- European stocks near records

- FOMC minutes did not surprise the markets

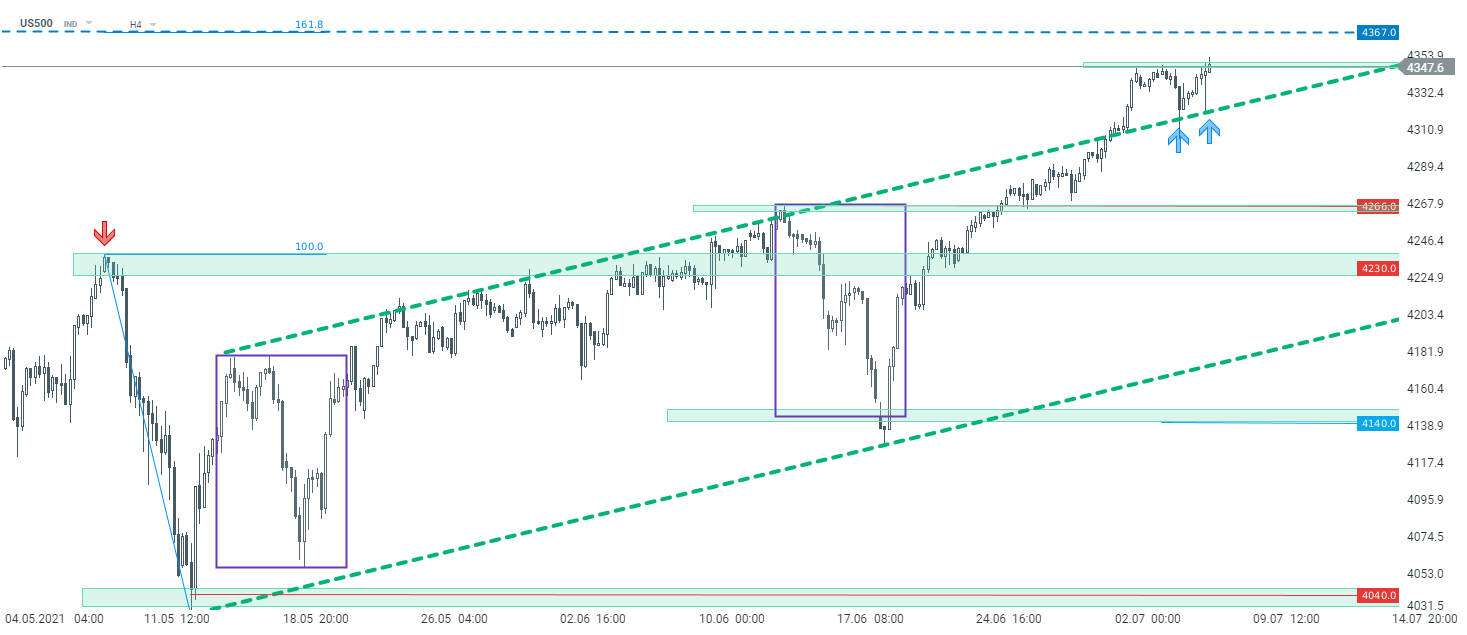

- US500 hit new all-time high

- Crude oil price fell sharply

European indices finished today's session higher near record-high levels after the European Commission revised upwards its Eurozone GDP and inflation forecasts for 2021 and 2022. DAX 30 added 1.17%, CAC 40% rose 0.31% and FTSE100 finished 0.71% higher. Meanwhile US indexes are trading higher after the Federal Reserve’s FOMC minutes showed FED officials felt that substantial further progress on the economic recovery was generally seen as not having yet been met suggesting the Fed would keep its monetary support for now. The S&P 500 and Nasdaq hit a fresh record high as big tech stocks gained after the yield on the benchmark 10-year Treasury note edged lower towards 1.3%, hovering around its lowest level since mid-February.

There is little volatility in the Forex market today. Mixed moods persist towards the end of the session. Only the NZDUSD currency pair deserves attention, where we observe a 0.3% increase. The GBPUSD and AUDUSD pairs both rise around 0.1%. The US dollar appreciates slightly against CAD, EUR and CHF, however moves oscillate here around 0.1%.

Much more was happening in the crude oil market today, where we could observe another day of declines. Brent crude oil fell by 1.9%, while WTI is trading over 2% lower. The declines intensified after information about a potential increase in production by the UAE. It's worth noting, however, that the WTI price hit the key support at $ 72.50.

US500 bounced off the upper limit of the previously broken ascending channel, which confirms that the uptrend remains intact. If the current sentiment prevails, there is a chance that the upward impulse will accelerate towards the resistance at 4367 pts, which is marked by the 161.8% external Fibonacci retracement. Source: xStation5

US500 bounced off the upper limit of the previously broken ascending channel, which confirms that the uptrend remains intact. If the current sentiment prevails, there is a chance that the upward impulse will accelerate towards the resistance at 4367 pts, which is marked by the 161.8% external Fibonacci retracement. Source: xStation5

BREAKING: ปริมาณสำรองน้ำมันสหรัฐเพิ่มขึ้นอย่างมหาศาล!

BREAKING: US100 พุ่งแรง หลังรายงาน NFP สหรัฐแข็งแกร่งกว่าคาด

📈 ราคาทองพุ่ง 1.5% ก่อน NFP ทำระดับสูงสุดตั้งแต่วันที่ 30 มกราคม

Silver พุ่ง 3% ในวันนี้ 📈