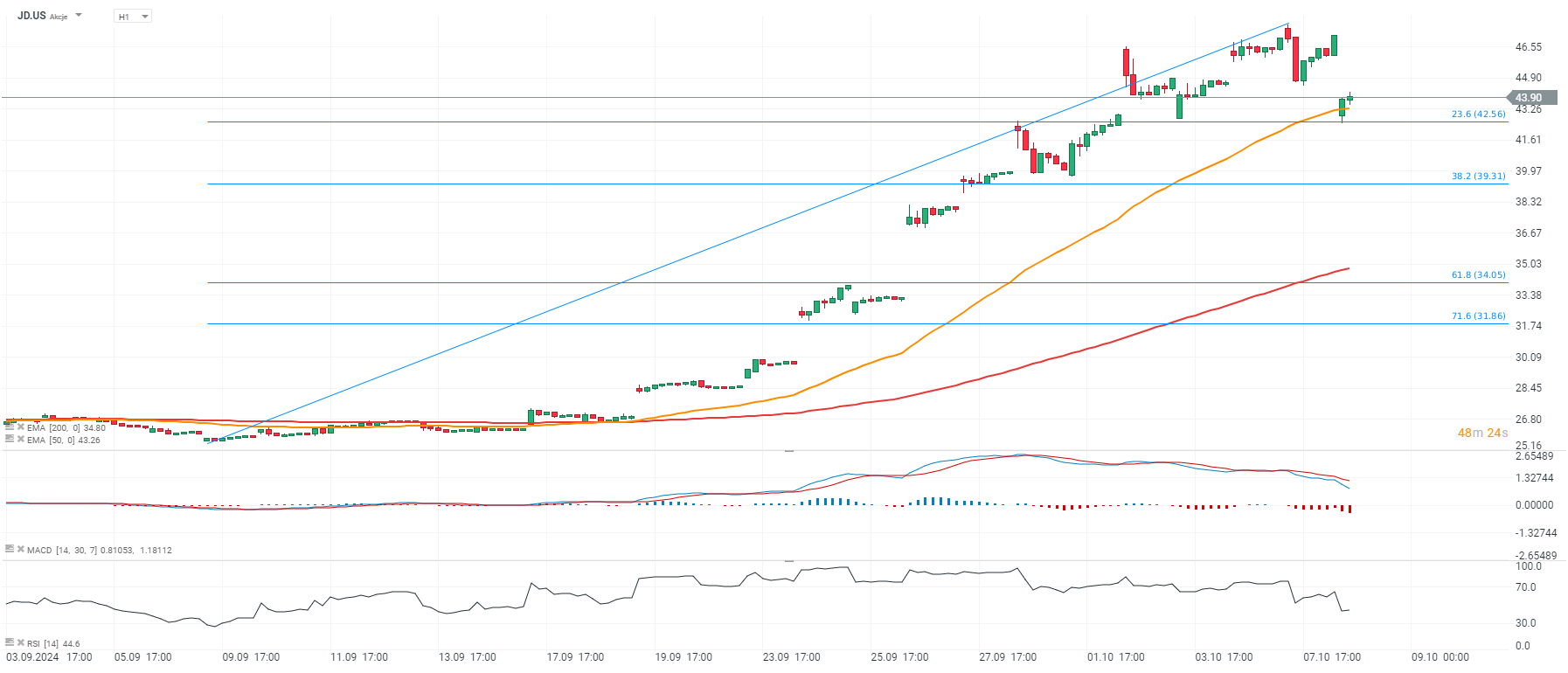

Shares of Chinese giants like JD.com (JD.US), Alibaba (BABA.US), Tencent (TME.US), and Yum!China (YUM.US) are trading in the 6 to 8% range today. A number of companies are even posting double-digit declines, driven by massive profit-taking in China, which has been on an unprecedented upswing. The Hang Seng Index retreated nearly 9.5% today, the strongest since 2008, after an announcement by Chinese authorities on expectations for further steps to stimulate the economy 'disappointed' exorbitant expectations.

It seems, however, that fundamentals may still be in favor of Chinese equities; as long as incoming macro data for September and October show at least a noticeable improvement, relative to recent months. However, this is not a foregone conclusion. Chinese authorities still expect this year's growth to 'meet current forecasts,' which seemed an insufficiently optimistic statement for 'Wall Street,' excited by the prospect of a strong rebound in Chinese demand. As a result, the mass of investors decided to realize profits, after the Hang Seng Index rallied more than 30%. China's Commerce Minister Wang Wentao spoke with US Commerce Secretary Gina Raimondo today and 'urged the US' to improve the business environment, for Chinese businesses operating in the United States.

Source: xStation5

Palo Alto เข้าซื้อกิจการ CyberArk! ก้าวสู่การเป็นผู้นำใหม่ในวงการไซเบอร์ซีเคียวริตี้

เหลือเวลาไม่กี่วัน รับหุ้น GRAB ฟรี ⏳

📅 ปฏิทินเศรษฐกิจ: ตัวเลข NFP และ รายงานปริมาณน้ำมันคงคลังสหรัฐฯ 💡

ข่าวเด่นวันนี้