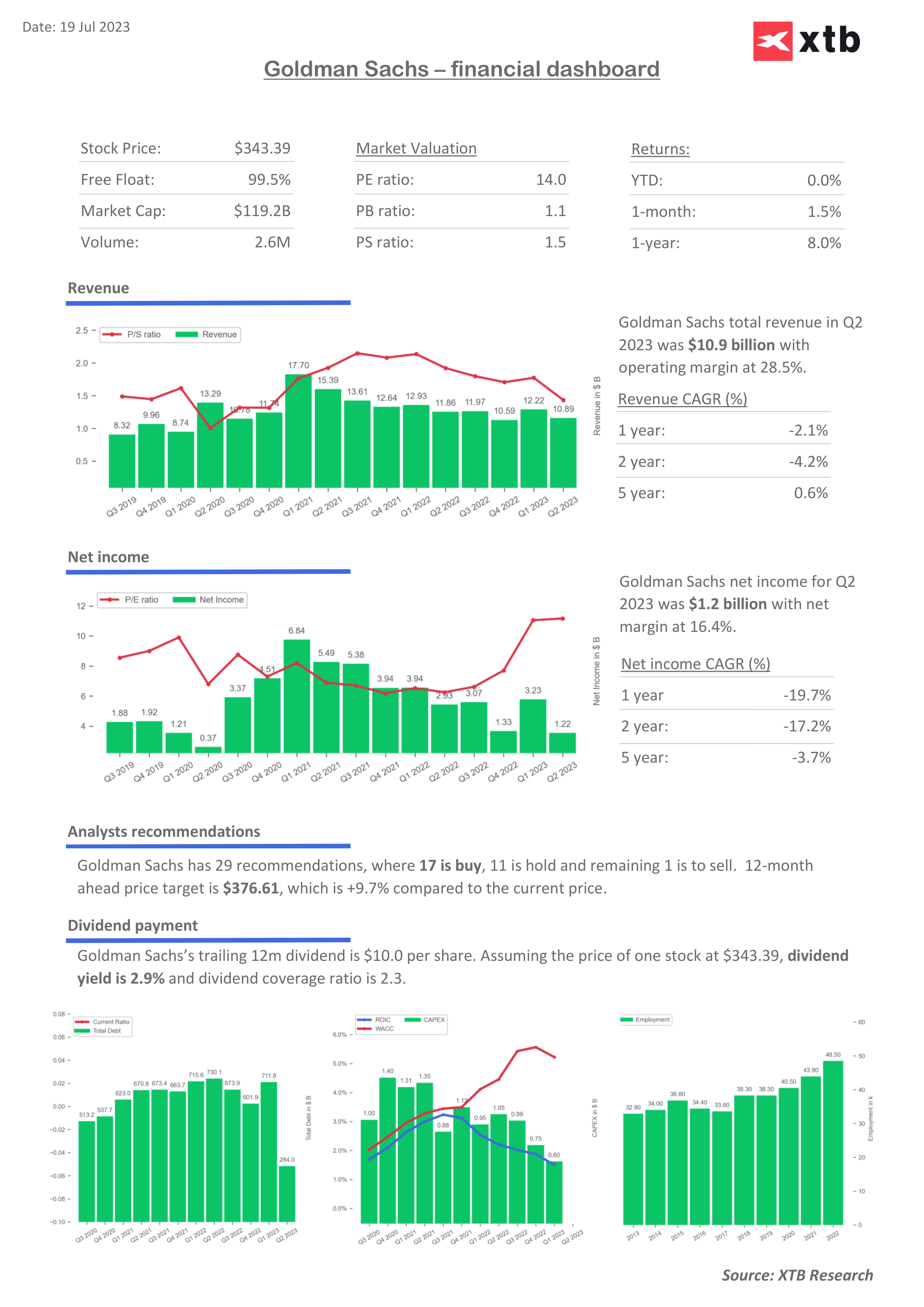

Goldman Sachs reported Q2 2023 earnings that fell short of expectations, the only miss among the six largest U.S. banks. Its earnings dropped to $1.07 billion or $3.08 a share, down from $2.79 billion or $7.73 a share in the same period last year. This was below the analyst expectations for per-share earnings of $3.16. The bank's Q2 revenue decreased to $10.9 billion from $11.86 billion, beating the analyst estimate of $10.61 billion. Goldman also increased its quarterly dividend to $2.75 per common share from $2.50 per share. Despite these results, CEO David Solomon is confident about a turnaround in investment banking and executing the plans to exit the consumer business.

