Gold is trading back above $2,000 per ounce level. Disappointing retail sales data for January from the United States is putting pressure on the US dollar and, in turn, is supporting precious metals. A much deeper-than-expected drop in headline retail sales as well as an unexpected decline in core and core-core retail sales is hinting a weakening of the US consumer. This weakness, if confirmed by future releases, may be an argument for Fed to begin cutting rates quicker. Moreover, industrial and production data for January also showed an unexpected drop.

Money markets are currently pricing in slightly higher chances for rate cuts at March and June meeting than they were yesterday. The first full cut is still priced in for June meeting.

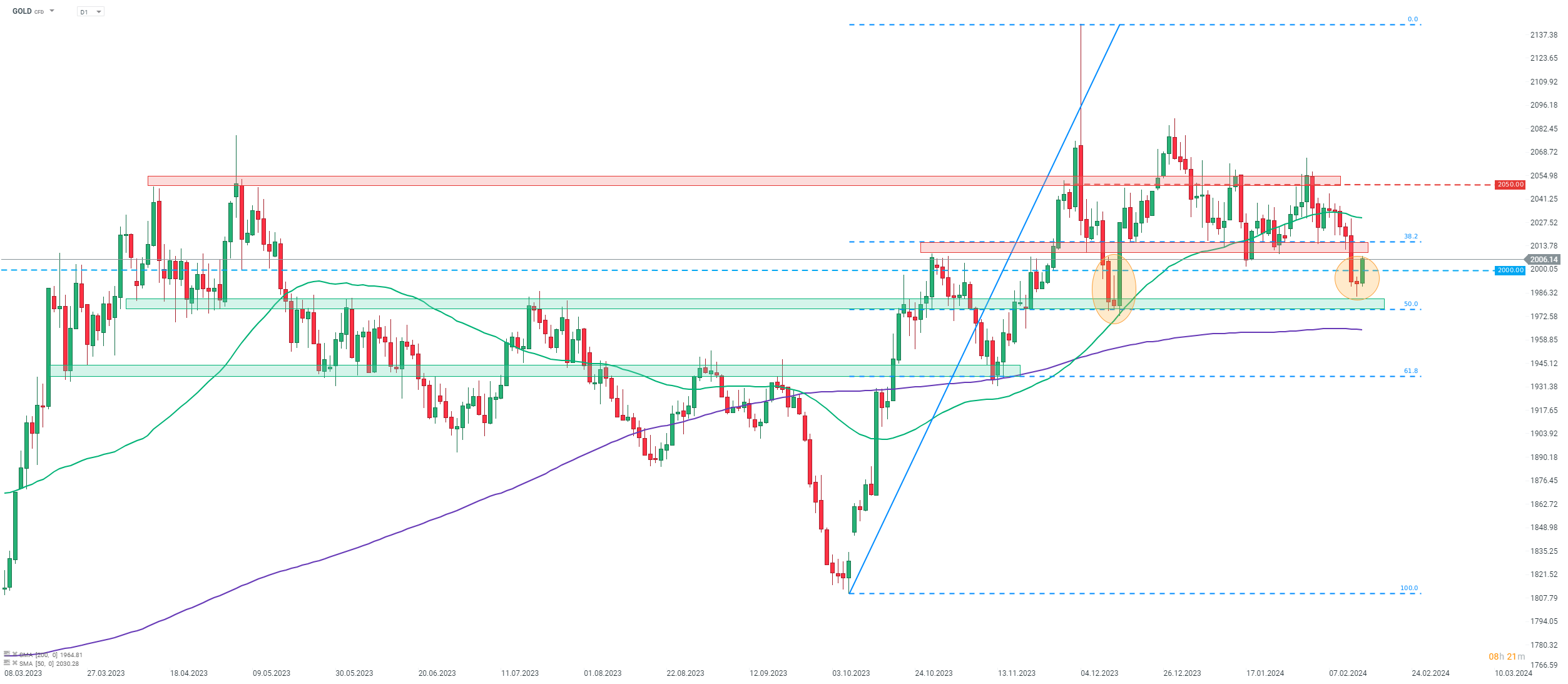

Taking a look at GOLD chart at D1 interval, we can see that the recent drop below $2,000 per ounce, triggered by higher-than-expected CPI print released on Tuesday this week, turned out to be short-lived, just as it was the case in mid-December. Near-term resistance zone to watch can be found ranging below the 38.2% retracement of the upward impulse launched in October 2022 ($2,015 per ounce area).

Source: xStation5

Source: xStation5

ข่าวเด่นวันนี้

3 ตลาดสำคัญที่ต้องจับตาในสัปดาห์นี้

ก๊าซธรรมชาติลด 6% ตามพยากรณ์อากาศใหม่

Geopolitical Briefing : Iran ยังเป็นปัจจัยเสี่ยงอยู่หรือไม่?