-

USDJPY pair is influenced by a weaker dollar and lower bond yields

-

A potential BoJ intervention effectively repel USDJPY from 145 level

-

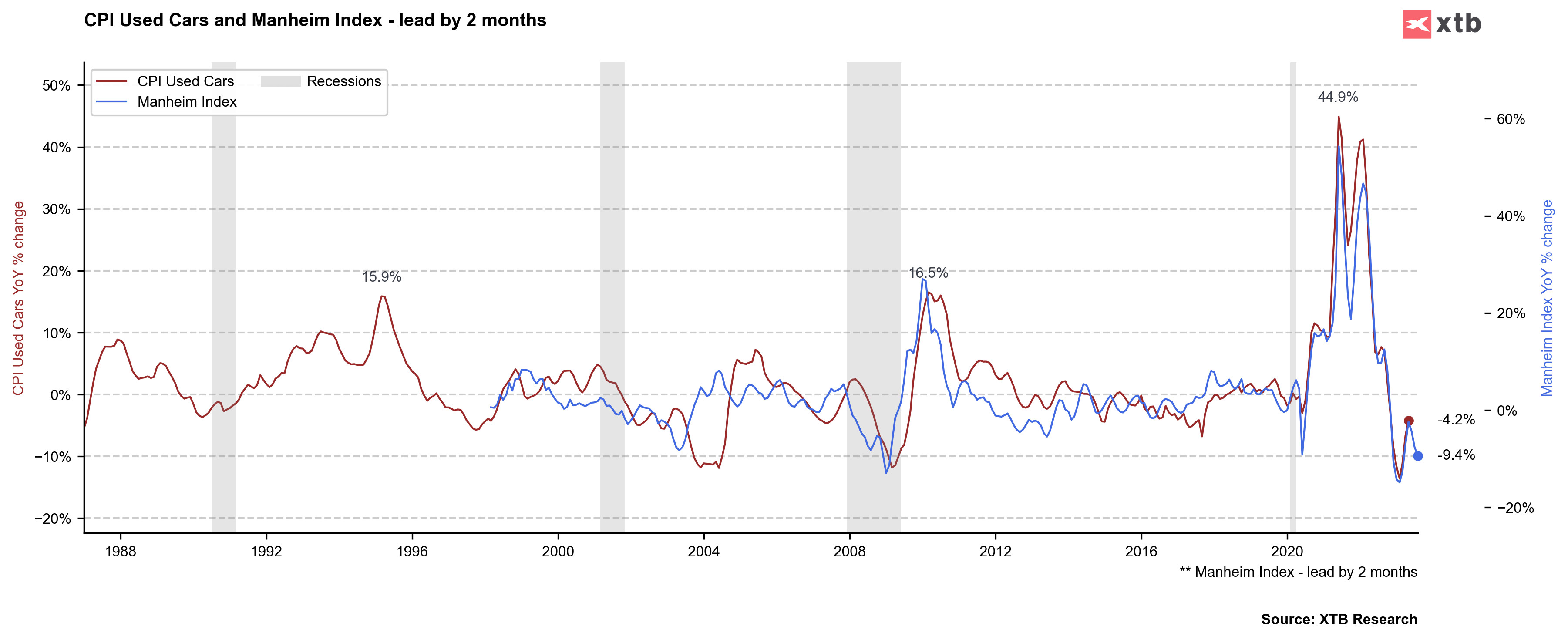

Decline in the used car price index, which correlates with US core inflation, contributes to lower expectations

USDJPY pair faced downward pressure as a result of the US dollar weakening and lower bond yields. Traders expect softer US CPI figures which could be confirmed by a decline in the used car price index, which closely reflects core inflation. The resistance at the 145.00 level in USDJPY persists, possibly due to potential intervention by the Bank of Japan. The dollar's recent weakness has also contributed to its decline against the euro and sterling.

USDJPY pair faced downward pressure as a result of the US dollar weakening and lower bond yields. Traders expect softer US CPI figures which could be confirmed by a decline in the used car price index, which closely reflects core inflation. The resistance at the 145.00 level in USDJPY persists, possibly due to potential intervention by the Bank of Japan. The dollar's recent weakness has also contributed to its decline against the euro and sterling.

USDJPY - It is anticipated that the pair will continue to face downward pressure, with focus shifting towards the 140.00 level. Currently, the pair is trading within the range of 140.00 to 145.00 and market participants are awaiting the US CPI data for further confirmation.

ข่าวเด่นวันนี้

BREAKING: ยอดขายปลีกสหรัฐฯ ต่ำกว่าคาดการณ์

3 ตลาดสำคัญที่ต้องจับตาในสัปดาห์นี้

พรรคของ Takaichi ชนะเลือกตั้งในญี่ปุ่น – ความกังวลหนี้กลับมาอีกครั้ง? 💰✂️