- DE30 jumped to 5-Week High

- Wall Street extends rally

- OIL. WTI briefly dropped below $100.00 per barrel

European indexes finished today's session sharply higher, with DAX up more than 2.5%, the highest level since mid- February after a Russian negotiator said that the Ukraine talks have entered a practical phase and that the Zelensky-Putin meeting could take place in the future. Meanwhile Ukraine proposed adopting a neutral status but with international guarantees that it would be protected from attack. Also the Russian Deputy Defense Minister said that Russia is willing to scale military activity near Ukraine’s Kyiv and Chernihiv. However moods worsened this afternoon after US intelligence revealed that this may be a move which aims to regroup Russian forces and launched another better prepared offensive. Across sectors, autos jumped nearly 6% to lead the gains as all sectors traded in positive territory except basic resources and oil and gas, which dropped approximately 2% each.

Major Wall Street indices extended yesterday gains, with Dow up more than 0.40%, the S&P 500 rising 0.70% and the Nasdaq 1.45%, as investors weighed on reports that the first day of talks between Russia and Ukraine had constructive dialogue. Stocks of defense companies like Lockheed Martin and Northrop Grumman are moving lower during today's session, which could be a sign that investors are counting on the suspension of military operations and the continuation of Kyiv-Moscow negotiations. Meanwhile stocks of Tesla, Amazon, Costco and Shopify, which recently announced a share split, rose sharply. The biggest banks, JP Morgan, Bank of America and Wells Fargo cut some of the early gains. Shares of technology companies Intel, Nvidia, Adobe and Palantir are trying to stave off declines for good and resume upward move. In turn, oil companies Exxon Mobil and Chevron took a hit, similar to the raw material giants Rio Tinto and BHP Billiton.On the data front, the number of job openings in the United States came at 11.266 million in February, little changed from January and in line with analysts’ estimates. This week the market will focus on Friday's NFP data to measure the job market's strength further and gauge the outlook for monetary policy.

Inflation concerns eased slightly as oil prices briefly dropped below the $100-per-barrel mark, extending a 7% fall the day before. Precious metals also took a hit early in the session, however bulls regained some ground after the US open. Meanwhile cryptocurrencies swung between gains and losses. Bitcoin is currently trading slightly below the flatline while Ethereum bounced of the major resistance at $3500.

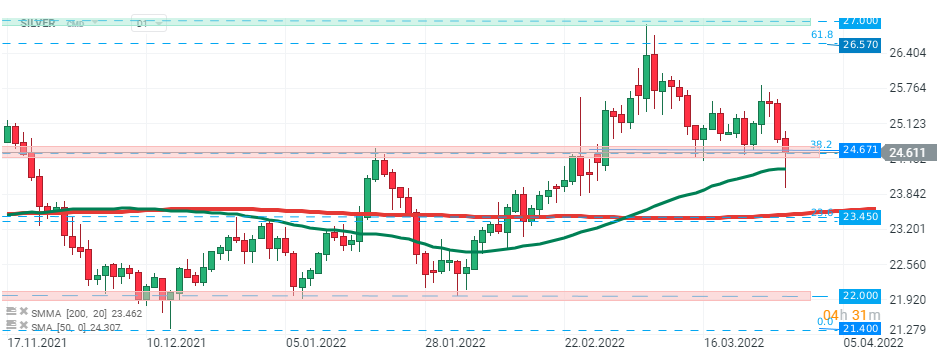

Silver price fell sharply during the European session, however buyers managed to regain control after US traders joined the market. Price erased most of the early losses and returned above major support at $24.67 which coincides with 38.2% Fibonacci retracement of the last major downward correction. Source: xStation5

Silver price fell sharply during the European session, however buyers managed to regain control after US traders joined the market. Price erased most of the early losses and returned above major support at $24.67 which coincides with 38.2% Fibonacci retracement of the last major downward correction. Source: xStation5

US100 ร่วง 1.5% 📉

ข่าวเด่นวันนี้

🚨 ทองคำร่วง 3% ขณะที่ตลาดเตรียมตัวเข้าสู่ช่วงหยุดตรุษจีน

ราคาช็อกโกแลต (Cocoa) ร่วง 2.5% แตะระดับต่ำสุดตั้งแต่ตุลาคม 2023 📉