The BoE will publish its decision on interest rates at 1:00 PM. We will also get the bank's statement, new inflation forecasts, and possibly hear from the bank's chief Bailey. The market is hopeful that the BoE will once again surprise with a larger-than-expected increase, although that might not save the pound in the short term.

Lower inflation than expected, but extremely high in the G7

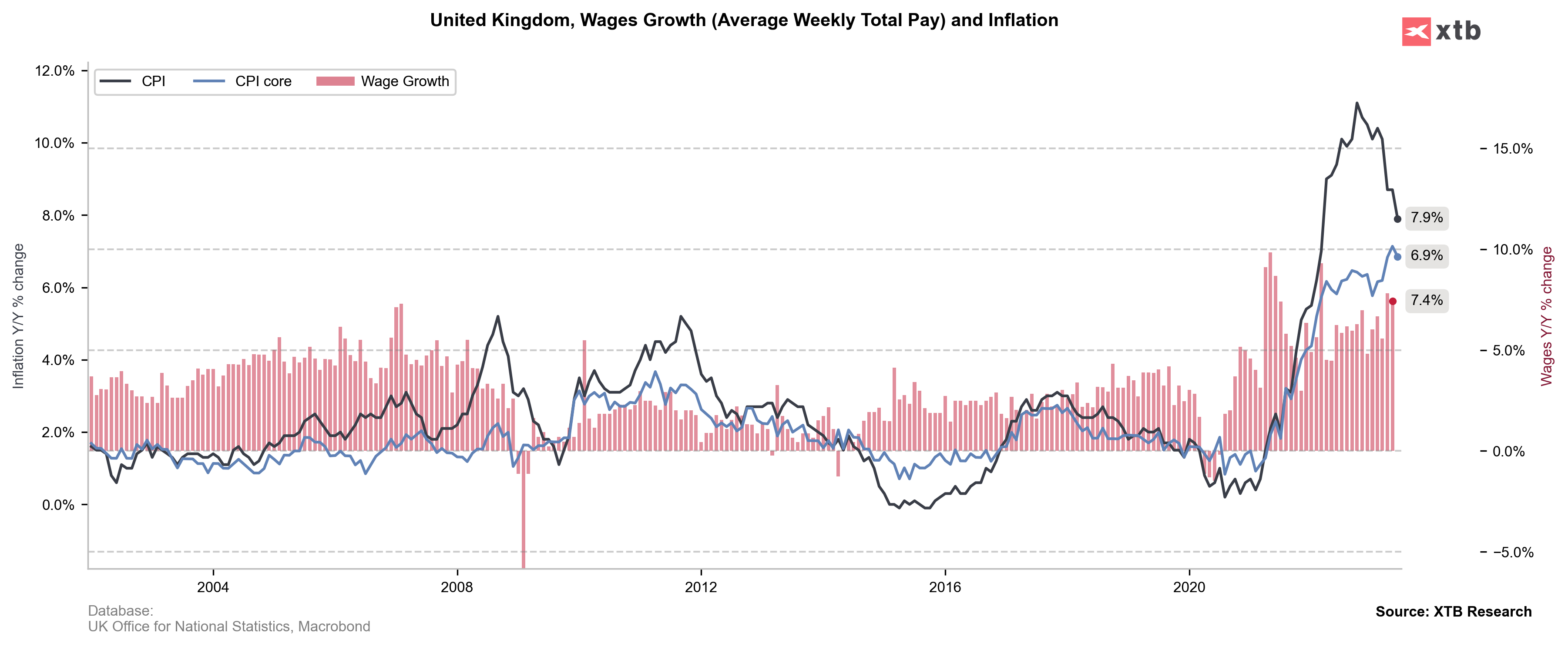

The latest inflation reading in the UK came in below expectations at 7.9% year-on-year. Nevertheless, this is the highest inflation reading in the G7, significantly higher than in the USA or the Eurozone. Moreover, wages are growing at 7.3% year-on-year, a faster rate of growth than in the USA or the EMU. Additionally, the British seem to be complaining the most about rising living costs, and high-interest rates on loans are leading to a significant drop in property prices. It seems that at least a strong economic slowdown is inevitable, so the pound should not receive support from the economy.

