Fed Chair Powell started the second session of semi-annual testimonies before Congress. Below we will present some key takeaways from the Q&A session:

-

I stress that no decision has been made on the pace of rate hikes.

-

The terminal rate is likely to be higher than we expected.

-

The extraordinary strength of the jobs report and the inflation report both pointed in the same direction.

-

We have not made a decision about the March meeting and it is data dependent.

-

We have critical information before the March meeting.

-

No one should believe the Fed can protect the economy in the event of a debt default.

-

Congress would have to approve retail CBDC

-

We've had our eyes on the whole housing inflation thing from the beginning

-

Regarding the transitory mistake says 'if we ever see this pitch again, we'll know how to swing at it'

-

The cost of failure to control inflation would be extremely high

-

China faster reopening isn't expected to be a big net effect on the US

-

We expect China's impact to be moderate overall

-

Notes that oil prices could be affected by China reopening and notes that it's more of a concern for Europe

-

Lower housing inflation is a big reason everyone thinks inflation will go down

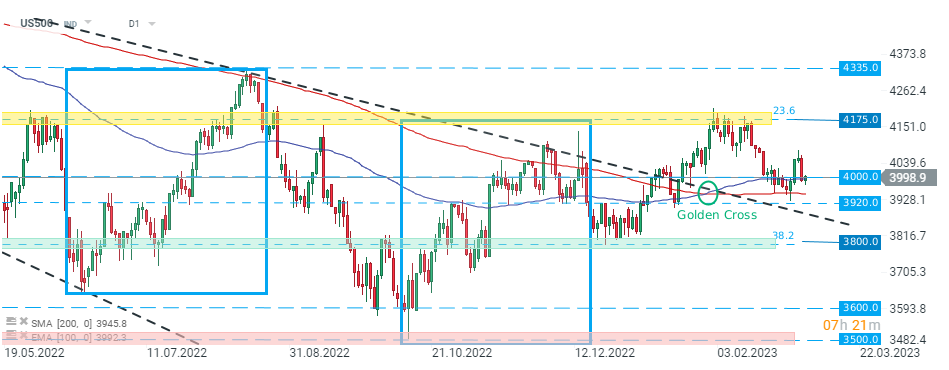

US500 rebounds from daily lows and approaches psychological 4000 pts level. Source: xStation5

BREAKING: ยอดขายปลีกสหรัฐฯ ต่ำกว่าคาดการณ์

ปฏิทินเศรษฐกิจ: ดัชนีหุ้นและคู่สกุลเงิน EUR/USD รอตัวเลขการขายปลีกสหรัฐฯ

สรุปข่าวเช้า

Market Wrap: หุ้น Novo Nordisk ทะยานมากกว่า 7% 🚀