A combination of 'risk appetite' sentiments fueled by hope around a 'helpful Fed' and banking sector problems has put downward pressure on the US dollar and a rally on EURUSD. Following the bankruptcy of three US banks Silvergate, Signature, Silicon Valley Bank (now we now that,First Republic Bank also joined this trio) the Federal Reserve, the Treasury Secretary and the National Economic Council reached an agreement with banking regulators. The institutions decided to help depositors through liquidity programs and created an instrument so that banks would not have to realize losses on bonds to cover payouts. Indexes and cryptocurrencies reacted with a dynamic rally to the regulators' effort to provide more details before markets opened in Asia to prevent panic and stop a potential domino effect.

Index futures ignored news of Signature Bank's collapse, and declines in the eurodollar took their toll. EURUSD gains were supported by today's comments from Goldman Sachs, which does not expect the Fed to keep rates unchanged at its upcoming March 22 meeting. According to analysts, the regulators' decisions will increase liquidity in the banking sector and improve depositor confidence. At the same time, Goldman reiterated expectations for a 25bp hike in May June and July, still sees the final rate in the 5.25 - 5.5% range

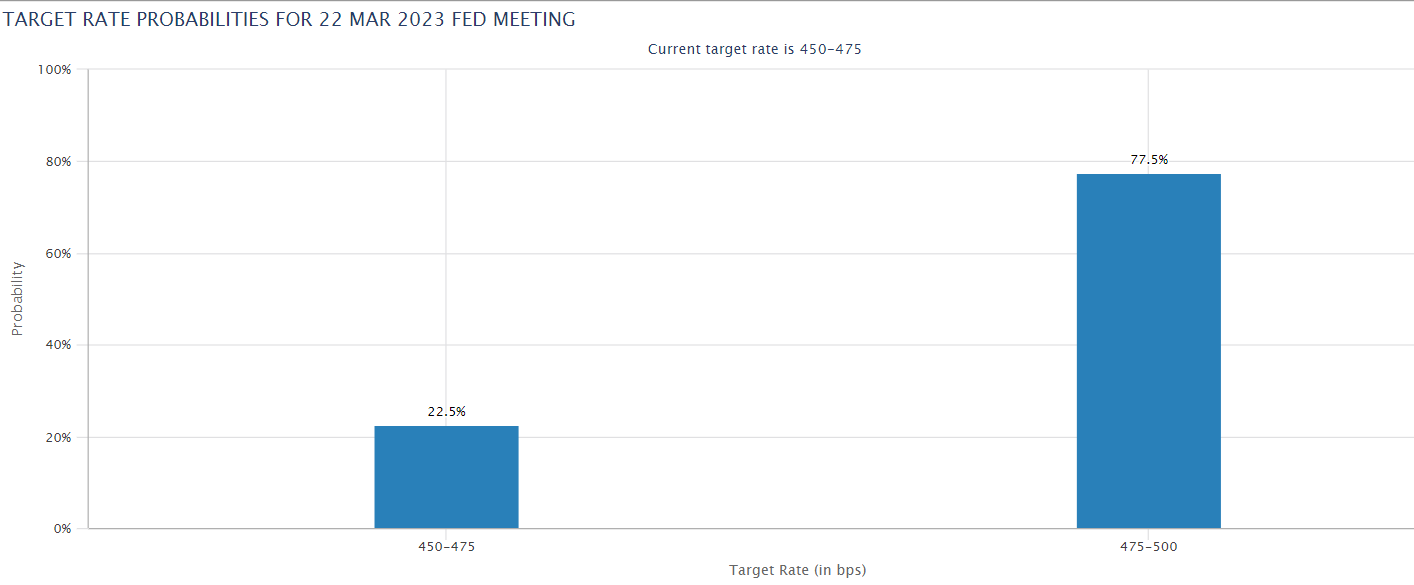

The market has sharply reduced expectations for the amount of a Fed rate hike on March 22. It now sees a 22,5% chance of no hike and a 77,5% chance of a 25 bp hike. Before to the banks' collapses, a narrative of 50 bp prevailed. Source: CME, FedWatch

The market has sharply reduced expectations for the amount of a Fed rate hike on March 22. It now sees a 22,5% chance of no hike and a 77,5% chance of a 25 bp hike. Before to the banks' collapses, a narrative of 50 bp prevailed. Source: CME, FedWatch

