First Republic (FRC.US) shares are losing more than 30% today although they have already rebounded nearly 20% from their session lows. They found themselves at levels seen in the fall of 2016. Investors have become concerned about the stability of bank deposits in an environment of rising interest rates.

- First Republic primarily serves business owners and more affluent customers, who, according to The Wall Street Journal's findings, are beginning to withdraw their deposits from bank accounts in search of higher interest rates on Treasury bonds and other products that guarantee fixed income;

- First Republic's deposits rose 13% in 2022 from the previous year, but the lender had to pay more for them, which ultimately reduced its yield ratio;

- With the prospect of a growing exodus of customers, who may be further spooked by current media reports, the bank's shares are trading at record lows throughout the bank's history;

- The risk of customer outflows from banks does not only affect First Republic - it is mainly smaller banks that may be most affected.

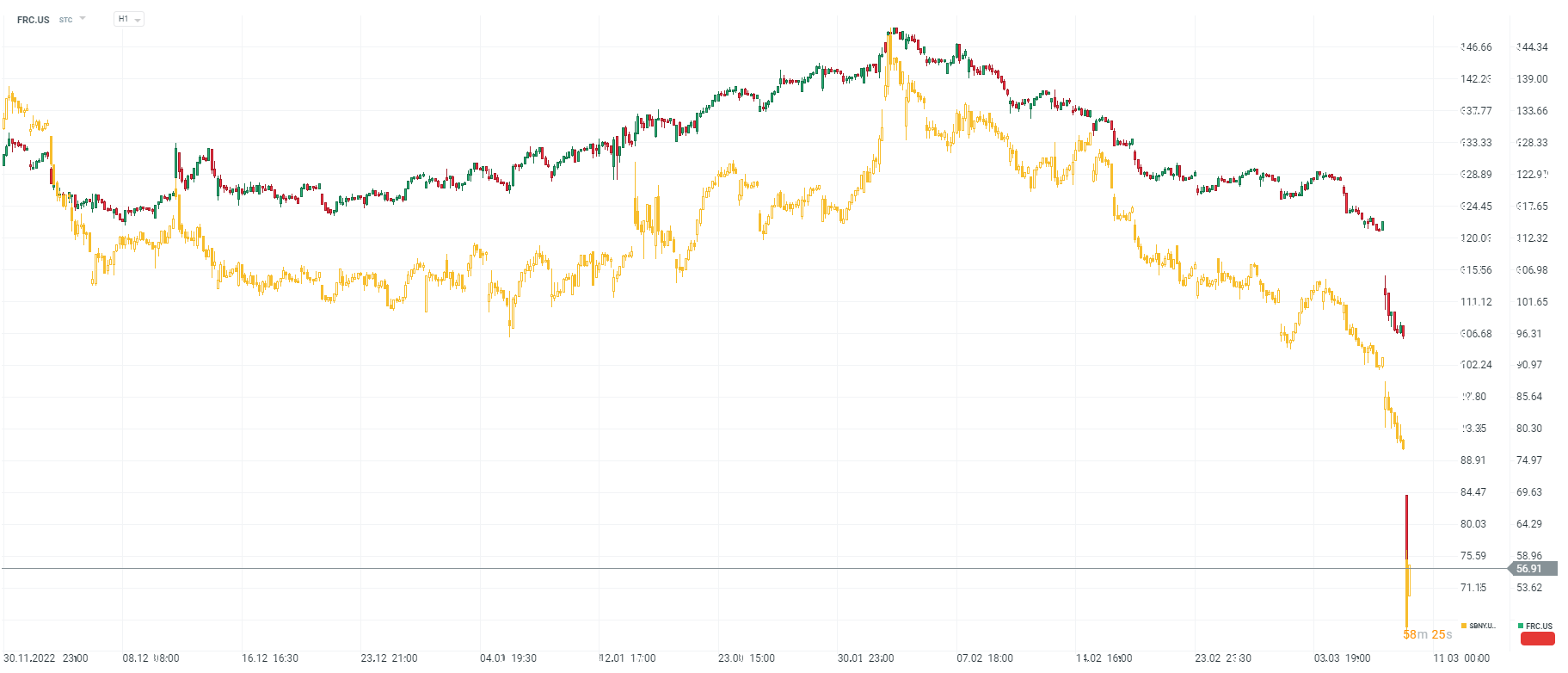

The most losing stocks on Wall Street today - Signature Bank and First Republic. Source: xStation5

First Republic's (FRC.US) share price rose after a more than 50% crash at the opening of the session and is trying to hold above the 71.6 Fiboancci retracement of the upward wave started in 2011. Source: xStation5

First Republic's (FRC.US) share price rose after a more than 50% crash at the opening of the session and is trying to hold above the 71.6 Fiboancci retracement of the upward wave started in 2011. Source: xStation5

Although yesterday's report indicated the healthy financial health of Signature Bank (SBNY.US), the bank is trading at record highs and retreating to levels not seen since 2017. Estimates show that the bank is at the 6th highest unrealized loss of a bond portfolio held by US banks. The bond portfolio may include government bonds, corporation bonds and mortgage-backed securities.

First Republic Bank ranked last on the list signaling a relatively strong balance sheet, but the sharp drop in shares indicates that the bank could potentially have other internal problems not included in the metric. Source: Bloomberg

Shares of First Republic and Signature Bank (SBNY.US,yellow chart). Source: xStation5

ข่าวเด่นวันนี้

การขายทำกำไรในปัจจุบันหมายถึงจุดจบของบริษัทควอนตัมหรือไม่?

Howmet Aerospace พุ่ง 10% หลังประกาศผลกำไร ทำมูลค่าบริษัททะลุ 100 พันล้านดอลลาร์ 📈

📊 หุ้นเด่นรายสัปดาห์: Datadog – การมอนิเตอร์ที่คุ้มค่า