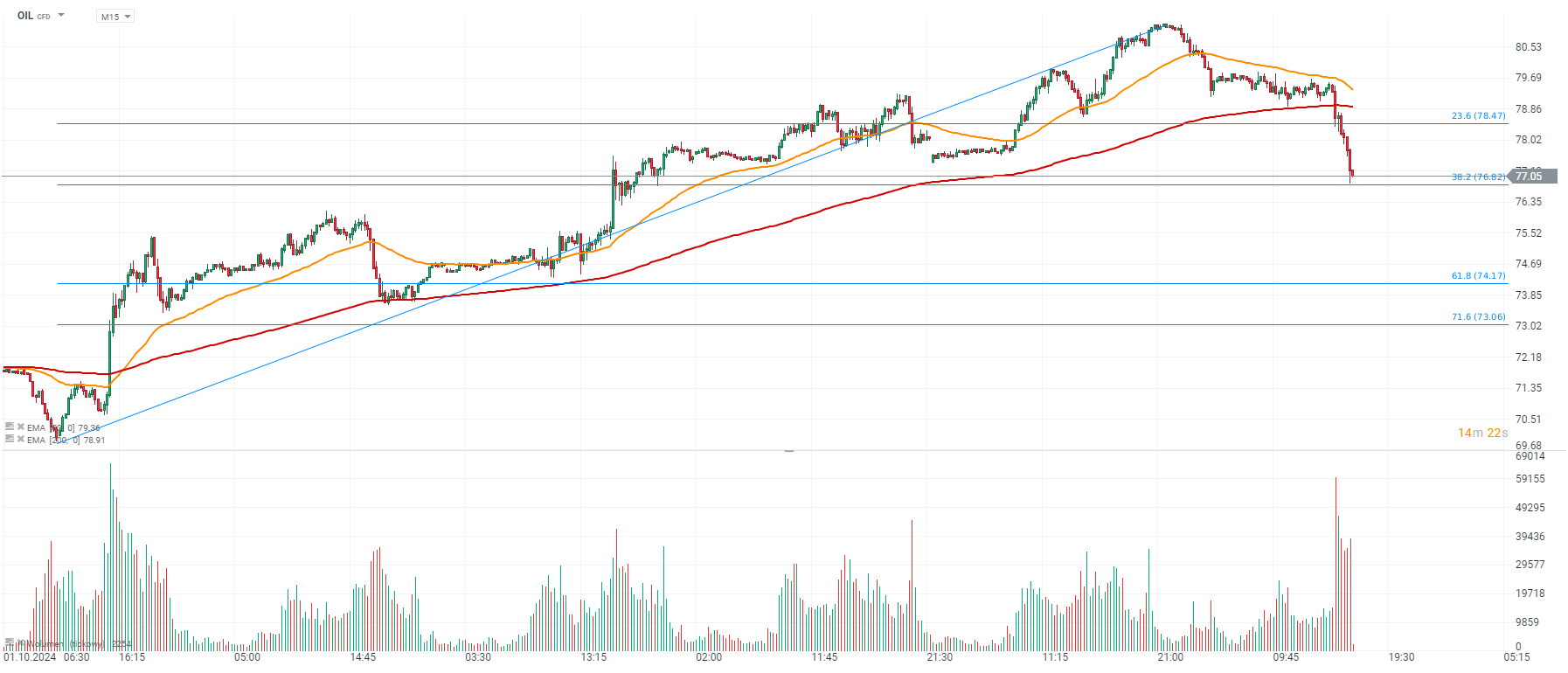

Brent Crude (OIL) drops almost 5% as Libya's NOC informed about rising production (to 1.13 million barrels per day, first time since August), while Middle East tensions weakened, as Israel didn't respond to Iran's attack yet. Investors expect that the political stalemate, which stopped production in Libya for more than a month, is now ended.

Libya expects that oil production will back to historic levels during days. Even hundred thousand oil barrels per day may now return to the market, if the Libyan crisis will end for real, balancing investors 'geopolitical risk'. Another source of supply today is weakening sentiment among Chinese economy, reflected in a drop in Chinese equities.

OIL stopped declines at 38.2 Fibonacci retracement of the last upward wave, driven by Israel-Iran crisis, but the downward impulse is today very strong.

Source: xStation5

📉 Market Wrap: เงินทุนไหลออกจากยุโรป 🇪🇺

📈 ราคาน้ำมันพุ่ง 6% – จะเกิดซ้ำเหมือนปี 2022 หรือไม่? 🛢️

สรุปข่าวเช้า 6 มี.ค.

สรุปข่าวเช้า 5 มี.ค.