Today's European session began in a mixed mood, with volatility remaining low in the early hours of trading. However, after 12:00 pm BST sellers took the lead and major European indices are trading lower. A pullback can also be seen on the US index futures market, which are also trading lower before the start of trading.

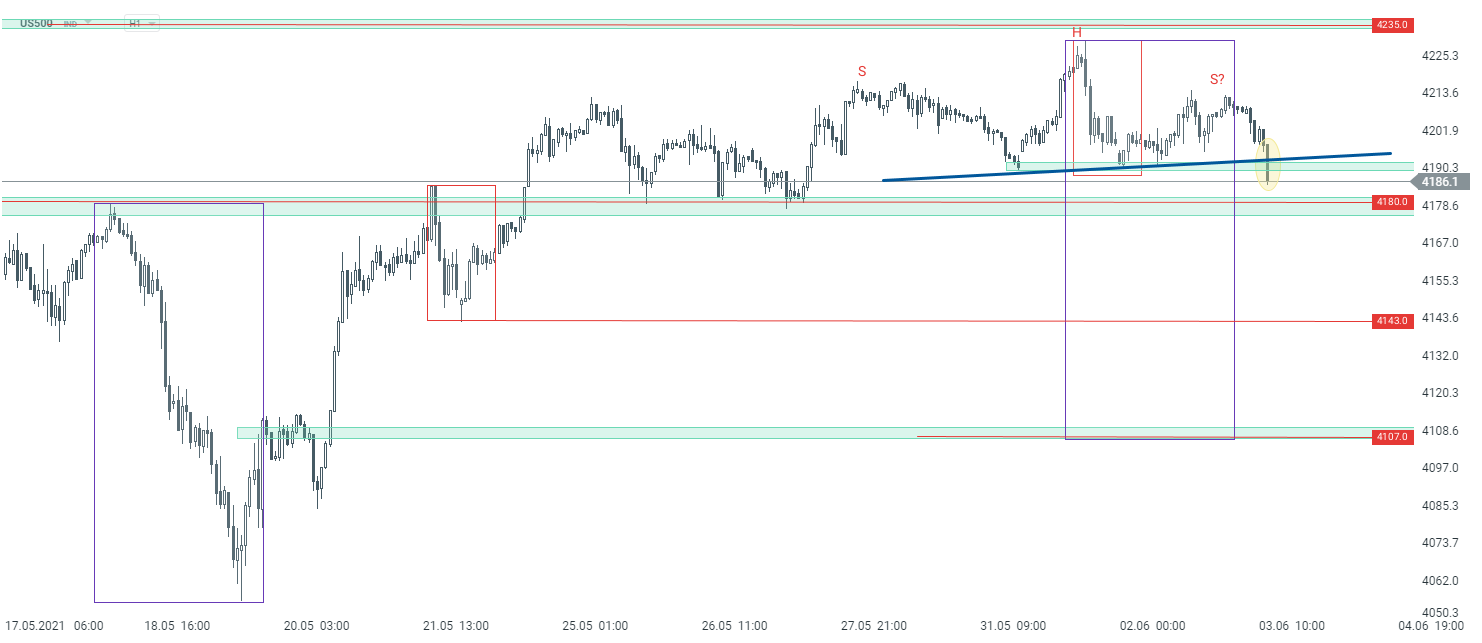

Looking at the US500, we are observing an attempt to break down the neckline of the head-and-shoulders formation, which usually heralds a trend reversal. However, it is worth noting that the support zone, resulting from previous price reactions (4,180 pts), is close by, and only its breaking below may result in a deepening of the correction.

One should be aware that the market may become more volatile once key US data (ADP report) is released at 1:15 pm BST

US500 H1 interval. Source: xStation5

US500 H1 interval. Source: xStation5

ข่าวเด่นวันนี้ 5 มี.ค.

🚨 สถานการณ์อิหร่าน: ภาพรวมปัจจุบันและแนวโน้ม

ดัชนีภาคบริการ ISM ออกมาแข็งแกร่ง กิจกรรมทางเศรษฐกิจขยายตัวมากที่สุดนับตั้งแต่ปี 2022

สหรัฐขึ้นภาษีนำเข้าสินค้าขึ้นเป็น 15%