The ECB has decided to raise rates by 25 basis points today. Christine Lagarde, the head of the ECB, is speaking:

-

Inflation has been decreasing but is projected to remain too high for too long. The ECB is determined to ensure that inflation returns to their two per cent medium-term target in a timely manner.

-

The rate increase reflects the updated assessment of the inflation outlook, the dynamics of underlying inflation, and the strength of monetary policy transmission.

-

Eurosystem staff expect headline inflation to average 5.4% in 2023, 3.0% in 2024 and 2.2% in 2025.

-

The economy is expected to grow by 0.9% in 2023, 1.5% in 2024 and 1.6% in 2025.

-

The past rate increases are being transmitted forcefully to financing conditions and are gradually having an impact across the economy.

-

The Governing Council confirms that it will discontinue the reinvestments under the asset purchase programme as of July 2023.

-

The labour market remains a source of strength, with almost a million new jobs added in the first quarter of the year and the unemployment rate at its historical low of 6.5% in April.

-

The outlook for economic growth and inflation remains highly uncertain, with downside risks including Russia’s war against Ukraine, potential increases in broader geopolitical tensions, and potential renewed financial market tensions.

-

The ECB's monetary policy tightening continues to be reflected in risk-free interest rates and broader financing conditions. Funding conditions are tighter for banks and credit is becoming more expensive for firms and households.

-

The financial stability outlook has remained challenging.

-

ECB interest rates will be brought to levels sufficiently restrictive to achieve a timely return of inflation to their two per cent medium-term target.

-

The ECB has not ended the cycle - there is still plenty of room to tighten policy - rates will likely also rise in July despite the Fed's pause. ECB's decision was made with a very broad consensus of ECB members.

-

The labor market is key - wages are rising, employment is increasing, and this fact also influenced the slightly higher inflation forecast of the ECB. Higher labor costs affect inflation.

-

The ECB is aware that the ECB policy works with a delay - ans the first effects can be seen in the banking and credit market.

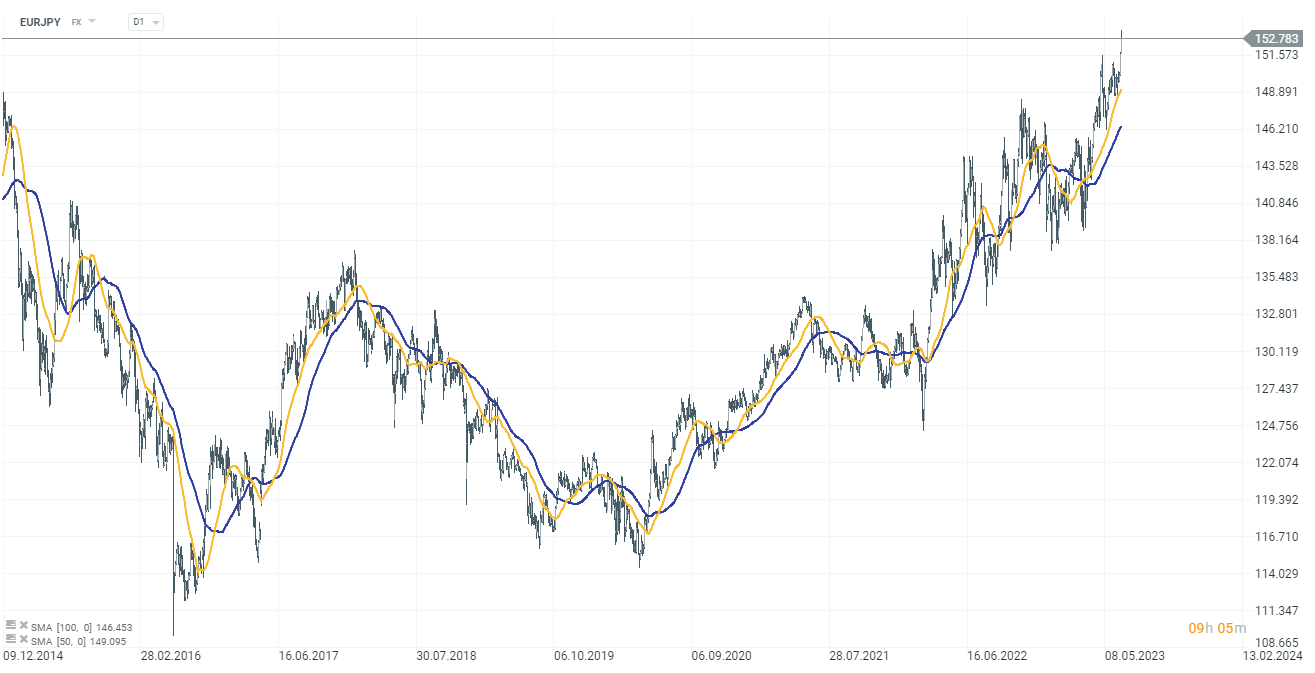

EURJPY has reached its highest point since 2008, up by 1.1% to 153.39., D1 interval, source xStation 5

ปฏิทินเศรษฐกิจวันนี้: 🔎 รายงานตลาดแรงงาน ADP (ADP Labor Market Report)

สรุปข่าวเช้า 4 มี.ค.

ข่าวเด่นวันนี้ 4 มี.ค.

📅 ปฏิทินเศรษฐกิจ: ยูโรโซน (Eurozone)