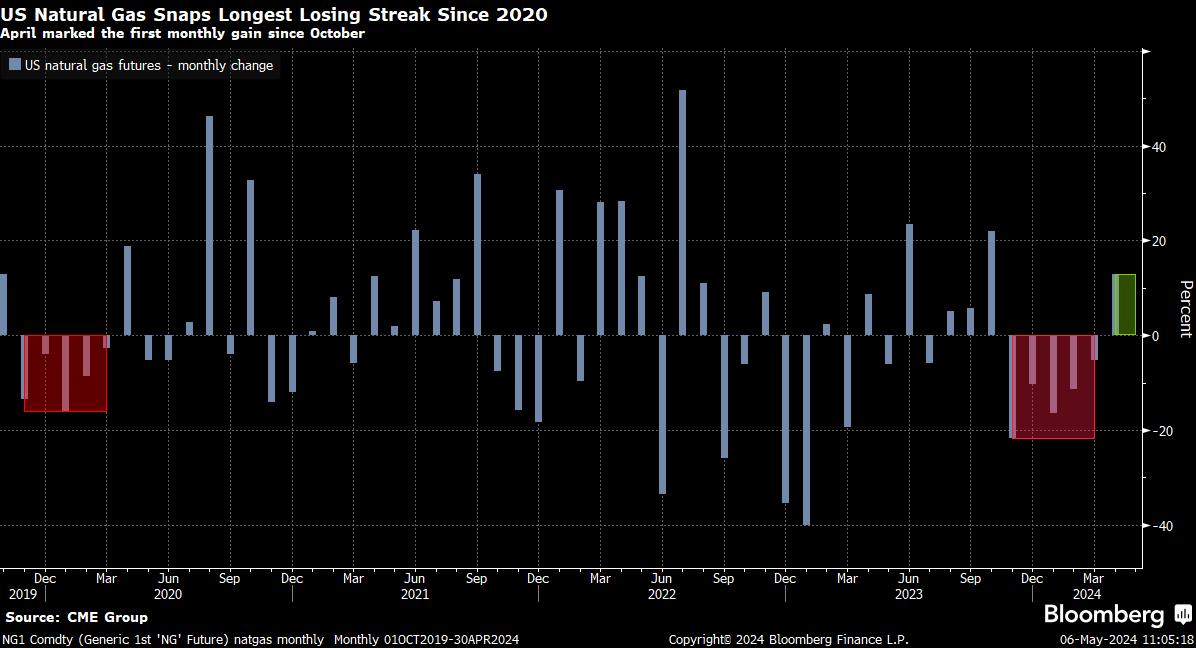

April was the first month of gains for US natural gas prices (NATGAS) since October last year. The earlier period from November to March was the longest period of declines in at least 4 years. Gas remained at a low level due to the sustained high production and low demand during the heating season in the US. However, the situation is starting to change now.

Production in the US is falling from high levels, even nearly from 106 bcfd per day to levels of 100 or lower, due to a significant decrease in drilling rigs in the US. Earlier, US producers indicated that the price was too low to continue investments, resulting in low drilling activity. Although oversupply in the US gas market is huge, the upcoming summer period, when demand for electricity produced from gas increases, could lead to a significant rebound in gas consumption. Additionally, demand for American gas from Europe may increase along with further problems in the Middle East, which could lead to a reduction in the regularity of LNG gas deliveries from Arab countries. US exports have been declining in recent months, but there are grounds to believe that demand will rebound again during the summer period, when stocks are being rebuilt before winter.

NATGAS rebounded to its highest levels since January 26th. Moreover, the recent candles suggest a return of greater volatility, which may indicate that in the coming weeks, in line with seasonality, we will see a rebound even to the range of 2.5 USD/MMBTU, where the 200-period moving average is located. Seasonality indicates that buying pressure should persist until mid-month.

Source: xStation5

NATGAS has had a very long period of declines. Source: Bloomberg Finance LP

ข่าวเด่นวันนี้

3 ตลาดสำคัญที่ต้องจับตาในสัปดาห์นี้

ก๊าซธรรมชาติลด 6% ตามพยากรณ์อากาศใหม่

Geopolitical Briefing : Iran ยังเป็นปัจจัยเสี่ยงอยู่หรือไม่?