Euro is having a bad start to the week. While EURUSD is trading flat today, the major currency pair experienced a strong sell-off yesterday and dropped below the 1.1400 mark for the first time since July 2020. There were two reasons behind such a move. The first one is broad US dollar strengthening. The second one, and a more important one, is yesterday's speech from ECB President Lagarde. Christine Lagarde said that ECB rate hike next year looks highly unlikely. She also said that inflation is expected to remain below a 2% target over the medium-term. Asked about 2023, Lagarde declined to specify her opinion on rate hikes. Interest rate derivatives market no longer prices in a Eurozone rate hike in 2022. Probability of such a move by the end of the next year exceeded 80% on Friday.

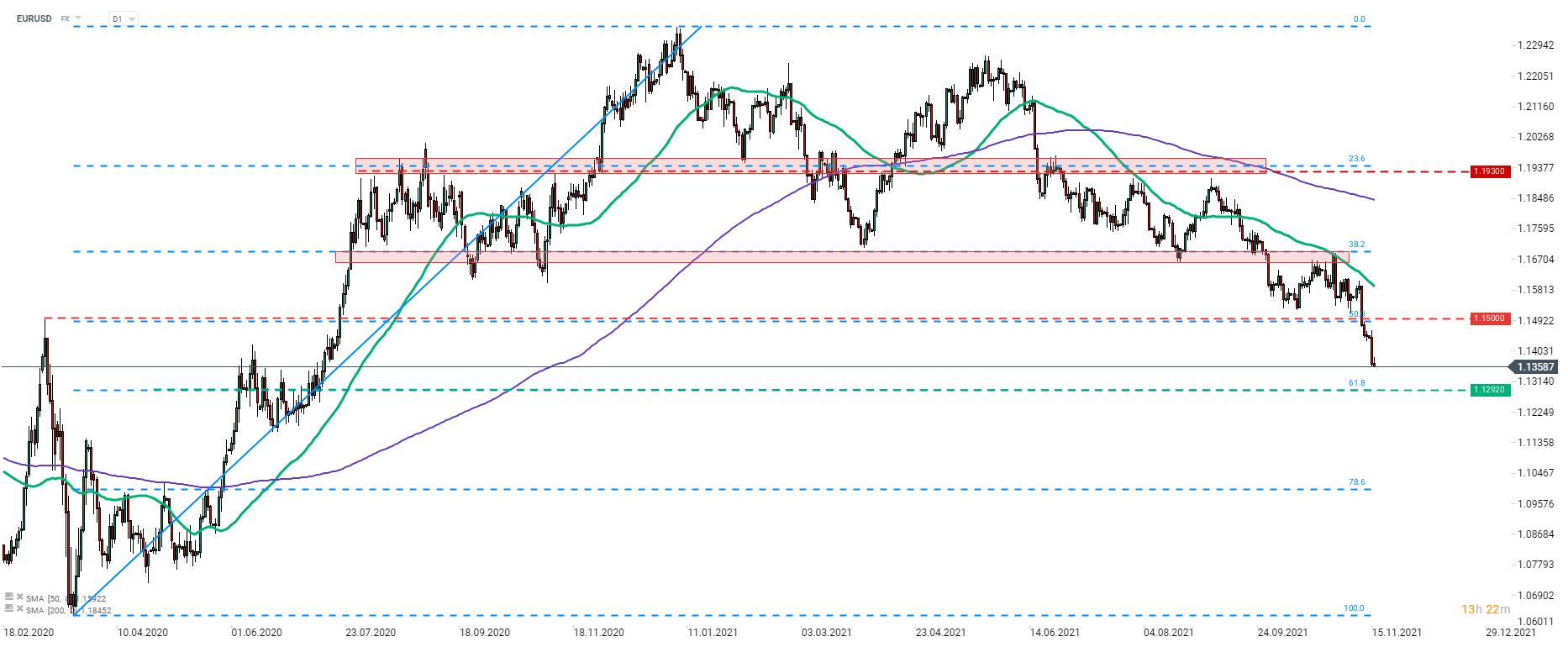

A look at the EURUSD chart shows us that the pair has been freefalling for over a week now. The pair has reacted to Fibonacci retracements of the post-pandemic recovery move during the past 10 months, making a 61.8% retracement in the 1.1292 area an important level to watch for traders. Source: xStation5

A look at the EURUSD chart shows us that the pair has been freefalling for over a week now. The pair has reacted to Fibonacci retracements of the post-pandemic recovery move during the past 10 months, making a 61.8% retracement in the 1.1292 area an important level to watch for traders. Source: xStation5

ตลาดเด่นวันนี้: EURUSD

สรุปข่าวเช้า 5 มี.ค.

สหรัฐขึ้นภาษีนำเข้าสินค้าขึ้นเป็น 15%

ดอลลาร์ชะลอขึ้น แต่ยังแข็งแรงระยะยาว❓💸