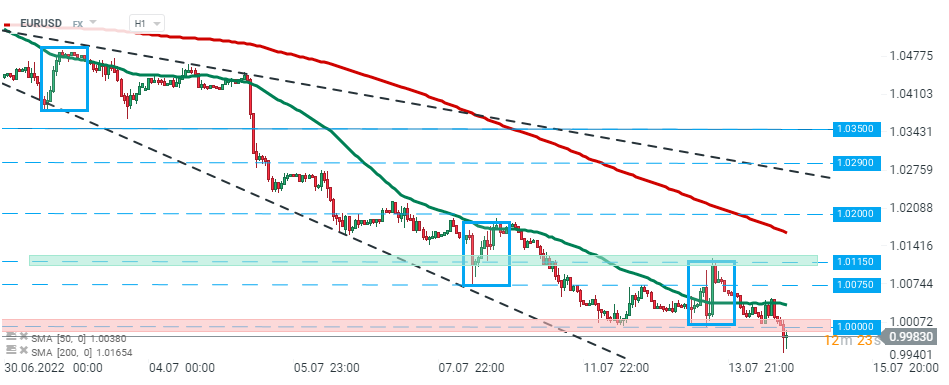

The dollar rally continues and the EURUSD pair dropped below the 0.99 level. Most likely, the stop loss positions which were placed below parity levels were activated. On the other hand, oil is very cheap at the moment. WTI crude is trading at prices below the level from when Russia invaded Ukraine in late February.This is a good sign for Europe, where recession expectations shifted to merely a slowdown. The chances of hikes in Europe are also rising. Currently, the market expects an increase of almost 100 bp by September, while yesterday analysts expected only 80 bp.Of course, a 50 bp hike in July would be a huge positive surprise given the high level of inflation. On the other hand, the uncertain situation of the PIGS (Portugal, Italy, Greece and Spain) countries may mean that the ECB will try to delay the tightening process.

Source: xStation5

Source: xStation5

📉 Market Wrap: เงินทุนไหลออกจากยุโรป 🇪🇺

สรุปข่าวเช้า 6 มี.ค.

ตลาดเด่นวันนี้: EURUSD

สรุปข่าวเช้า 5 มี.ค.