Rate decision from the European Central Bank is the main macro event of the day. Another 75 basis point rate hike looks like a done deal so attention will be on what comes next as well as how the Bank plans to cope with excess liquidity. Currently, expectations are for a 50 basis point rate hike in December and two 25 basis point rate hikes at the first two meetings of 2023 before the end of tightening. When it comes to excess liquidity, there is expectation for a tiering system on interests paid on excess reserves to be restarted but change of terms of TLTRO loans to make them more aligned with current market rates is also an option.

Apart from the ECB rate decision, traders should keep in mind that flash reading of US GDP for Q3 will be released at 1:30 pm BST and it is expected to show the US economy expanding after a contraction in Q2 2022. This means that EURUSD traders may be in for a wild ride in the early afternoon as ECB rate announcement will come at 1:15 pm BST, followed by US GDP report at 1:30 pm BST, which will be followed by Lagarde's presser at 1:45 pm BST.

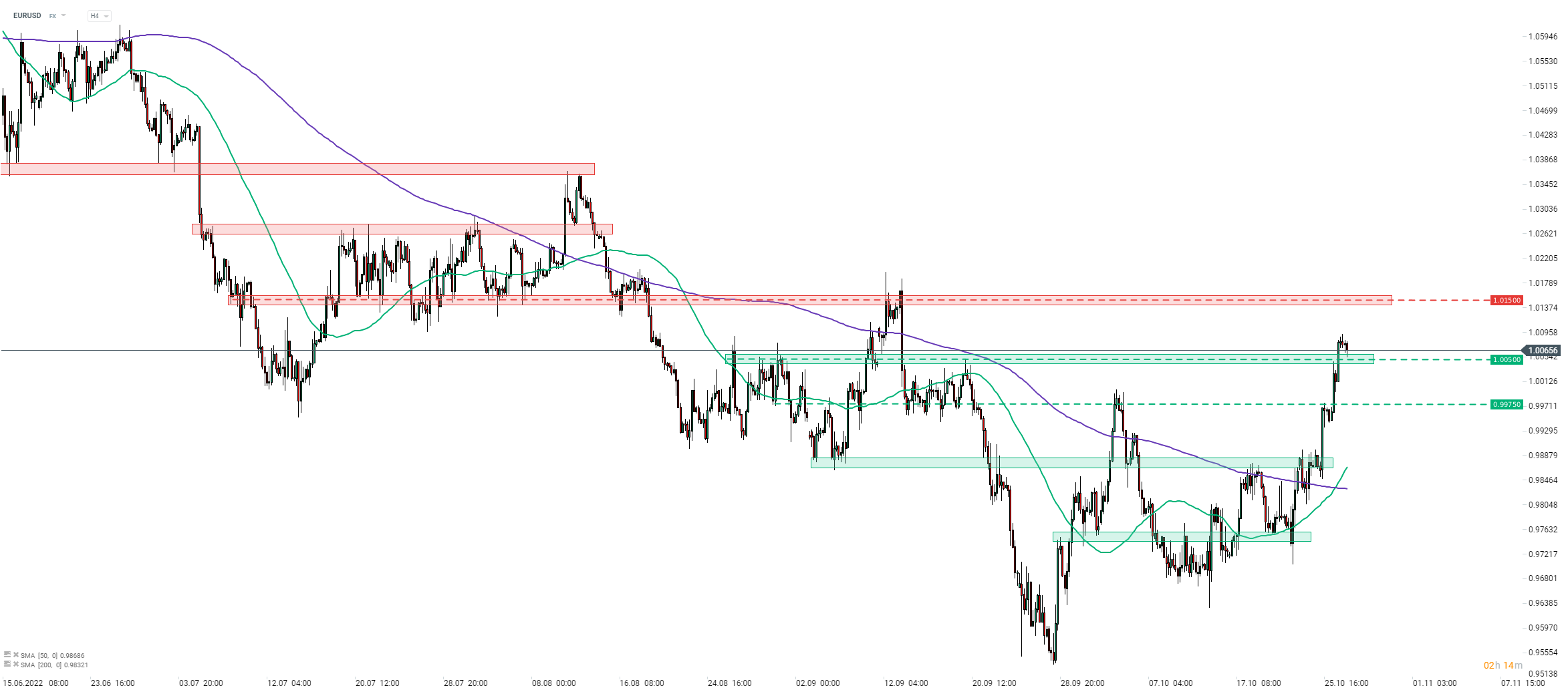

Taking a look at EURUSD chart at H4 interval, we can see that the pair is experiencing a pullback this morning. A test of the 1.0050 price zone was made and so far it looks like bulls have managed to defend it. The pair will likely be very volatile between 1:00 pm and 2:00 pm BST due to ECB decision, press conference and US GDP report release. The levels to watch during that period are 0.9975 support and 1.0150 resistance.

Source: xStation5

Source: xStation5

3 ตลาดที่น่าจับตาสัปดาห์นี้

ข่าวเด่นวันนี้ 9 มี.ค.

📉 Market Wrap: เงินทุนไหลออกจากยุโรป 🇪🇺

สรุปข่าวเช้า 6 มี.ค.