OPEC+ members announced massive voluntary oil output cuts over the weekend, triggering a spike in oil prices at the beginning of new week's trade. A total cut of 1.157 million barrels was announced by 8 OPEC and non-OPEC countries. Those cuts will take effect from May and will remain in force until the year of the year. On top of that, Russia announced that its 500 thousand barrel output cut, which was set to end by the end of June 2023, will be extended until the end of 2023. This is a massive reduction in supply, amounting to more than 1% of global output, and it should not come as a surprise that oil prices jumped over 5% at the beginning of a new week. However, it should be noted that such massive oil output cuts may also hint that OPEC has some serious concerns about demand outlook. Having said that, this may not be bullish for oil prices in the long-term. OPEC+ Joint Minister Monitoring Committee is meeting today and will provide recommendations on policy. It was widely expected that recommendation will be for no change in the output but weekend announcements created uncertainty.

OPEC: 1,079k bpd

- Saudi Arabia: 500k bpd

- Iraq: 211k bpd

- United Arab Emirates: 144k bpd

- Kuwait: 128k bpd

- Algeria: 48k bpd

- Oman: 40k bpd

- Gabon: 8k bpd

OPEC+: 578k bpd

- Kazakhstan: 78k bpd

- Russia: extension of 500k bpd cut until end of the year (was set to end in June)

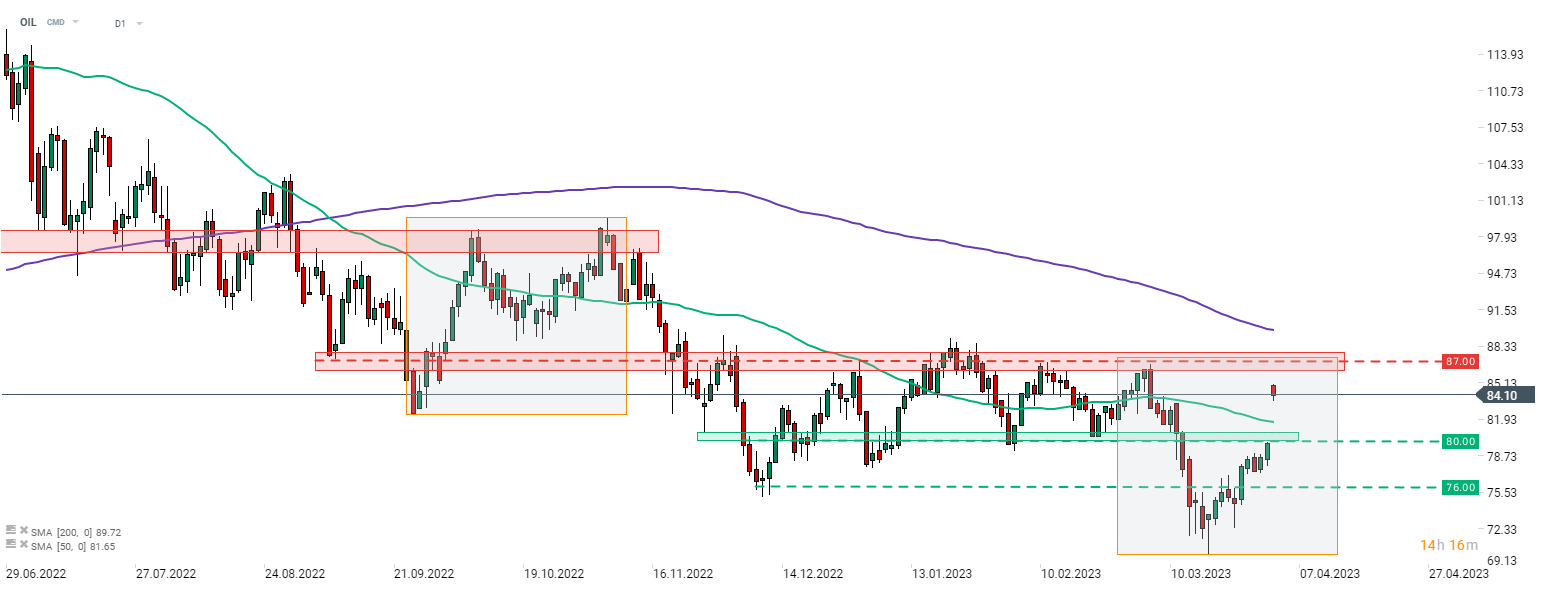

Brent (OIL) launched this week's trading with a big bullish price gap but those gains started to be erased later on. Nevertheless, oil continues to trade around 5% higher on the day. A point to note, however, is that price did not manage to reach a key resistance zone in the $87 area, marked with previous price reactions and the upper limit of the Overbalance structure. This means that the outlook remains bearish and an attempt to fill the bullish price gap cannot be ruled out. The $80 area is the first support to watch in such a scenario.

Source: xStation5

Source: xStation5

สรุปข่าวเช้า 5 มี.ค.

ข่าวเด่นวันนี้ 5 มี.ค.

🚨 สถานการณ์อิหร่าน: ภาพรวมปัจจุบันและแนวโน้ม

🚨 ด่วน: สต็อกน้ำมันเพิ่มขึ้นแรงอีกครั้ง – WTI ใกล้แตะ 74 ดอลลาร์