- Major European indices finished today's session higher, with DAX rose 0.48%, the highest since January 2022, whileCAC40 reached new all-time high at 7400 pts.

-

ECB's chief economist Lane said it would be appropriate to raise interest rates further beyond the March meeting as inflation in the bloc remained high.

-

ECB's Holzmann hopes that peak interest rates will be reached in the next year and calls for 50 bp hikes at the next 4 meetings.

-

US indices also trade higher, with Dow Jones gaining 0.26%, while S&P 500 Nasdaq rose 0.40% and 0.45% respectively

-

JPMorgan CEO Dimon: Consumer is currently in great shape, but this will come to an end at some point.

-

Apple stock rose over 2.5% after Goldman Sachs initiated coverage on the iPhone maker with a "buy" rating. .

-

The markets are waiting for Powell's testimony on Tuesday and job data on Friday.

-

Precious metals pulled back amid a slightly stronger dollar. Gold fell below the $1850 mark, while silver retreated towards support at $21.00.

-

Cryptocurrencies are trading higher however the scale of moves is rather negligible as uncertainties surrounding Silvergate and Binance capped upward move. Bitcoin is trading below resistance at $22,500, while Ethereum defended support at $1550.

-

Mixed moods prevail on the energy commodities market. WTI gains slightly, while Brent oscillates around flatline as the Chinese government set a modest 5% target for economic growth this year, which sparked speculation that the reopening of the world's second-largest oil consumer would not spur demand as initially thought. Meanwhile, WSJ reported a growing rift between two of OPEC's biggest producers, Saudi Arabia and the UAE, sparking fears of a crack in the cartel's policy which could lead to more supplies.

-

NATGAS fell over 10.0% and tested support at $2.55, the biggest daily decline since December 14, on expectations of lower demand in the next two weeks after forecasts pointed to milder weather.

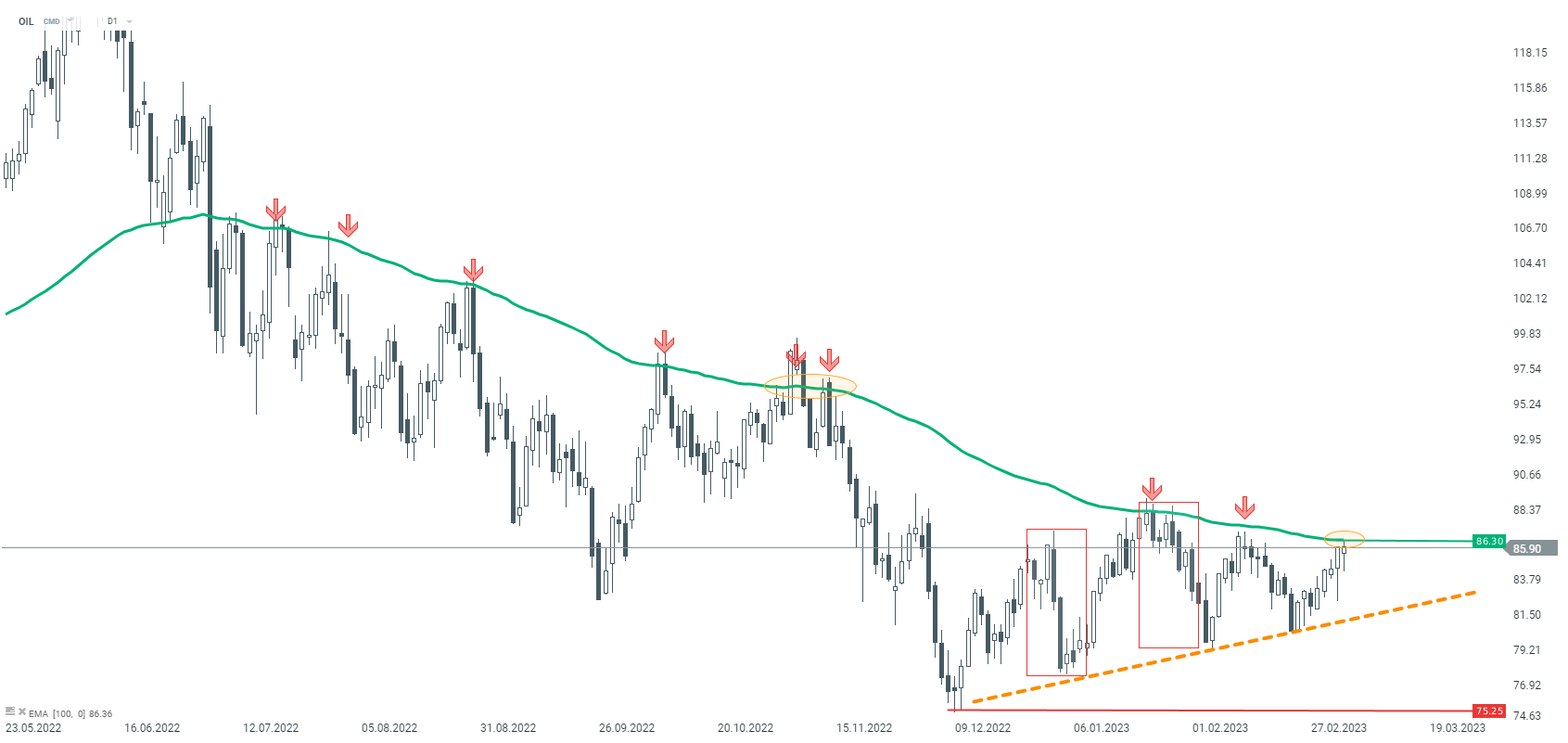

Crude oil (OIL) once again tests the key EMA100 average, which several times managed to fend off the buyers. Therefore the $86.30 level should be treated as nearest medium-term resistance. An upward breakout may herald a change of the main sentiment to bullish. Otherwise, if sellers manage to regain control, another downward impulse towards local upward trendline may be launched . Source: xStation5

📉 Market Wrap: เงินทุนไหลออกจากยุโรป 🇪🇺

📈 ราคาน้ำมันพุ่ง 6% – จะเกิดซ้ำเหมือนปี 2022 หรือไม่? 🛢️

🚩 US500 ร่วงก่อนตลาดสหรัฐเปิด ขณะที่ดัชนี VIX พุ่งขึ้น 6%

สรุปข่าวเช้า 6 มี.ค.