Key financial metrics:

- Earnings: fell by over half to $1.07 billion, or $3.08 per share, from Q2 2022's $2.79 billion, or $7.73 per share, missing the $3.16 per share analyst estimate.

- Revenue: decreased to $10.9 billion from Q2 2022's $11.86 billion, exceeding the analyst estimate of $10.61 billion.

- Quarterly dividend: increased to $2.75 per common share from $2.50 per share.

- A $504 million goodwill impairment charge related to the GreenSky consumer lending business was noted.

- Operating expenses: increased by 12% to $8.54 billion, exceeding the analyst estimate of $7.67 billion.

- Investment banking fees: decreased by 20% to $1.43 billion, falling short of the $1.49 billion analyst estimate.

- Asset and Wealth Management revenue: decreased by 4% to $3.05 billion, below the estimate of $3.69 billion.

- Global Banking and Markets revenue: decreased by 14% to $7.19 billion, exceeding the analyst estimate of $6.65 billion.

Goldman Sachs held its Q2 2023 earnings conference call with the participation of David Solomon, CEO, and Denis Coleman, CFO. Solomon noted that despite some challenges, the company generated net revenues of $1.9 billion and earnings per share of $3.88 with a Return on Equity (ROE) of 4% and Return on Tangible Equity (ROTE) of 4.4%. He attributed the decline in earnings to a challenging macro-environment, headwinds facing their specific mix of businesses, and their strategic shift towards a less capital-intensive model. However, Solomon pointed out that there are signs of increasing activity, particularly in equity capital markets and M&A.

Goldman Sachs held its Q2 2023 earnings conference call with the participation of David Solomon, CEO, and Denis Coleman, CFO. Solomon noted that despite some challenges, the company generated net revenues of $1.9 billion and earnings per share of $3.88 with a Return on Equity (ROE) of 4% and Return on Tangible Equity (ROTE) of 4.4%. He attributed the decline in earnings to a challenging macro-environment, headwinds facing their specific mix of businesses, and their strategic shift towards a less capital-intensive model. However, Solomon pointed out that there are signs of increasing activity, particularly in equity capital markets and M&A.

Denis Coleman provided a detailed financial update. The company reported Q2 net revenues of $10.9 billion and net earnings of $1.2 billion. This led to earnings per share of $3.08. These results were impacted by three factors: a gain from the sale process of the Marcus unsecured loan portfolio, losses from principal investments within Asset & Wealth Management, and results related to GreenSky. As part of its strategy to reduce capital intensity, Goldman Sachs continues to execute on its $30 billion share repurchase program and has recently announced a 10% increase to its quarterly dividend.

Key takeaways from the earnings call:

- Goldman Sachs generated net revenues of $1.9 billion and earnings per share of $3.88 in Q2 2023.

- Their results were affected by a challenging macro-environment and headwinds facing their specific mix of businesses.

- The company is strategically transitioning towards a less capital-intensive business model.

- There are indications of increased levels of activity in the equity capital markets and M&A.

- Goldman Sachs continues to execute on its $30 billion share repurchase program and has recently increased its quarterly dividend by 10%.

- Despite lower results due to challenging macro-economic conditions and strategic transition, Goldman Sachs remains confident in delivering mid-teens returns and significant shareholder value.

Goldman Sachs (GS.US), D1 interval, source xStation 5

Goldman Sachs (GS.US), D1 interval, source xStation 5

หุ้น Ryanair กดดันจากความตึงเครียดในตะวันออกกลาง 📉

Stock of the Week: Broadcom ขับเคลื่อนโดย AI ทำสถิติใหม่ 🚀

Market Wrap: ดัชนีหุ้นพยายามยืนรีบาวด์ แม้ราคาน้ำมันปรับตัวสูงขึ้น 🗽 หุ้น Broadcom พุ่งแรง หลังผลประกอบการและแนวโน้มธุรกิจ AI เกินคาด

📀 Coinbase และ MicroStrategy พุ่งแรง หลังทรัมป์ท้าทายธนาคารบนวอลล์สตรีท