected (167k previously)

- Unemployment rate: 4.0% vs 3.9% expected (3.9% previously)

- Participation rate: 62.5% vs 62.7% expected (62.7% previously)

- Wage growth (annual): 4.1% YoY vs 3.9% YoY expected (3.9% YoY previously)

- Wage growth (monthly): 0.4% MoM vs 0.3% MoM expected (0.5% MoM previously)

Source: xStation5

Source: xStation5

สรุปตลาดเช้า: ดอลลาร์ติดกับดัก ตลาดจับตา NFP คืนนี้ 🏛️

BREAKING: ยอดขายปลีกสหรัฐฯ ต่ำกว่าคาดการณ์

ปฏิทินเศรษฐกิจ: ดัชนีหุ้นและคู่สกุลเงิน EUR/USD รอตัวเลขการขายปลีกสหรัฐฯ

สรุปข่าวเช้า