FOMC decided to keep rates unchanged at a meeting today, in-line with market expectations. However, new set of economic projections pointed to a higher GDP growth forecasts than March projections as well as slower progress on core inflation this year. On top of that, median rate forecast in dot-plot increased and now points to rates at 5.6% at the end of 2023, up from 5.1% in March projections, and at 4.6% at the end of 2024, up from 4.3% in March projection. Fed also did not rule out additional tightening later this year.

Market saw this decision as a 'hawkish' pause, leaving the door open for more rate increases should the situation require. Market pricing also turned more hawkish after the decision with swap market no longer pricing in Fed rate cuts in 2023.

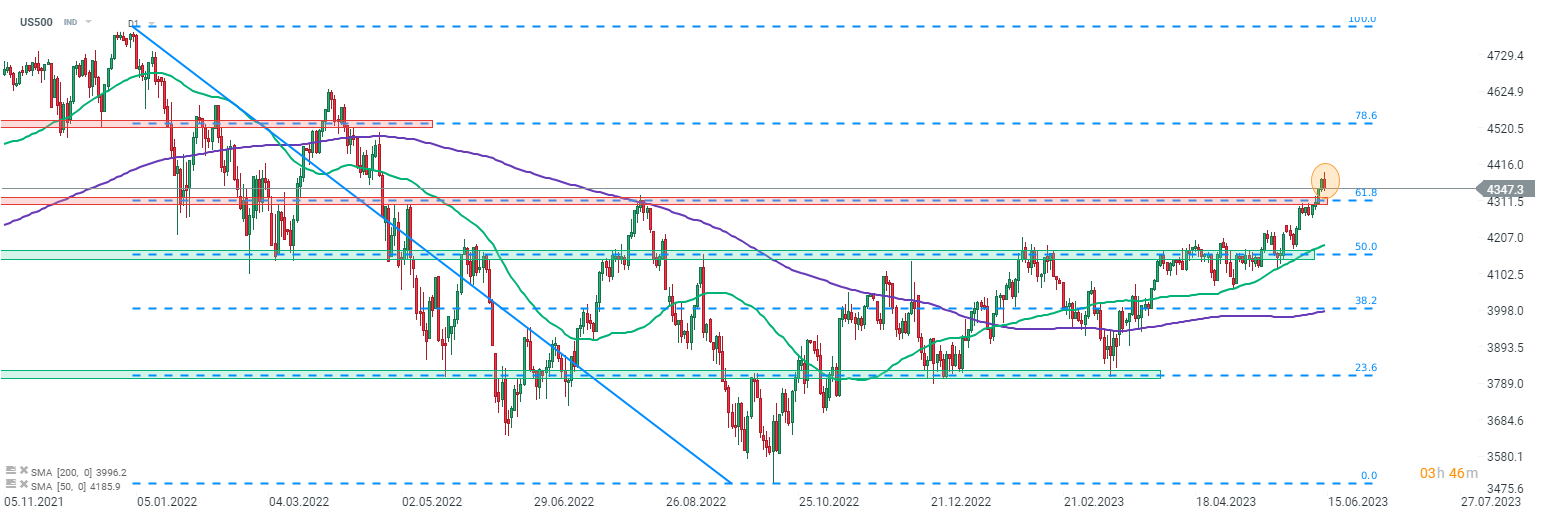

USD gained on the decision with EURUSD slumping from 1.0850 to 1.0800 area. Wall Street indices also took a hit with S&P 500 futures (US500) dropping around 0.5% following the decision and testing 4,350 pts area. Gold dropped back below $1,950 amid USD strengthening and increase in yields. As it seems that hawkishness of the decision surprised markets (dot-plot suggests more than one hike this year), traders should expect elevated volatility during Powell's presser, which is set to begin at 7:30 pm BST.

