FOMC minutes revealed that US central bankers believe tapering of the quantitative easing programme should begin this year. With just 4 months of the year left, this was viewed as a hawkish shift by markets and triggered a sell-off on the stock markets. S&P 500 futures (US500) deepened ongoing downward move and reached a 4-week lows DAX (DE30) drops around 2% and trades near 15,650 pts mark. European indices are experiencing the worst day in a month.

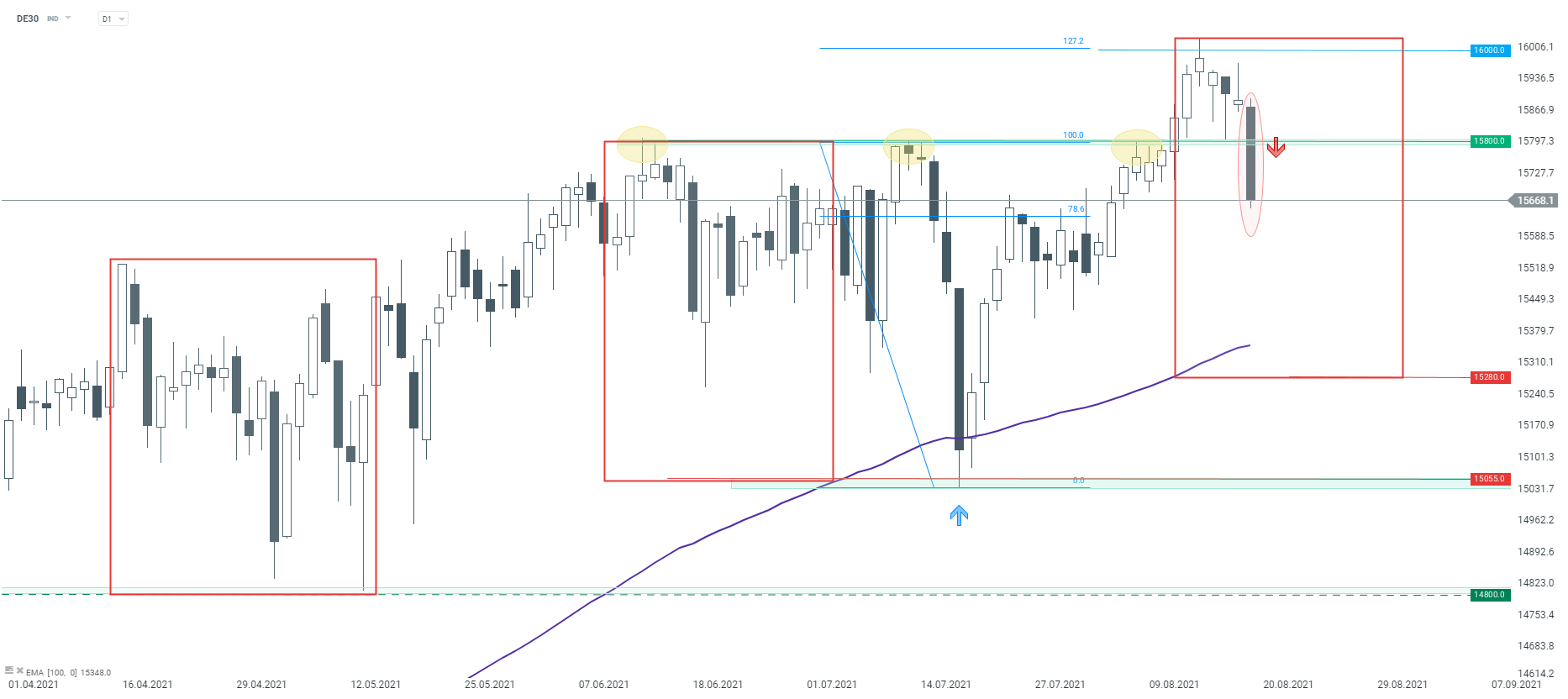

DE30 broke below a mid-term support zone at 15,800 pts and the downward move accelerated later on. The lower limit of the Overbalance structure at 15,280 pts is a key support to watch in case the index continues to move lower. However, 100-session EMA may also offer some support earlier (currently in 15,350 pts area).

Source: xStation5

Source: xStation5

BREAKING: US100 พุ่งแรง หลังรายงาน NFP สหรัฐแข็งแกร่งกว่าคาด

ข่าวเด่นวันนี้

US2000 ใกล้ระดับสูงสุดเป็นประวัติการณ์ 🗽 ข้อมูล NFIB แสดงอะไรบ้าง?

กราฟวันนี้ 🗽 US100 ฟื้นตัวต่อเนื่อง หลังฤดูกาลประกาศผลกำไรสหรัฐฯ