- European stocks post their best week since November 2020

- Wall Street gains following Biden-Xi phone call

- Crypto bulls become more active

European indices finished today's session higher tand recorded best weekly performance since November 2020 despite lack of progress of Ukraine-Russia peace talks. Also Russia paid US$117 million in interest due on two sovereign dollar bonds, easing doubts about its ability to honour external debt after harsh sanctions imposed by the West. Meanwhile Ukrainian President Zelensky called for additional sanctions against Putin’s regime as Russian troops started to attack Lviv, a city located not far from the Polish border. On the corporate front, German arms manufacturer Rheinmetall stock jumped nearly 5% after UBS, Deutsche Bank, and HSBC lifted their target prices for its shares. Yesterday Ukrainian Prime Minister Denys Shmyhal urged Nestle CEO Mark Schneider to rethink the company's decision to continue its operations in Russia. DAX 30 finished the week around the 14,400 level and posted its second weekly gain.

Major Wall Street indices cut early losses and resumed upward movement following the phone call between U.S. President Joe Biden and his Chinese counterpart Xi Jinping over Russian aggression in Ukraine. China stated that the current conflict is convenient for everyone and that all states should focus on bringing peace as soon as possible. Biden described the consequences if China provides material support to Russia and reassured that US policy on Taiwan has not changed. On the other hand, today's session was full of hawkish speeches by FOMC committee members. Waller pointed to a 50bp hike at the next FED meeting, Kashkari said that the pace of balance sheet reduction should be doubled. Barkin called for caution and a thorough analysis of the current economic situation. However, he stated that if inflation did not start to normalize, a 50 bp hike would be advisable. US100 index trades 1.5%higher, while the US500 and US30 rose 0.60% and 0.205 respectively.

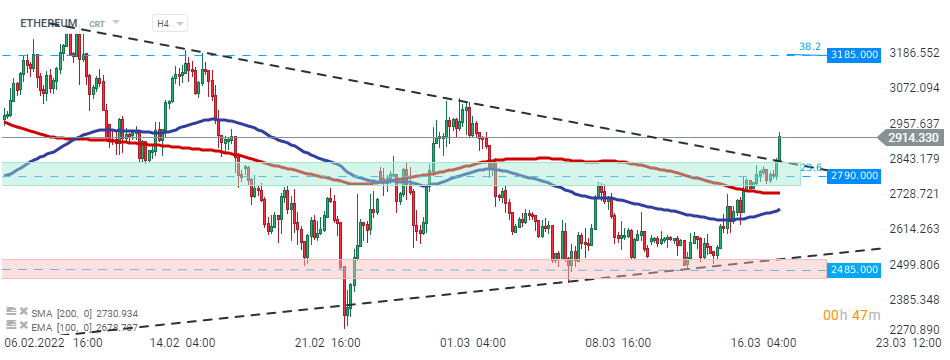

The commodity market is relatively diversified today. On the one hand, the so-called soft commodities, i.e. coffee, sugar or cotton recorded gains. Meanwhile wheat and corn fell more than 2%. Gold prices drop below the $ 1,930 barrier due to improving sentiment in the US market. Brent and WTI crude oil prices remain above the psychological barrier of $ 100 a barrel amid weaker dollar and elevated treasury yields. Upbeat moods prevail on the cryptocurrency market. Bitcoin is testing resistance at $41,500 while Ethereum managed to break above resistance at $2900.

Ethereum managed to break above the major resistance zone around $2790.00, which is marked with lower limit of the triangle formation and 23.6% Fibonacci retracement of the last downward correction. Upward move was sparked by possible supply shortage. Nearly 10% of the altcoin's supply has been pulled out of circulation through staking in the ETH2 contract. Source: xStation5

สรุปข่าวเช้า

US100 ร่วง 1.5% 📉

ข่าวเด่นวันนี้

🚨 ทองคำร่วง 3% ขณะที่ตลาดเตรียมตัวเข้าสู่ช่วงหยุดตรุษจีน