-

US indices bounced off the daily lows but bulls were unable to fully erase declines. S&P 500 dropped 0.70%, Dow Jones moved 0.87% lower and Russell 2000 plunged 1.74%. Nasdaq outperformed and managed to finish 0.05% higher

-

Moods started to improve after Credit Suisse announced that it will take actions to improve liquidity position

-

Credit Suisse intends to exercise an option to borrow an additional 50 billion CHF from Swiss National Bank. CS will also buy back senior debt worth up to 3 billion CHF

-

Indices from Asia-Pacific traded lower today - Nikkei dropped 0.8%, S&P/ASX 200 moved 1.5% lower while Kospi and Nifty 50 traded little changed

-

Indices from China traded 0.6-1.8% lower

-

DAX futures point to a higher opening of today's European cash session

-

G7 countries oppose the idea of lowering price cap on Russian oil below current $60 per barrel

-

Goldman Sachs estimates the probability of US recession in the next 12 months at 35%, up from 25% in the previous estimate

-

Goldman Sachs also lowered the 2023 GDP growth forecast from 1.5 to 1.2%. Meanwhile, forecast for China 2023 GDP growth was boosted from 5.5 to 6.0%

-

Australian employment increased by 64.6k in February (exp. +49.1k) while the unemployment rate dropped from 3.7 to 3.5% (exp. 3.6% YoY)

-

New Zealand GDP shrank by 0.6% QoQ in Q4 202 (exp. -0.2% QoQ)

-

Japanese exports increased 6.5% YoY in February (exp. 7.1% YoY) while imports were 8.3% YoY higher (exp. 12.2% YoY)

-

Japanese machinery orders increased 9.5% MoM in January (exp. +1.6% MoM)

-

Japanese industrial production dropped 3.1% YoY in January (exp. -2.3% YoY)

-

Cryptocurrencies are trading slightly higher today - Bitcoin gains 0.2%, Dogecoin adds 0.8% and Ripple advances 1.2%

-

Energy commodities are trading little changed - oil drops 0.2% while US natural gas prices add 0.1%

-

In spite of USD weakening, precious metals trade mixed today - silver drops 0.3%, gold trades 0.1% lower and platinum adds 0.2%

-

AUD and CHF are the best performing major currencies while USD and GBP lag the most

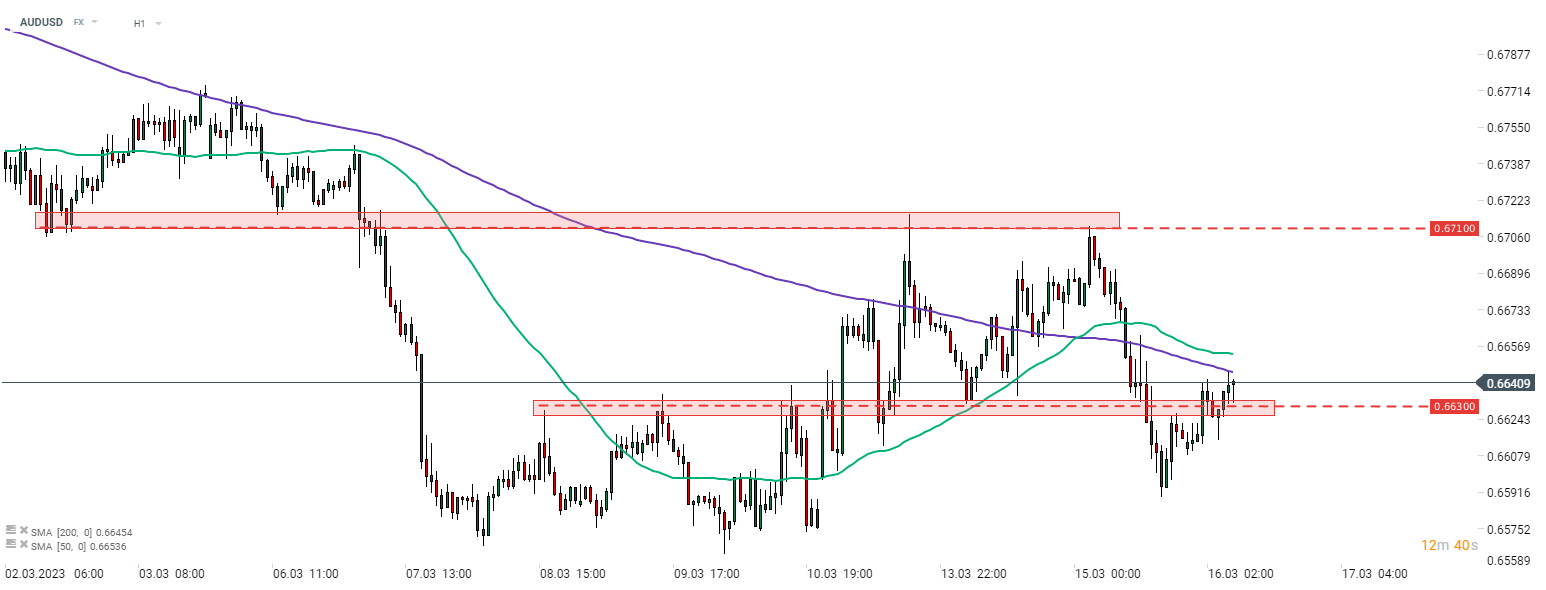

AUDUSD broke above the 0.6630 resistance zone following a solid jobs report from Australia. The pair is now testing the 200-hour moving average (purple line). Source: xStation5

AUDUSD broke above the 0.6630 resistance zone following a solid jobs report from Australia. The pair is now testing the 200-hour moving average (purple line). Source: xStation5

📉 Market Wrap: เงินทุนไหลออกจากยุโรป 🇪🇺

สรุปข่าวเช้า 6 มี.ค.

ตลาดเด่นวันนี้: EURUSD

สรุปข่าวเช้า 5 มี.ค.