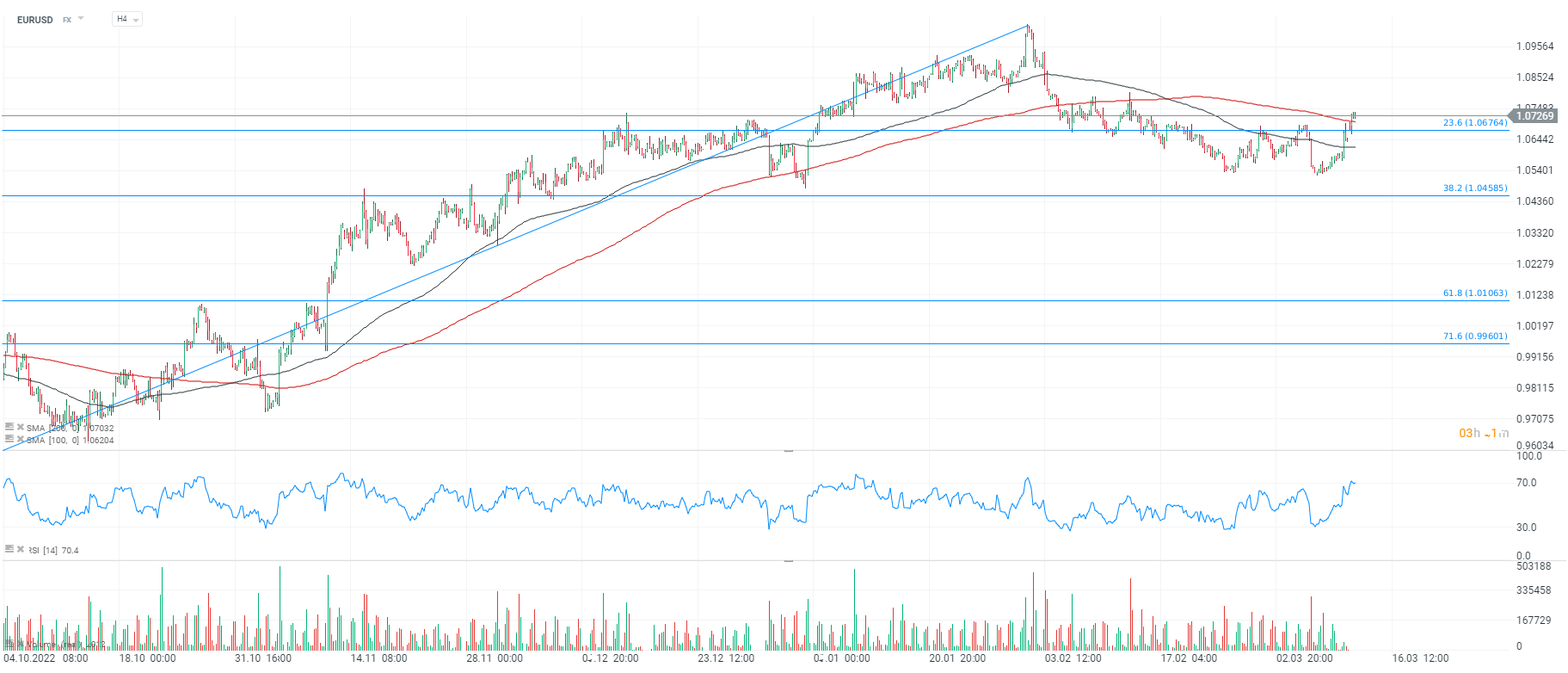

EURUSD chart, H4 interval. The dollar has weakened mightily since March 8, the EURUSD exchange rate returned above 1.07. The market reacted positively to the Fed's support. The price climbed above the 23.6 abolition of the upward wave started in September 2022 and the 200-session average SMA200 (red line). Looking at the volume candles, that the dollar's prolonged weakness is supported by considerable volume signaling the markets' hopes for the end of the Federal Reserve's rate hike cycle while maintaining a hawkish stance at the ECB, which has started raising rates of late. Source: xStation5

BREAKING: US100 พุ่งแรง หลังรายงาน NFP สหรัฐแข็งแกร่งกว่าคาด

📅 ปฏิทินเศรษฐกิจ: ตัวเลข NFP และ รายงานปริมาณน้ำมันคงคลังสหรัฐฯ 💡

สรุปตลาดเช้า: ดอลลาร์ติดกับดัก ตลาดจับตา NFP คืนนี้ 🏛️

ข่าวเด่นวันนี้