-

US indices finished yesterday's trading lower but off the daily lows. S&P 500 dropped 0.04%, Dow Jones moved 0.58% lower and Nasdaq dropped 0.40%. Russell 2000 finished 0.97% lower

-

Indices from Asia traded mostly higher today. Nikkei rallied almost 1.5%, S&P/ASX 200 jumped 0.9% and Kospi added 1%. Indices from China traded mixed

-

DAX futures point to a flat opening of the European cash session today

-

Fed Chair Powell said that if there is a need for a hike bigger than 25 bp at one or more of upcoming meetings, Fed is ready to deliver

-

Ukraine President Zelensky said he is ready not to seek NATO membership for Ukraine in exchange for ceasefire

-

US officials once again warned about possibility of false flag operations in Ukraine with use of chemical weapons

-

Russia canceled peace talks with Japan that were ongoing since World War II. Decision was triggered by sanctions imposed by Japan on Russia

-

Cryptocurrencies trade higher with Bitcoin jumping above the $42,000 mark. Ethereum approaches $3,000 area

-

Oil is continuing to move higher. Brent and WTI trade over 1.5% higher following yesterday's solid gains

-

Precious metals trade mixed - silver and platinum gain, gold trades flat and palladium drops

-

CAD and USD are the best performing major currencies while JPY and CHF lag the most

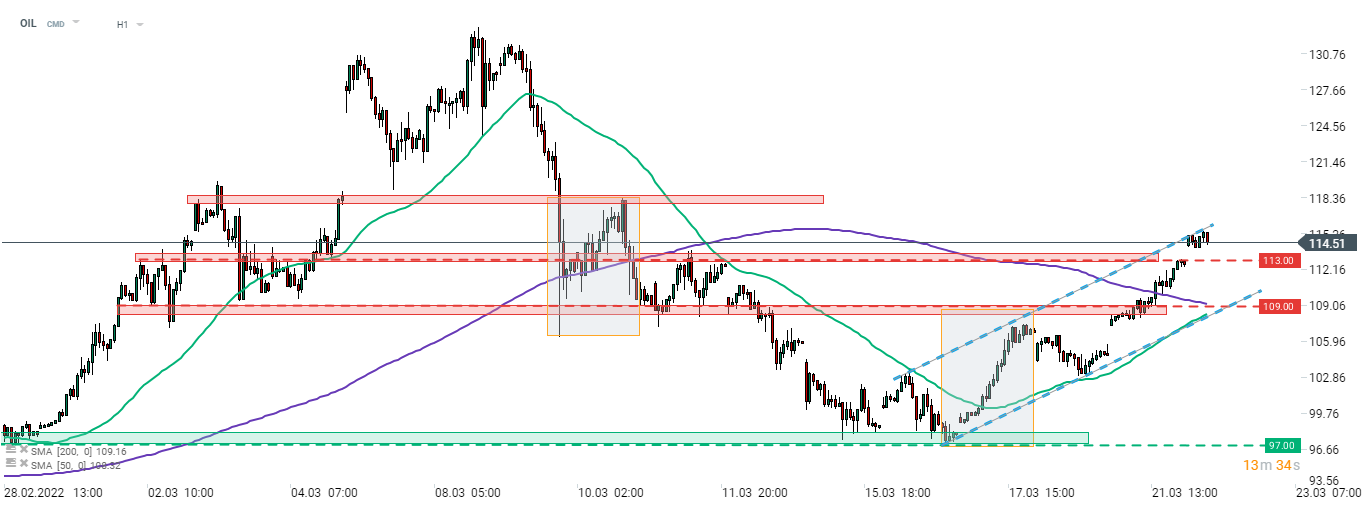

Brent (OIL) managed to break above the upper limit of a market geometry in the $109 per barrel area. Upward move was extended later on and price broke above $113 resistance as well. The upper limit of an upward channel in the $115 area is being tested at press time. Source: xStation5

Brent (OIL) managed to break above the upper limit of a market geometry in the $109 per barrel area. Upward move was extended later on and price broke above $113 resistance as well. The upper limit of an upward channel in the $115 area is being tested at press time. Source: xStation5

สรุปข่าวเช้า 6 มี.ค.

สรุปข่าวเช้า 5 มี.ค.

ข่าวเด่นวันนี้ 5 มี.ค.

🚨 สถานการณ์อิหร่าน: ภาพรวมปัจจุบันและแนวโน้ม