Gas prices extend sharp declines that started in the second half of October, which is in line with seasonality. Typically, seasonal highs on the US gas market were reached in October/November, while the first part of December usually brought lower prices.

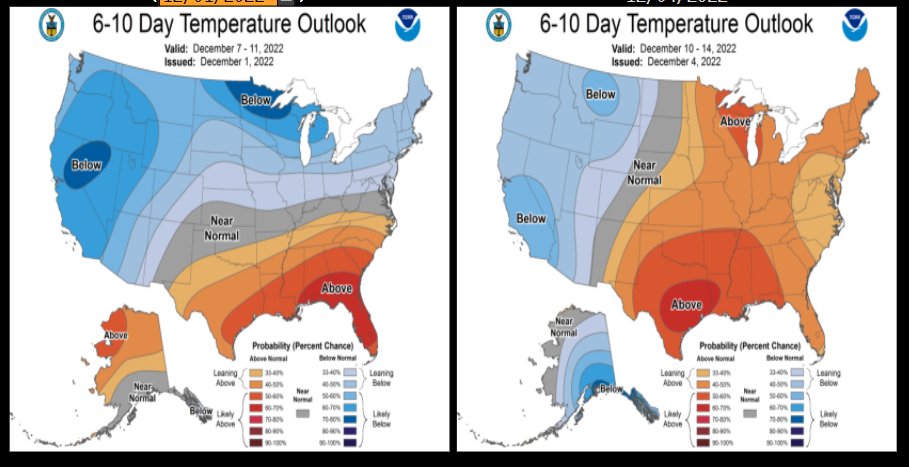

Changes in gas stockpiles are in line with seasonality, and just before the beginning of the heating season, inventories reached the 5-year average. However, taking into consideration weather forecasts, one can expect that the stockpiles reduction could be much smaller. The US temperature outlook has improved significantly. Now, warmer temperatures are expected across more than half of the US territory, including the key North Midwest region. As a result price broke below the short-term uptrend line. If the weather continues to be very mild, NATGAS price may move towards a long-term uptrend line around $5/MMBTU.

Weather forecasts improved significantly in recent days. Source: Bloomberg

Weather forecasts improved significantly in recent days. Source: Bloomberg

NATGAS price has broken the uptrend line and is heading towards the July-October lows. Source: xStation5

ข่าวเด่นวันนี้

3 ตลาดสำคัญที่ต้องจับตาในสัปดาห์นี้

ก๊าซธรรมชาติลด 6% ตามพยากรณ์อากาศใหม่

Geopolitical Briefing : Iran ยังเป็นปัจจัยเสี่ยงอยู่หรือไม่?