-

FOMC delivered a 75 bp rate hike, in-line with market expectations

-

New FOMC projections showed downward revisions to GDP growth forecast and upward revisions to inflation and unemployment forecasts

-

New FOMC dot-plot showed rates at 4.4% at the end of 2022, compared to 3.4% in June forecast. Terminal rate still seen in 2023 but at 4.6%

-

Indices dipped and USD gained following decision but those moves were reversed during Powell's press conference amid lack of further hawkish comments

-

Gold and silver jumped during Powell's press conference as the market took it as dovish. Silver gains 3% while gold trades over 1% higher

-

US indices trade higher with Nasdaq leading the gains (+1.2%). Dow Jones is top laggard but still gains around 0.5% at press time

-

Russian President Vladimir Putin announced a partial mobilization. It will cover reservists and former soldiers. Russia plans to mobilize around 300 thousand additional troops

-

European stock market indices finished today's trading higher. German DAX, UK FTSE 100 and French CAC40 gained 0.6-0.8%. Main Russian indices slumped around 4%

-

China has put Tangshan city, an important steel-making hub, under lockdown

-

DOE report confirmed a smaller-than-expected build in US oil inventories signaled by API report yesterday (+1.14 mb vs +2.3 mb expected)

-

US existing home sales dropped from 4.82 million to 4.80 million in August (exp. 4.71 million)

-

Oil had a volatile session today, jumping after Putin's address and pulling back later on. Brent currently trades around 0.5% higher

-

AUD and NZD are top performing G10 currencies while EUR and GBP lag the most

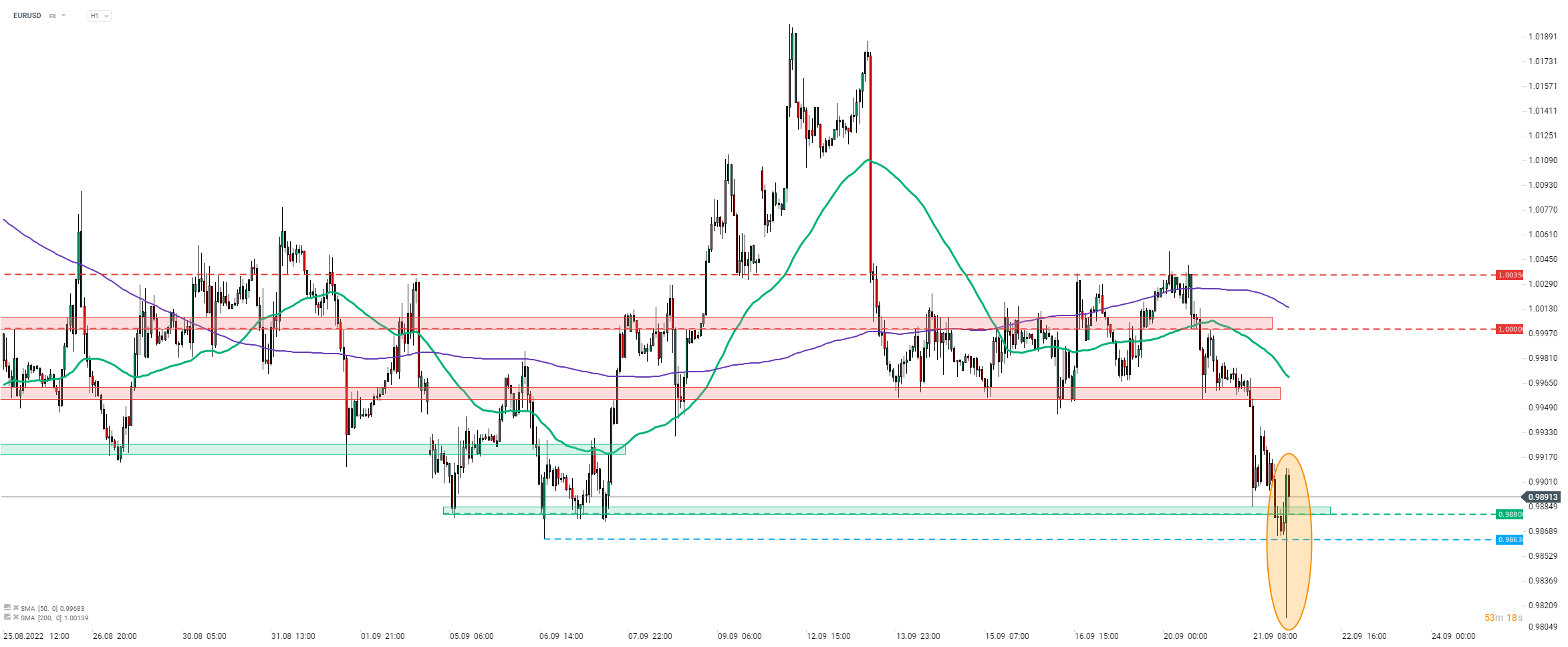

EURUSD plunged to a fresh 20-year low after Fed decision announcement as US dollar strengthened on hawkish dot-plot. However, the move was reversed during Powell's press conference. Source: xStation5

EURUSD plunged to a fresh 20-year low after Fed decision announcement as US dollar strengthened on hawkish dot-plot. However, the move was reversed during Powell's press conference. Source: xStation5

ข่าวเด่นวันนี้

BREAKING: ยอดขายปลีกสหรัฐฯ ต่ำกว่าคาดการณ์

3 ตลาดสำคัญที่ต้องจับตาในสัปดาห์นี้

พรรคของ Takaichi ชนะเลือกตั้งในญี่ปุ่น – ความกังวลหนี้กลับมาอีกครั้ง? 💰✂️