During the first session of the new trading week, we saw a deceleration of stock market gains, most of the major stock market indices from Europe ended the day higher, but the gains were limited, with the FTSE100 gaining 0.66%, the DAX adding 0.08% and the CAC40 losing 0.1%.

U.S. indices, which finished last week phenomenally, fared worse. Today, all major stock indexes from overseas are trading under the bar, and the weakest performer is the Nasdaq, where the discount reaches 0.8%.

Monday brought a strengthening of the U.S. currency, with the dollar gaining most strongly against the British pound, where GBPUSD is trading more than 1% lower . The euro and yen are losing 0.75% against the USD, while the franc is trading 0.55% lower, and AUD and CAD are off 0.25%

U.S. bond yields continue to rise, with today's move on the 10-year reaching +0.8%.

As White House official said, Biden will call on oil and gas companies to invest record profits in lowering costs for American families.

Russia has withdrawn from the operation of the so-called Safe Export Corridor for grains, including Ukrainian wheat and corn, which are posting massive rallies in response. UN-moderated negotiations on the operation of the above agreement were still underway this weekend. Cutting off Ukraine's ability to export grains once again creates the threat of a food crisis in Africa and the Middle East.

The crypto market is sharply divided today. Small projects such as Dogecoin and Binancecoin are gaining more than 5%. Bitcoin, on the other hand, is losing nearly 1% and struggling to hold the $20,000 level.

The precious metals market remains in a downtrend today. Gold is down more than 0.5%, while Palladium is losing nearly 2.2%. Silver is doing much better, trading near Friday's closing levels. The strengthening of the dollar, as well as rise in U.S. bond yields, are translating into a pullback in the precious metals market.

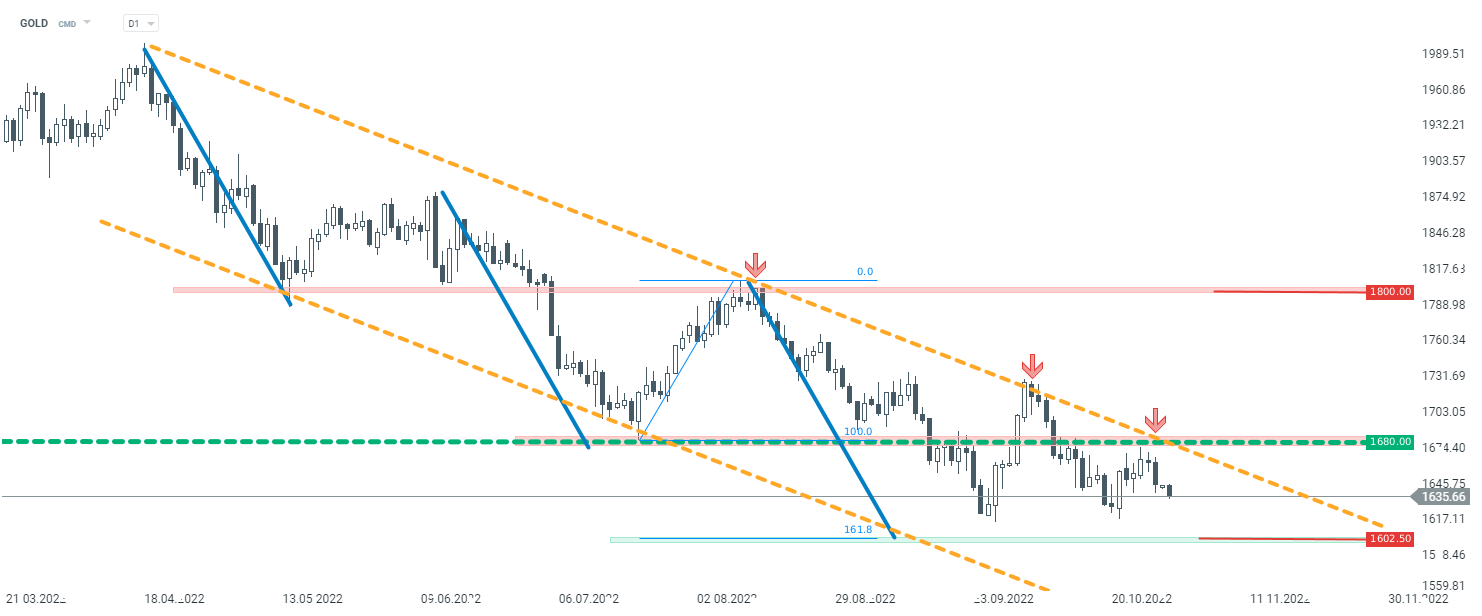

Gold quotes remain in a downtrend. Looking technically at the D1 interval, the price remains below the key resistance zone at $1680. According to classic technical analysis assumptions, a move toward support at $1602.5, where the parity with the last two downward impulses falls, is not excluded.

Gold D1 interval. Source: xStation5

ข่าวเด่นวันนี้

🚨 ทองคำร่วง 3% ขณะที่ตลาดเตรียมตัวเข้าสู่ช่วงหยุดตรุษจีน

ราคาช็อกโกแลต (Cocoa) ร่วง 2.5% แตะระดับต่ำสุดตั้งแต่ตุลาคม 2023 📉

ก๊าซธรรมชาติ (NATGAS) ผันผวนน้อย หลังรายงานการเปลี่ยนแปลงสต็อกของ EIA