The opening on Wall Street indicated a potential rebound after several days of increased selling pressure. However, the first few hours of trading verified this, and currently, both the US500 and US100 are experiencing declines and struggling to maintain key resistance zones.

Fitch Ratings: U.S. Consumer Health Monitor — 3Q23

Today, Fitch published its quarterly report on consumer conditions in the USA. From the document, we learn that consumer spending in the United States remained at a high level throughout 2023, supported by significant job and income growth, a strong consumer balance sheet, and positive consumer sentiments. The robustness is evident with real consumer spending rates of 4.3% in 1Q23, 1.7% in 2Q23, and an anticipated 3% in 3Q23. Fitch Ratings adjusted its annual consumer spending growth forecast to 1.9% from 1.0%.

However, an anticipated slowdown is visible on the horizon due to factors like a cooling labor market, decelerating wage growth, and the effects of the Fed's tightening policy. The slowdown will be noticeable in Q423, with spending expected to decrease by 1.2% and continue to decline in 2024. The consistent spending so far can be attributed to the increase in household incomes, supported by savings accumulated during the pandemic, but this buffer is expected to largely deplete by the end of 4Q23.

Moody's

On the other hand, the rating agency Moody's also expects an upcoming slowdown in consumer spending. According to Moody's, the decrease in dynamics will be visible in the coming months. Moreover, the quality of consumer debt is declining, which may signal potential risk in certain areas of the credit market.

US500

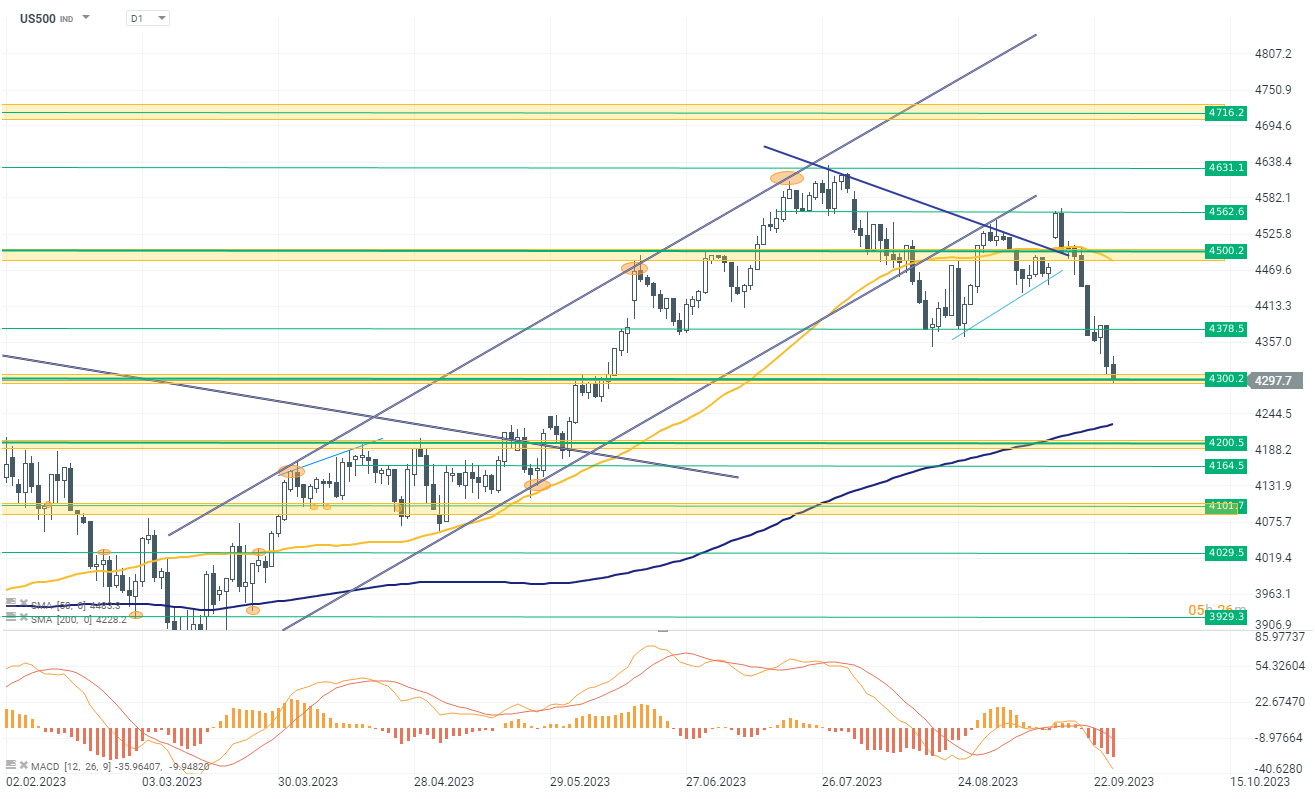

At the beginning of today's session, the US500 opened 0.30% higher. However, initial gains were quickly reversed, and currently, the index is down by 0.60%. Bulls are struggling to maintain another key support zone at the 4300 points level. At the moment, the price is breaking below this level. If the selling pressure remains, the index may head towards the next support zone at the 4200 points level.

Source: xStation 5

📉 BREAKING: US100 ร่วงเล็กน้อย หลังรายงาน NFP ต่ำกว่าคาด

📉 Market Wrap: เงินทุนไหลออกจากยุโรป 🇪🇺

🚩 US500 ร่วงก่อนตลาดสหรัฐเปิด ขณะที่ดัชนี VIX พุ่งขึ้น 6%

ปฏิทินเศรษฐกิจ – ทุกสายตาจับตา NFP