- Wall Street indices finished yesterday's lower - S&P 500 dropped 0.17%, Dow Jones finished 0.06% lower, Nasdaq declined 0.55% and small-cap Russell moved 0.77% lower

- Indices from Asia-Pacific traded mixed today - S&P/ASX 200 gained 0.5%, Kospi dropped 0.3%, while indices from Japan and India traded flat. Chinese indices traded higher

- DAX futures point to a slightly lower opening of the European cash session today

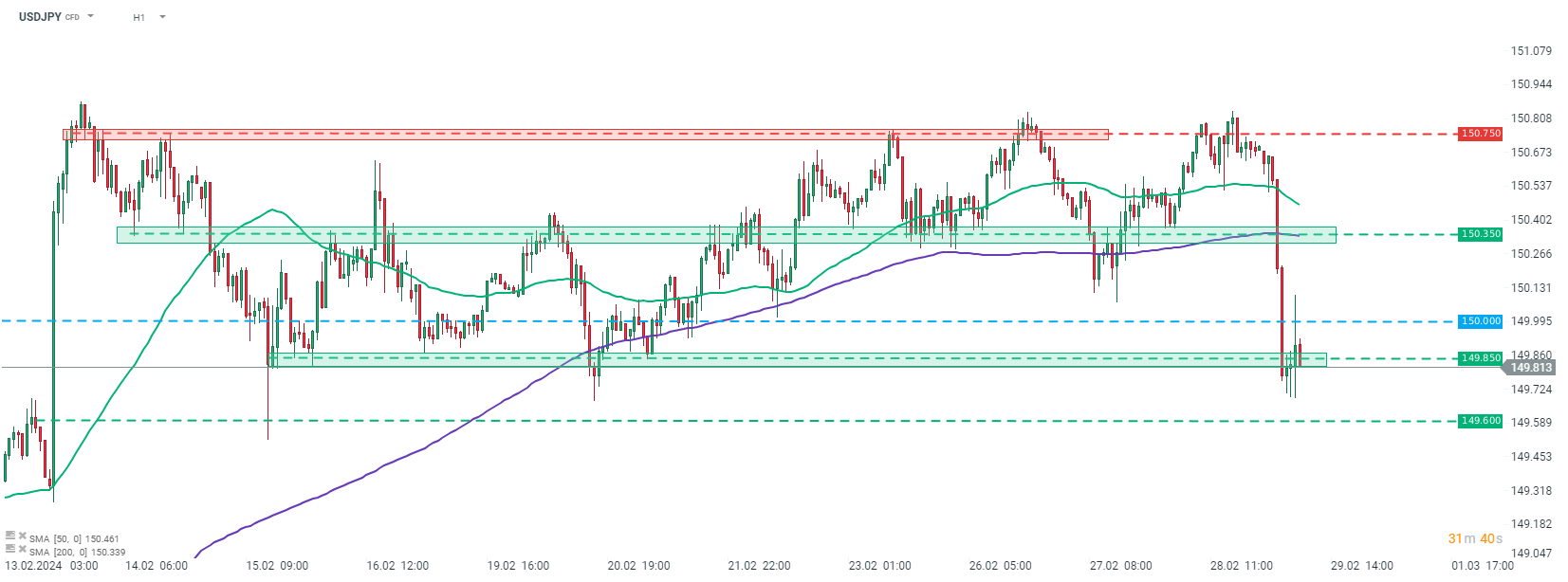

- USDJPY dropped below 150.00 mark, following comments from BoJ member Takata

- BoJ Takata said that many companies are offering wage hikes that are higher than in the previous year, and that achievement of 2% inflation target in becoming in sight

- Takata added that exit measures should include abandoning of the yield curve control mechanism, exiting negative rates and committing to overshooting inflation target

- RBNZ Governor Orr said that New Zealand's economy is developing as expected and that Official Cash Rate should stay at 5.50% in 2024

- Japanese retail sales increased 2.3% YoY in January (exp. 2.4% YoY), marking the 23rd month of consecutive year-over-year increases

- Japanese industrial production dropped 7.5% MoM in January (exp. -7.3% MoM). On an annual basis, industrial production was 1.5% YoY lower

- Australian retail sales increased 1.1% MoM in January (exp. 1.7% MoM)

- Australian private sector credit increased 0.4% MoM in January (exp. 0.4% MoM)

- Australian Q4 capital expenditure increased 0.8% QoQ (exp. 0.4% QoQ)

- Cryptocurrencies gain - Bitcoin trades 3.1% higher, Ethereum gains 4% and Dogecoin rallies over 12%. However, Bitcoin did not manage to climb back to yesterday's highs near $64,000

- Energy commodities trade mixed - oil gains 0.3%, while US natural gas prices drop 0.6%

- Precious metals trade higher - gold gains 0.1%, silver trades 0.3% higher, platinum jumps 0.7% and palladium adds 0.4%

- AUD and JPY are the best performing major currencies, while EUR and USD lag the most

USDJPY dropped below 150.00 mark after BoJ member Takata suggested that policy normalization in Japan is in sight. Source: xStation5

USDJPY dropped below 150.00 mark after BoJ member Takata suggested that policy normalization in Japan is in sight. Source: xStation5

📉 Market Wrap: เงินทุนไหลออกจากยุโรป 🇪🇺

สรุปข่าวเช้า 6 มี.ค.

ตลาดเด่นวันนี้: EURUSD

สรุปข่าวเช้า 5 มี.ค.