Just two days ago, we wrote that the main tech companies index, Nasdaq 100, was striving to break the 15,000-point level. After a strong nearly 8.0% correction that began at the end of July, the index rebounded with significant gains last Friday. At the beginning of this week, the mood in the tech sector started to improve, and in yesterday's session, the index gained a staggering 1.60%, returning again above the support line of the upward trend. After the close, Nvidia's results were published, further solidifying the optimistic sentiment for the Nasdaq 100. Despite the return to euphoric growth, investors should remain focused. The Jackson Hole symposium begins today, where market leaders and bankers are expected to signal the end of the interest rate hike cycle. Reality might again prove different. Recent comments from Federal Reserve members and the Fed's stance suggest that the Fed might not give in so easily, especially since the job market remains strong, and the latest inflation readings were higher than the previous ones, 3.2% year-on-year versus 3.0% year-on-year.

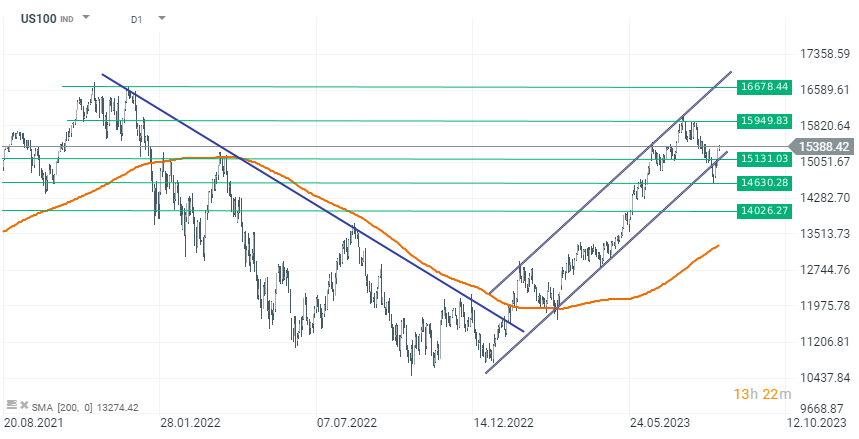

Nasdaq 100 (US100), after four days of gains, continues to rise today, gaining 0.40% before the Wall Street opening. The index has returned above the support line of the rising trend marked on the chart with a navy line. Currently, the bulls are battling resistance at the 15,400-point level. If the momentum isn't halted, it's conceivable the index might aim to retest the peaks at 15,900-16,000 points. However, if hawkish remarks are made during Jerome Powell's speech at Jackson Hole tomorrow, the market might once again retreat below the support line currently at around 15,100 points. Source: Xstation 5

Nasdaq 100 (US100), after four days of gains, continues to rise today, gaining 0.40% before the Wall Street opening. The index has returned above the support line of the rising trend marked on the chart with a navy line. Currently, the bulls are battling resistance at the 15,400-point level. If the momentum isn't halted, it's conceivable the index might aim to retest the peaks at 15,900-16,000 points. However, if hawkish remarks are made during Jerome Powell's speech at Jackson Hole tomorrow, the market might once again retreat below the support line currently at around 15,100 points. Source: Xstation 5

สหรัฐขึ้นภาษีนำเข้าสินค้าขึ้นเป็น 15%

สรุปตลาด: หุ้นยุโรปและสหรัฐพยายามรีบาวด์ฟื้นตัว 📈

VIX พยายามปรับตัวขึ้นแต่ติดขัด แม้ความไม่แน่นอนในวอลล์สตรีทยังสูง 🔎

ข่าวเด่นวันนี้ 4 มี.ค.