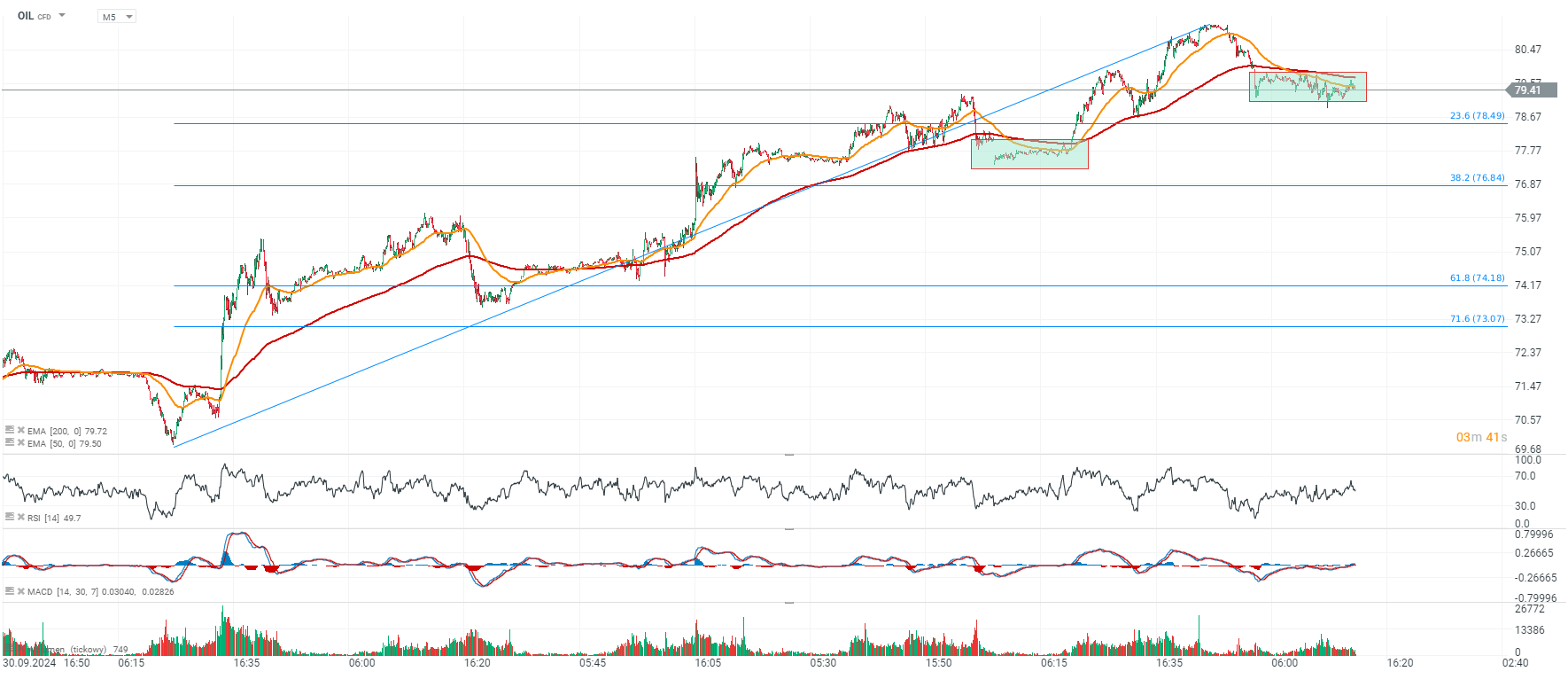

Oil is losing nearly 2% today, after 6 days of virtually uninterrupted gains, supported mainly by the escalating geopolitical tensions in the Middle East. Today's strong declines in China, where the CHN.cash contract is losing almost 10%, due to the disappointing lack of further communication on economic stimulus measures and the lack of escalation of tensions in the Middle East have caused investors to take profits.

- China indicated today that it was confident of 'meeting targets' for economic growth, which somewhat disappointed markets building up great expectations about the impact of stimulus packages on potentially outperforming forecasts. As a result, investors are beginning to re-examine whether 'stimulus' will seriously lift oil demand in China.

- In addition, despite the ongoing Israel-Hezbollah military operations, the market still sees only limited chances for a major shake-up in the Middle East (at least not before the U.S. elections). As a result, some of the geopolitical premium after oil's biggest rally since 2023 may evaporate, while Israel's military response to an Iranian attack has been postponed to an unknown future.

- On the other hand, some short-term support for oil prices could potentially come from Hurricane Milton, which has been upgraded to hurricane scale 5 and could cause short-term production outages in the Gulf of Mexico. Investors are awaiting today's API report, which estimates a 1.9 million barrel increase in oil inventories.

Oil is retreating below $80 per barrel today, but the trend is still clearly upward; a rise above $80 could pave the way for another upward momentum.

Source: xStation5

สรุปข่าวเช้า 5 มี.ค.

ข่าวเด่นวันนี้ 5 มี.ค.

🚨 สถานการณ์อิหร่าน: ภาพรวมปัจจุบันและแนวโน้ม

🚨 ด่วน: สต็อกน้ำมันเพิ่มขึ้นแรงอีกครั้ง – WTI ใกล้แตะ 74 ดอลลาร์