-

US economy added 850k jobs in June (est. 700k)

-

Wall Street climbs to new record highs

-

European stock indices mixed

-

OPEC+ talks drag on, oil prices swinging

Friday was all about key jobs data from the United States and OPEC+ talks. The NFP report showed that the US economy added 850k jobs in June (vs exp. 700k). Average hourly earnings increased 0.3%, below forecasts of 0.4% so the report eased inflation fears a bit. As the headline number topped expectations, US equity markets hit fresh all-time highs.

The initial reaction on the FX market following the NFP release was rather mixed. However, several hours after the publication the US dollar is weakening against most of its peers as the risk of rapid monetary tightening eased (due to wage growth miss). The CAD is the strongest among major currencies. Gold and silver prices are also moving higher amid weaker USD.

European stock markets finished the day mixed. The German DAX added 0.30% while blue chip indices from the UK, France and Italy closed more-or-less flat. Oil traders are still staying on the sideline as OPEC+ delayed its decision. The meeting started late and, according to commodity markets correspondents, has not finished yet. Brent and WTI prices are swinging near the flatline at press time.

Commodity traders will stay on watch today due to OPEC+ meeting. Apart from that, one should expect thinner volume on Monday as Americans will celebrate Independence Day and US stock markets will be closed. Regular trading in US stocks and bonds will resume on Tuesday.

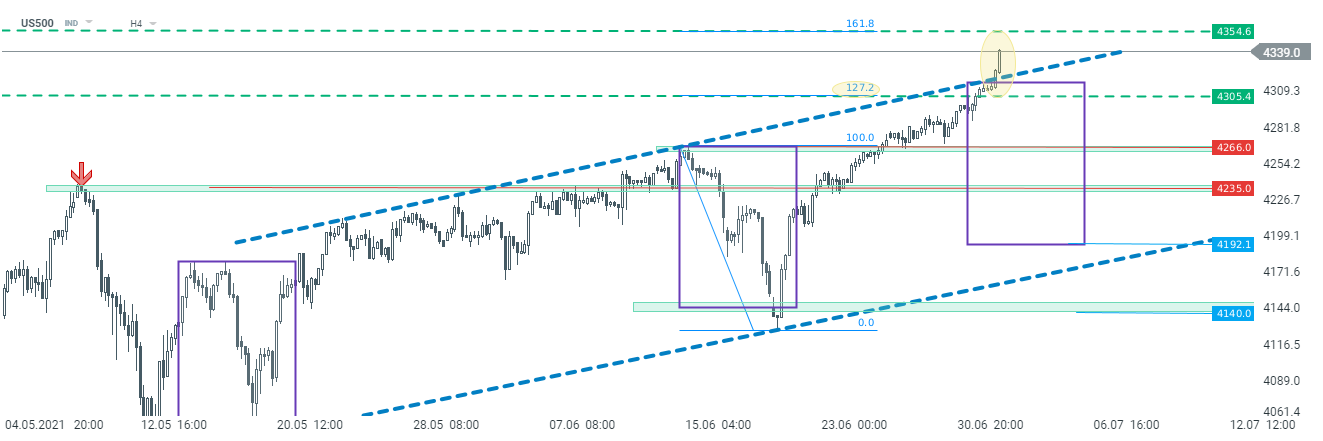

US500 advanced and hit new all-time highs after long-awaited NFP data, which topped expectations. The index climbed above the upper limit of an upward channel. Currently there are 2 near-term levels to watch: 4,354 pts (the 161.8% Fibonacci retracement) and 4,305 pts (the 127.2% Fibonacci retracement) of the recent drop. Source: xStation5

BREAKING: ปริมาณสำรองน้ำมันสหรัฐเพิ่มขึ้นอย่างมหาศาล!

BREAKING: US100 พุ่งแรง หลังรายงาน NFP สหรัฐแข็งแกร่งกว่าคาด

📈 ราคาทองพุ่ง 1.5% ก่อน NFP ทำระดับสูงสุดตั้งแต่วันที่ 30 มกราคม

Silver พุ่ง 3% ในวันนี้ 📈