While economic releases scheduled for today are scarce, the ones that will be published are definitely worth attention. European Commission will release a new set of economic forecasts today at 10:00 am BST. Traders should expect some short-term volatility in case forecasts differ significantly from the previous ones. Apart from that, FOMC minutes will be released in the evening (7:00 pm BST). Some Fed members hinted that taper discussions have begun during the latest FOMC meeting on 15-16 July and minutes may confirm this. If this is so, market reaction will depend on whether taper was only mentioned or was it discussed more in depth.

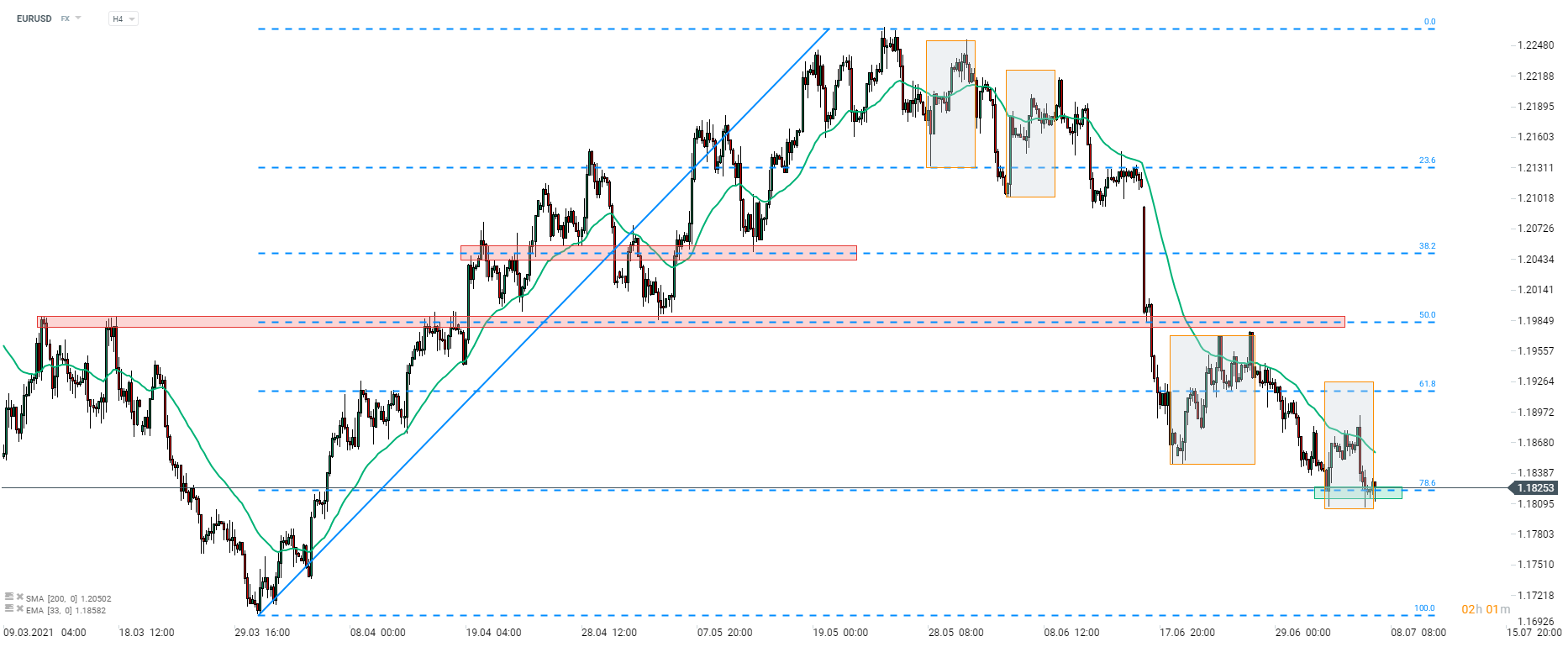

EURUSD halted what seemed to be an upward correction this week and pulled back towards the 1.1820 support area. This zone is marked with previous local high as well as 78.6% retracement of the upward move started at the end of March 2021. Pair can become more active following release of EC forecasts and FOMC minutes. Should we see a rebound, the major resistance to watch can be found in the 1.1920 area and is marked with 61.8% retracement and the upper limit of local market geometry.

Source: xStation5

Source: xStation5

ข่าวเด่นวันนี้

BREAKING: ยอดขายปลีกสหรัฐฯ ต่ำกว่าคาดการณ์

3 ตลาดสำคัญที่ต้องจับตาในสัปดาห์นี้

พรรคของ Takaichi ชนะเลือกตั้งในญี่ปุ่น – ความกังวลหนี้กลับมาอีกครั้ง? 💰✂️