US natural gas price (NATGAS) are trading over 7% higher this morning after launching today's trade with an over-8% bullish price gap. Price tested $7.00/MMBTu resistance zone today, following an attack on the $6.30-6.40 zone on Friday. Price has now recovered a third of the latest major downward impulse and has broken above the downward channel in which it traded since early-August. The aforementioned $6.30-6.40 price zone, along with 23.6% retracement of the downward impulse, can now be seen as a key near-term support should bears attempt to fill the price gap.

Source: xStation5

Source: xStation5

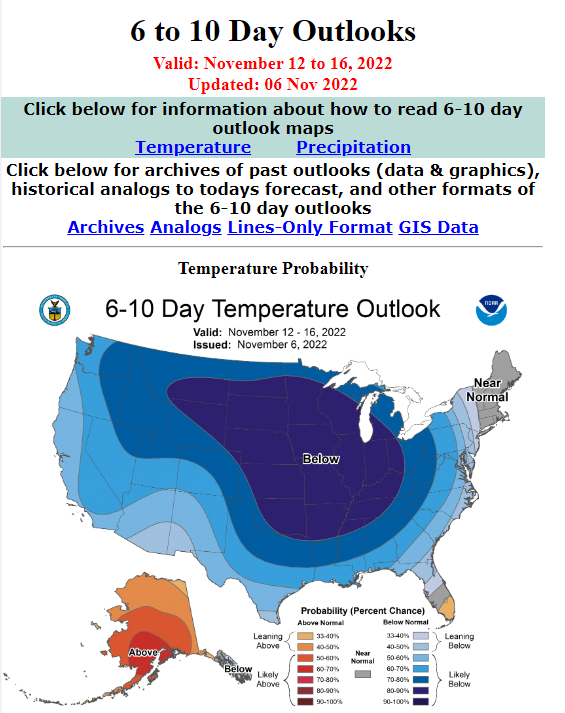

US weather forecasts for the coming days point that temperatures in key heating regions will be lower than usual. This means that the US heating season may already be underway. Source: NOAA

US weather forecasts for the coming days point that temperatures in key heating regions will be lower than usual. This means that the US heating season may already be underway. Source: NOAA

Interestingly, 5-year seasonal patterns suggest that significant natural gas price jumps are set to occur by the end of this week. Simultaneously, forecasts for Europe still point to higher-than-average temperatures, what is triggering a 3-4% drop in European natural gas price today.

BREAKING: ปริมาณสำรองน้ำมันสหรัฐเพิ่มขึ้นอย่างมหาศาล!

📈 ราคาทองพุ่ง 1.5% ก่อน NFP ทำระดับสูงสุดตั้งแต่วันที่ 30 มกราคม

Silver พุ่ง 3% ในวันนี้ 📈

ข่าวเด่นวันนี้