Release of the US CPI data for July at 1:30 pm BST is a key event of the day. Market expects headline measure to decelerate from 5.4% to 5.3% YoY. Core gauge is seen dropping from 4.5% to 4.3% YoY. However, one should remember that actual CPI data turned out to be higher than expected during the past three releases. Having said that, one cannot rule out an acceleration in the US price growth in July. Should it be a major acceleration, USD may catch a bid. The latest solid data from the US jobs market has boosted odds for a quicker Fed taper announcement and another acceleration in price growth may only cement such a view. In such a scenario, apart from the USD strengthening, gold should weaken.

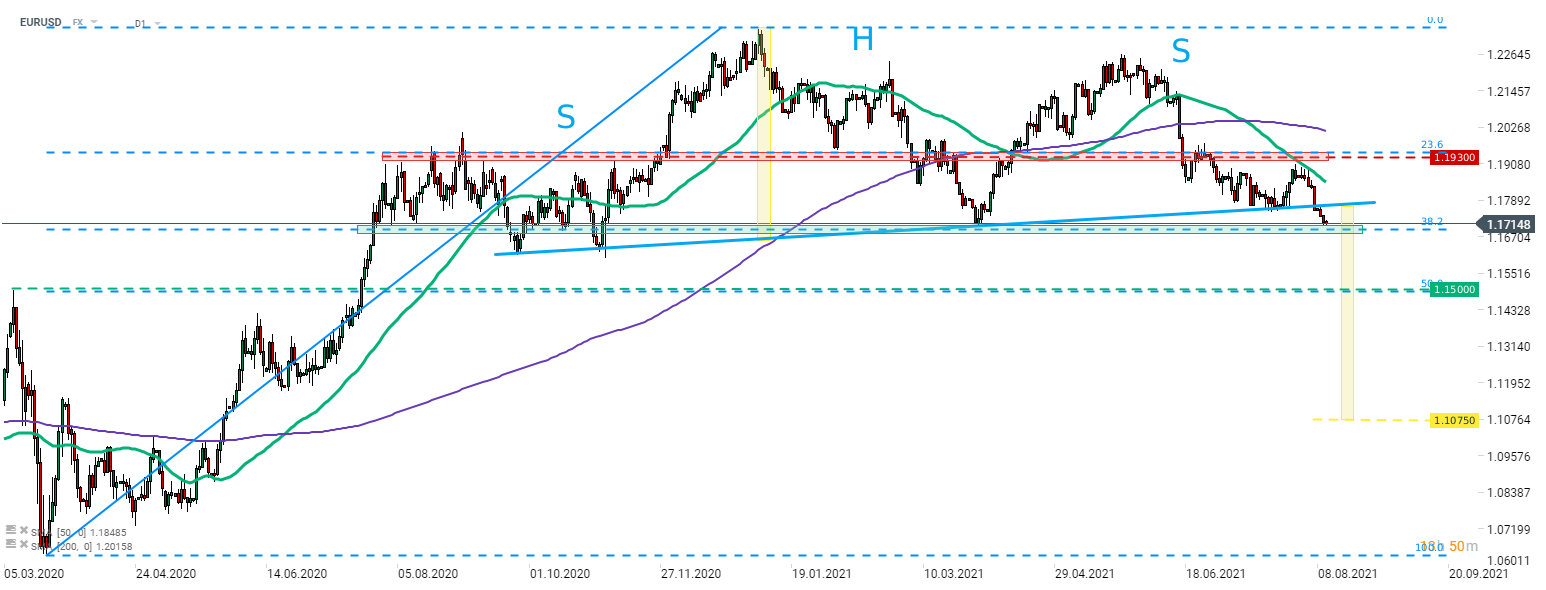

EURUSD has recently broken below the neckline of a large head and shoulders pattern. Potential range of the breakout from this pattern points to a drop below 1.1100. However, the pair needs to drop below the mid-term support area ranging around 38.2% retracement of the upward move launch in March 2020 (1.1700). Volatility on the pair is expected to jump around data release time (1:30 pm BST).

Source: xStation5

Source: xStation5

ตลาดเด่นวันนี้: EURUSD

สรุปข่าวเช้า 5 มี.ค.

สหรัฐขึ้นภาษีนำเข้าสินค้าขึ้นเป็น 15%

ดอลลาร์ชะลอขึ้น แต่ยังแข็งแรงระยะยาว❓💸