Inflation in the UK is falling, but at the slowest pace among the G7 countries. Additionally, we have a high wage growth rate, which may lead to the entrenchment of inflation at high levels until the end of this year

Expectations point to 25 basis points; is there a possibility of a surprise?

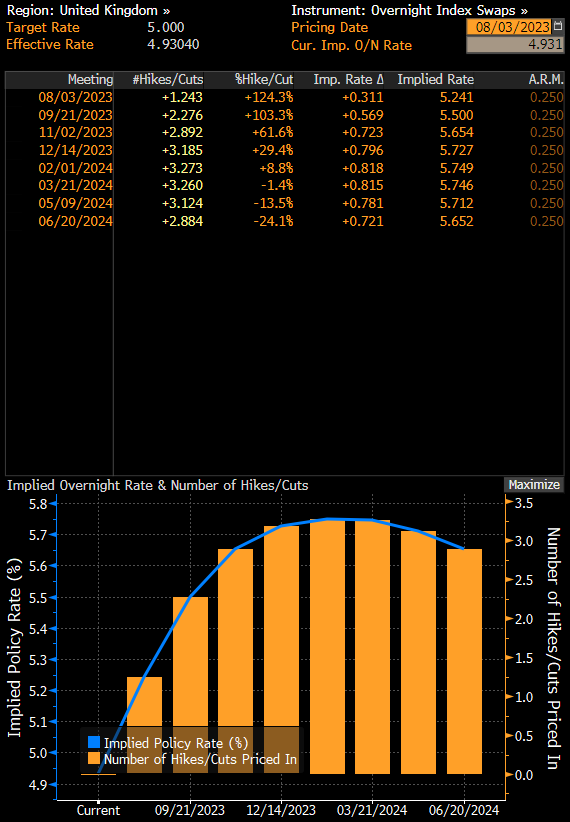

In June, the BoE surprised with a 50 basis point increase, which was even more puzzling based on previous inflation forecasts that predicted a quicker attainment of the inflation target. Currently, another optimistic revision is expected. Therefore, if the BoE presents lower inflation expectations, this may lead to a decrease in market expectations for the forward rate. However, if the BoE does decide on 50 basis points with lower inflation expectations, it will be a strong signal to the market that the BoE takes the country's inflation problem seriously, which could lead to a temporary revival in the pound. Nevertheless, without an improvement in the economic situation (industrial PMI below 50, and services rated lower than in June at 51.5), it will be hard to expect a better future for the pound currently. Additionally, in recent weeks, we have observed a return to the strength of the American currency, even despite the credit rating downgrade by Fitch.

The market sees only a 25% chance of a 50 basis point increase and sees the peak rates below 6.0%, although just a few weeks ago it saw chances even for 6.5%. Inflation prospects may set expectations for the market for the next six months. Source: Bloomberg Finance LP

What's next with GBPUSD?

The greatest chance for the pound today is a 50 basis point increase and no reduction in the inflation path. In both cases, the chances are small, and even if it were to happen, the typically optimistic Bailey might continue to weaken the pound. In the past, Bailey has sounded as if he did not want to raise interest rates, but he is compelled to do so by persistently high inflation.

GBPUSD is currently testing the area around the upward trend line. Earlier, there was a breakout of the largest correction of the upward impulse that began in early June. If the upward trend line is breached, the pair may fall to around the 1.2500 level, where the 23.6 retracement of the upward wave that began in September last year is located. On the other hand, a move to the lows around the end of May and June is not ruled out, which would result from the range of movement after breaking the 50-period average. A previous such breakout occurred in February of this year. It is also worth noting that the pound is quite heavily overbought looking at the COT indicator.

Source: xStation 5

ข่าวเด่นวันนี้

BREAKING: ยอดขายปลีกสหรัฐฯ ต่ำกว่าคาดการณ์

ปฏิทินเศรษฐกิจ: ดัชนีหุ้นและคู่สกุลเงิน EUR/USD รอตัวเลขการขายปลีกสหรัฐฯ

สรุปข่าวเช้า