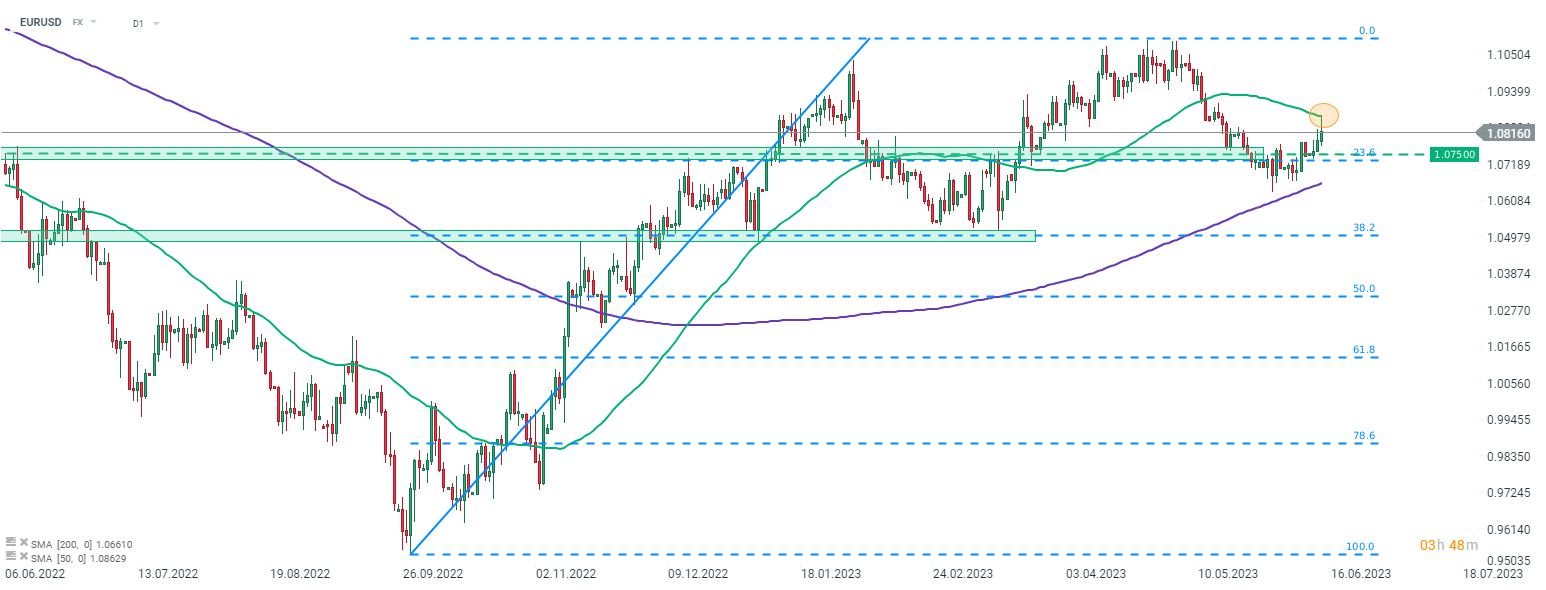

EURUSD failed to break above the 50-session moving average (green line) in the 1.0850 area and started to erase daily gains after Fed 'hawkish' pause. Source: xStation5

EURUSD failed to break above the 50-session moving average (green line) in the 1.0850 area and started to erase daily gains after Fed 'hawkish' pause. Source: xStation5

S&P 500 futures (US500) turned negative following Fed decision. Source: xStation5

ข่าวเด่นวันนี้

BREAKING: ยอดขายปลีกสหรัฐฯ ต่ำกว่าคาดการณ์

US2000 ใกล้ระดับสูงสุดเป็นประวัติการณ์ 🗽 ข้อมูล NFIB แสดงอะไรบ้าง?

กราฟวันนี้ 🗽 US100 ฟื้นตัวต่อเนื่อง หลังฤดูกาลประกาศผลกำไรสหรัฐฯ