Strong recession fears triggered by weak U.S. labor market data led to significant pullbacks in global stock indexes. We are observing very sharp declines in Wall Street futures, continuing the moves from last Friday. This is also connected to the significant retreat in the Japanese stock market. The Nikkei 225 on the cash market is down over 13%, while the futures market has been suspended.

In this situation, we see very stable gold. On Friday, gold rose to near historical highs, but the session ended with a slight decline. A similar situation is currently visible. On the other hand, the movements in gold are minimal compared to other assets. Bitcoin, which was considered digital gold and a safe asset against recession, is losing heavily. The strong sell-off across all assets is causing a pullback in Bitcoin, which may be related to investors withdrawing funds from ETFs or futures.

Gold remains above 2400 USD per ounce. Source: xStation5

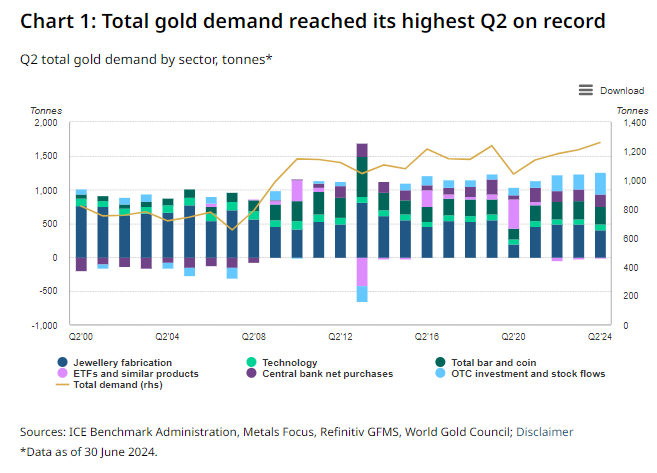

It is worth noting that recently published data for the second quarter in the gold market. The second quarter was quite weak in terms of demand - jewelry demand saw a significant decline, and only due to OTC demand (which has very limited significance in the context of physical gold), the overall situation did not look bad. On the other hand, ETFs experienced minimal sell-offs, while central banks bought a substantial amount of gold. Source: WGC

BREAKING: ปริมาณสำรองน้ำมันสหรัฐเพิ่มขึ้นอย่างมหาศาล!

📈 ราคาทองพุ่ง 1.5% ก่อน NFP ทำระดับสูงสุดตั้งแต่วันที่ 30 มกราคม

Silver พุ่ง 3% ในวันนี้ 📈

ข่าวเด่นวันนี้