Germany's DAX lost 0.3%, while the CAC40 and FTSE100 indices jumped 0.36% and 1.3% respectively after the Bank of England, as expected, raised its interest rate by 0.25%, as did the Fed yesterday. Unlike the US central bank, the BoE reverted to a dovish narrative and lowered its forecast to reach a 2% interest rate by the end of 2022, as the UK economy faces challenges from greater reliance on energy imports. Meanwhile, geopolitical tensions continue to weigh on market sentiment. The Russian government said a report of significant progress in talks on Ukraine was "wrong" but that negotiations would continue. Meanwhile, Ukraine's representative said the government had not changed its position that international borders that have existed since 1991 should continue to be recognised. On the data front, Eurozone inflation rose to a record 5.9% last month, slightly higher than the initial estimate (5.8%).

Wall Street is doing relatively well today, despite further reports of possible chemical weapons use in Ukraine and hawkish comments during yesterday's US interest rate hike decision. The US100 returned above the 14,000 point barrier. However, sentiment began to weaken shortly after the Secretary Blinken notified that China was considering supporting Russia with arms and ammunition. The White House has warned that China's possible military support will not go unanswered.

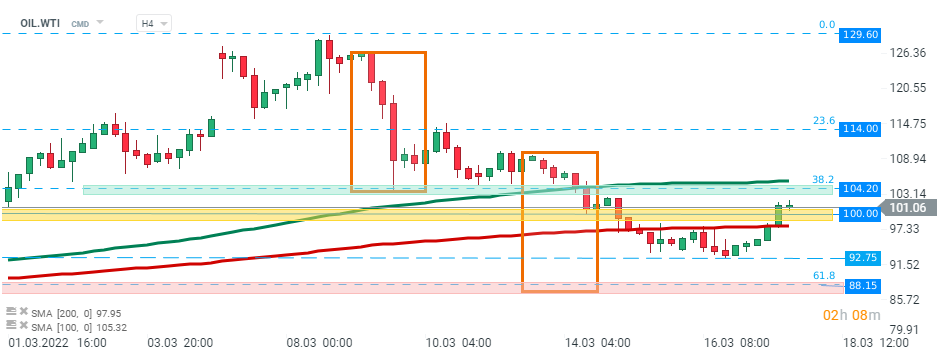

The commodity market is seeing gains today, driven by the return of war pessimism and Powell's hawkish tone in commenting on the interest rate hike decision yesterday. US 10-year bond yields jumped to 2.17%. The biggest increases today belong to energy commodities, where Brent and WTI crude oil returned above the psychological barrier of $100 per barrel. Good sentiment also persists in the precious metals sector, with palladium gaining over 4% and gold returning to the $1,950 area.

Cryptocurrencies have also regained some ground, with Bitcoin back above $40,000. Ethereum is doing much better, posting a more than 2% gain and returning above the $2,800 barrier.

Despite recent selling pressure, WTI crude oil managed to bounce off local support at $92.75 and break the psychological level of $100.00, which now acts as the nearest support. WTI crude oil jumped more than 7.0% during today's session and if the current sentiment continues, resistance at $104.20 could be threatened. This level is marked by the 38.2% Fibonacci retracement of the last upward wave. Source: xStation 5

สรุปข่าวเช้า

ข่าวเด่นวันนี้

🚨 ทองคำร่วง 3% ขณะที่ตลาดเตรียมตัวเข้าสู่ช่วงหยุดตรุษจีน

ราคาช็อกโกแลต (Cocoa) ร่วง 2.5% แตะระดับต่ำสุดตั้งแต่ตุลาคม 2023 📉