Although ICE has recently reported record cocoa inventories in European and American ports, the market is pricing in the risk of limited supply, primarily from the Ivory Coast, the world's leading cocoa exporter. The country is currently facing a pest infestation that could significantly reduce yields. Additionally, the record decline in cocoa exports from Nigeria, another important cocoa-producing country (ranked 5th globally), has supported the bullish sentiment. Nigerian exports fell by 42% MoM and nearly 34% YoY in May. COCOA is up nearly 3% today.

April data from Europe indicated that the amount of cocoa beans ground into chocolate mass reached levels not seen since the first quarter of 1999. The number of ground cocoa beans in Asia also increased by 4% YoY, signaling global demand for chocolate and cocoa by-products. According to the six largest cocoa bean processors worldwide, their cocoa grinding volume rose by 22% YoY. The prospect of high demand and limited supply from key exporters supports further price increases for the commodity.

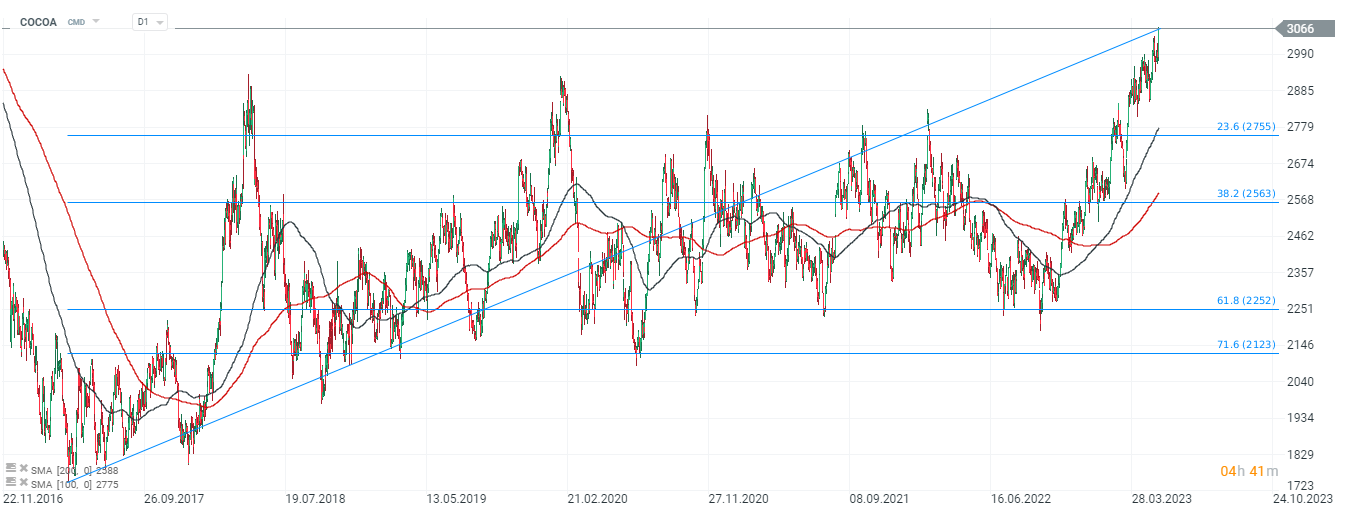

COCOA has reached levels last seen in 2016. In the event of a correction, a key support level could be the 23.6% retracement of the upward wave that began in 2016, around 2775 USD. This level is also determined by previous price reactions, represented by several previous peaks. Source: xStation5.

สรุปข่าวเช้า 5 มี.ค.

ข่าวเด่นวันนี้ 5 มี.ค.

🚨 สถานการณ์อิหร่าน: ภาพรวมปัจจุบันและแนวโน้ม

🚨 ด่วน: สต็อกน้ำมันเพิ่มขึ้นแรงอีกครั้ง – WTI ใกล้แตะ 74 ดอลลาร์