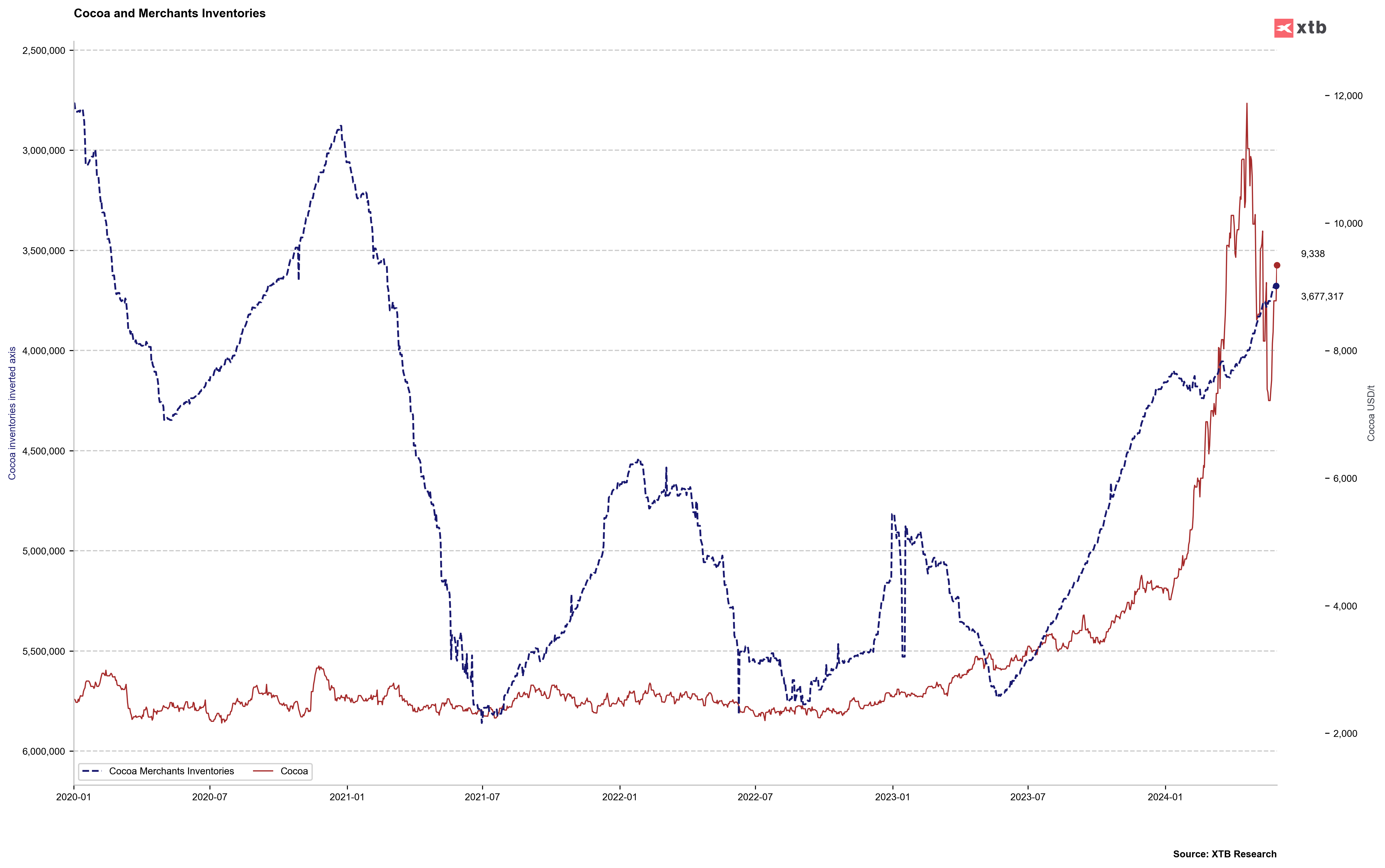

COCOA is the best performing commodity today, with front-month futures contract jumping 8%! Fundamental outlook is the driver of the move with WeatherDesk from Maxar Technologies, the US satellite technology company, saying that weekend rainfalls in West Africa help improve soil moisture, but were inefficient to fully restore moisture supplies. As such, the risk to next season's cocoa output in the region remains. Meanwhile, merchant inventories of cocoa beans continue to drop and has moved to the lowest level since Q1 2021 (blue line, inverted axis on the chart below). Declining inventories as well as still-present concerns over future supply are a perfect mix for cocoa prices to rise, with COCOA climbing to a 4-week high today.

Source: Bloomberg Finance LP, XTB Research.

Source: Bloomberg Finance LP, XTB Research.

COCOA rallies 8% today. Price traded even higher earlier today but bulls failed to break above the $9,400 per ton resistance zone, and a small pullback began. Source: xStation5

สหรัฐขึ้นภาษีนำเข้าสินค้าขึ้นเป็น 15%

ทองคำและเงินฟื้นตัวหลังการขายออก 📈

น้ำมัน: ราคายังคงปรับตัวขึ้นแม้สหรัฐเสนอให้กองทัพเรือคอยคุ้มเรือ📌

ข่าวเด่นวันนี้ 4 มี.ค.