Release of a flash PMI indices for September is one of the key events of the day in Europe. Readings from France and Germany have already been released. French manufacturing data came in below expectations, however the market saw almost no reaction to this release. However, DE30 began to move higher after the German data was published. German manufacturing PMI dropped more than expected, while services index came in below expectations. Today's reading indicates a slowdown in the German and euro area economies which makes the introduction of tapering in the old continent unlikely in the near future.

France:

- Manufacturing: 55.2 vs 57.0 expected

- Services: 56.0 vs 56.0 expected

Germany:

- Manufacturing: 58.5 vs 61.5 expected

- Services: 56.0 vs 60.2 expected

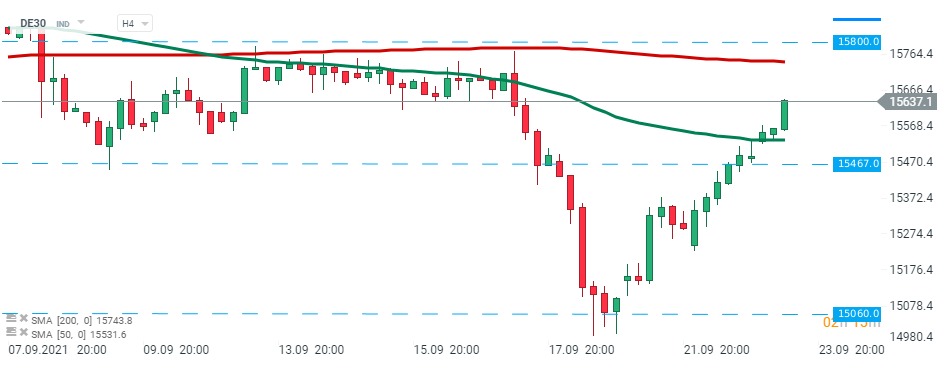

DE30 ignored weak PMI data for September and moved higher towards resistance at 15800 pts. Source: xStation5

DE30 ignored weak PMI data for September and moved higher towards resistance at 15800 pts. Source: xStation5

ปฏิทินเศรษฐกิจ: เงินเฟ้อ CPI ของสหรัฐ รายงานสำคัญที่สุดของสัปดาห์ 🔎

สรุปข่าวเช้า 9 มี.ค.

📉 BREAKING: US100 ร่วงเล็กน้อย หลังรายงาน NFP ต่ำกว่าคาด

ปฏิทินเศรษฐกิจ – ทุกสายตาจับตา NFP