PepsiCo reported 2Q24 results today. The company achieved a slight increase in revenue to $22.5 billion (+0.8% y/y). At the operating profit level, the company reported an 11% y/y increase, which translates into a 7% increase at constant exchange rates.

- At the operating profit level, the company recorded $4 billion (+9% y/y, at constant exchange rates +7% y/y), and EPS rose 13% y/y, with a 10% increase at constant exchange rates.

- The company's results turned out to be mixed. Revenues grew weaker than expectations, while net income beat market consensus.

- On a negative note, the company lowered its expectations for organic revenue growth to around 4% (previously the company had assumed at least 4% growth).

When breaking down revenue by segment, it appears that the company is further facing weaker demand in the US. PepsiCo's North American snacks business saw a strong year-on-year decline. Volumes recorded as much as a 17% y/y reduction in Quaker Foods North America (partially reinforced by the company's withdrawal of certain products), and in Frito-Lay North Amercia the company also reported a 4% y/y decline in volumes. Lower demand is also seen in the U.S. for beverages, whose volumes fell 3% y/y. Improved demand, however, can be seen in Europe, where sales volumes rose 5% y/y.

- The sales dynamics caused EPS in the U.S. to decline in the snacks sector by -3% (for the Frito Lay segment) and by -23% (for Quaker Foods) y/y on a constant currency basis.

- In addition to lowering its expected level of organic growth, the company reiterated its earlier projections. It expects to achieve at least 8% EPS growth (on a constant-currency basis), $8.2 billion transferred to shareholders ($7.2 billion in dividends and $1 billion in share buybacks), and a 1% impact from changes in sales and EPS results due to currency fluctuations. This puts the company's 2024 EPS guidance at $8.15 (+7% y/y).

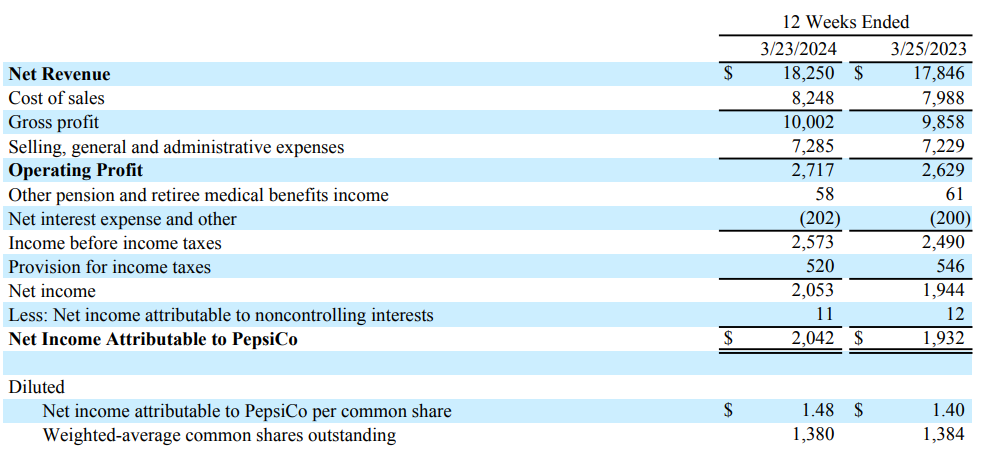

PepsiCo's 2Q24 results. Source: PepsiCo

PepsiCo's 2Q24 results. Source: PepsiCo

In response to deteriorating demand in the company's most important market and lowered revenue projections, PepsiCo's stock price is trading down nearly 3% in pre-opening trading. Pre-opening market quotes suggest the lowest price since October 2023. Source: xStation

Source: xStation5

📈 Boeing ปรับตัวขึ้น ท่ามกลางข่าว คำสั่งซื้อ 737 MAX ขนาดใหญ่จากจีนที่อาจเกิดขึ้น

หุ้น Ryanair กดดันจากความตึงเครียดในตะวันออกกลาง 📉

Stock of the Week: Broadcom ขับเคลื่อนโดย AI ทำสถิติใหม่ 🚀

Market Wrap: ดัชนีหุ้นพยายามยืนรีบาวด์ แม้ราคาน้ำมันปรับตัวสูงขึ้น 🗽 หุ้น Broadcom พุ่งแรง หลังผลประกอบการและแนวโน้มธุรกิจ AI เกินคาด