-

Wall Street indices traded lower during the first trading session after a long weekend. Indices launched today's cash trading lower and continued to drop. However, declines started to be recovered later on

-

S&P 500 and small-cap Russell 2000 drop around 0.3%, Dow Jones trades 0.5% lower and Nasdaq declines 0.1%

-

European stock market indices traded lower today. German DAX dropped 0.5%, French CAC40 and UK FTSE100 traded over 0.2% down and Dutch AEX slumped almost 0.8%. Spanish IBEX was outperformer with a 0.1% gain

-

ECB's Villeroy said that inflation is already past peak in euro area and may move near 2% target by the end of 2024

-

People's Bank of China lowered the 1- and 5-year loan prime rate by 10 basis points to 3.55 and 4.20%, respectively. While a cut to 1-year LPR was in-line with market expectations, 5-year LPR was expected to be cut by 15 basis points to 4.15%

-

Minutes of Reserve Bank of Australia showed that recent unexpected rate hike was driven by inflation taking longer to reach its target. However, RBA noted that the decision on a hike was close and it led to a drop in market's pricing of future RBA rate hikes

-

US housing market data for May surprised positively. Building permits jumped 5.2% MoM to 1491k (exp. 1425k) while housing starts were 21.7% MoM higher at 1631k (exp. 1400k)

-

Cryptocurrencies gained today with Bitcoin jumping almost 4% to a fresh two-week high

-

Energy commodities traded lower today - oil drops 1% while US natural gas prices decline almost 5%

-

Precious metals pulled back after USD caught a bid following solid housing market data. Gold trades 0.7% lower, silver slumps 3% and platinum drops 1.2%

-

USD and JPY are the best performing major currencies while AUD and NZD lag the most

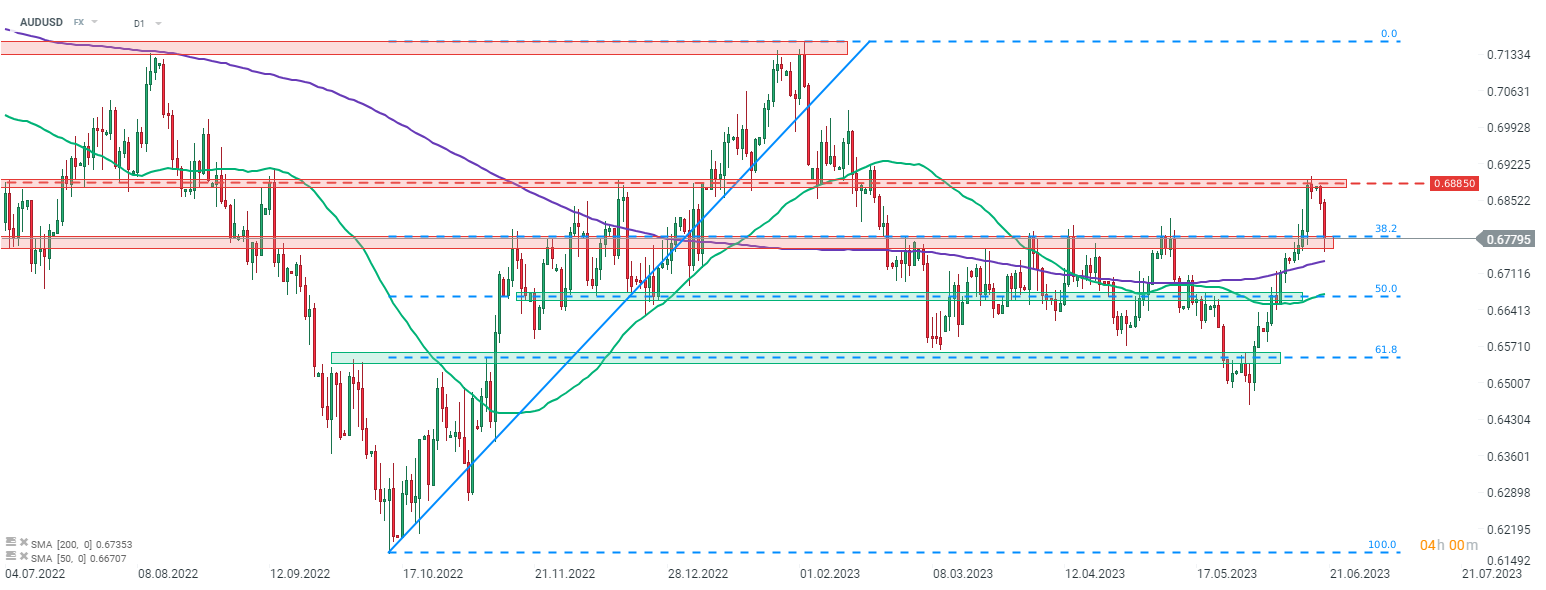

AUDUSD took a big hit today as RBA minutes turned out to be dovish and US housing market data beat expectations by a huge margin. The pair deepens pullback launched after a failed attempt at breaking above the 0.6885 resistance zone and tests 38.2% retracement today. Source: xStation5

AUDUSD took a big hit today as RBA minutes turned out to be dovish and US housing market data beat expectations by a huge margin. The pair deepens pullback launched after a failed attempt at breaking above the 0.6885 resistance zone and tests 38.2% retracement today. Source: xStation5

ข่าวเด่นวันนี้

BREAKING: ยอดขายปลีกสหรัฐฯ ต่ำกว่าคาดการณ์

3 ตลาดสำคัญที่ต้องจับตาในสัปดาห์นี้

พรรคของ Takaichi ชนะเลือกตั้งในญี่ปุ่น – ความกังวลหนี้กลับมาอีกครั้ง? 💰✂️