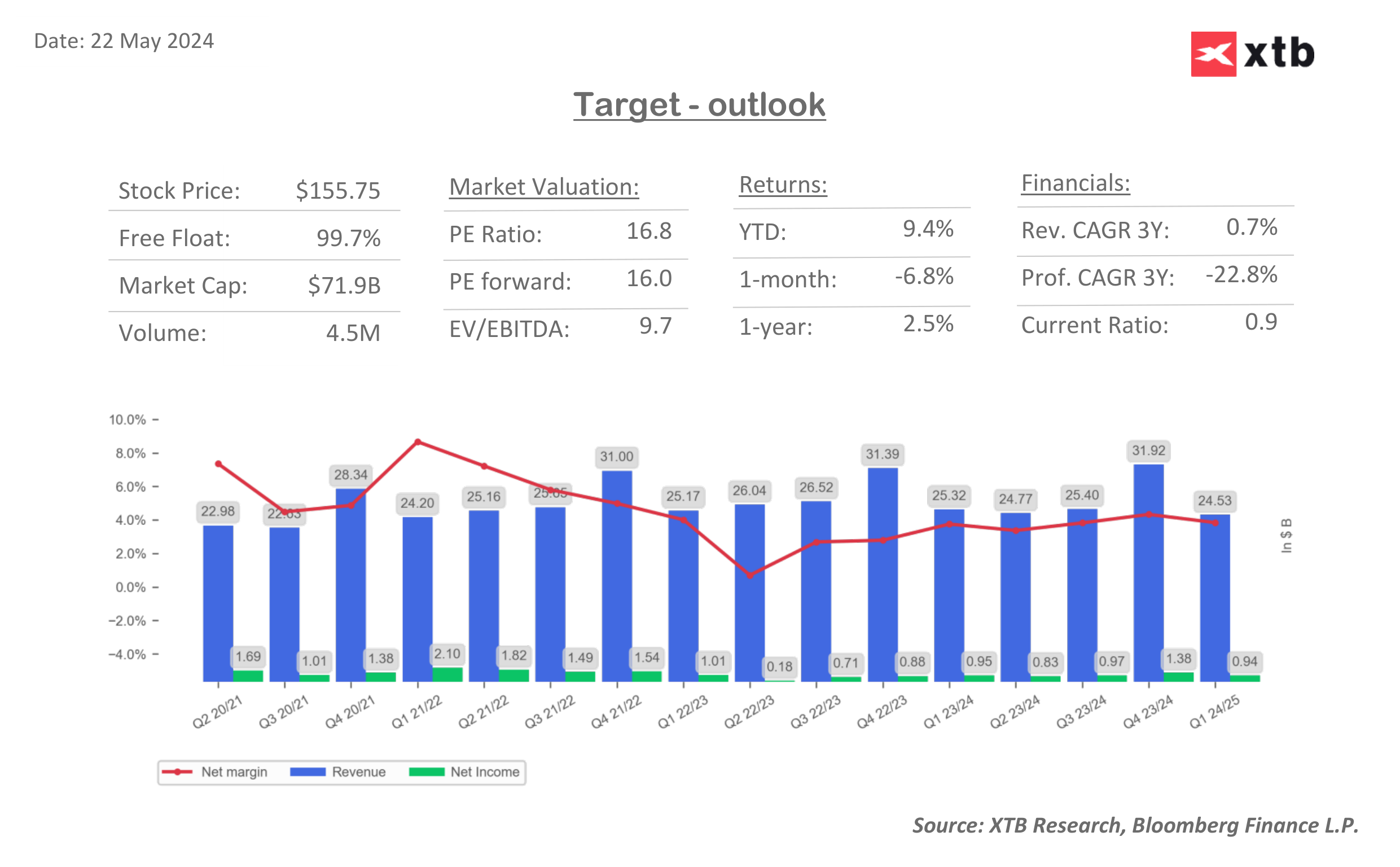

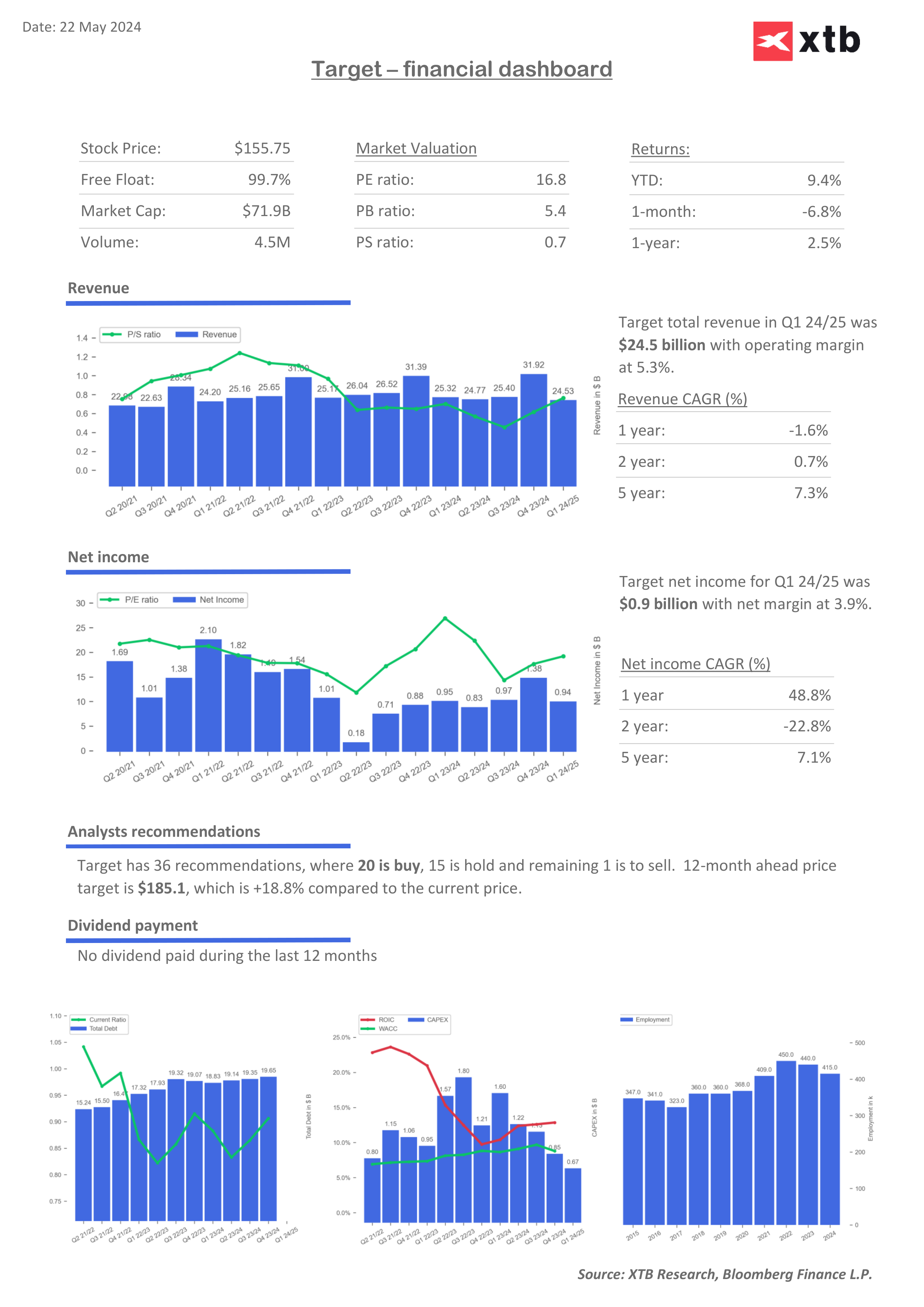

The shares of Target Corp (TGT.US), the US large format retail giant, are losing nearly 7.9% before the opening of the Wall Street session, following the release of conservative earnings forecasts for the rest of the year. Target reported that a key measure of sales fell for the fourth consecutive quarter, down 3.7%.

Adjusted earnings per share of $2.03 came in slightly below expectations, marking the first “miss” (failure to meet market expectations) of this measure in the last six quarters. Discretionary spending is likely to remain under pressure in the near term, the company's development director said, adding that demand for household products and appliances remains weak.

Selected results and forecasts presented by the company:

Q2 FORECASTS

- Adjusted earnings per share $1.95-2.35, analysts estimated $2.19

- Comparable sales flat to 2% maximum, analysts estimated +1.9%

2025 FORECAST

- Still forecast adjusted EPS of $8.60 to $9.60, analysts estimated $9.44

- Still sees comparable sales flat to 2% maximum, analysts estimated +0.9%

FIRST QUARTER RESULTS

- Comparable sales -3.7%, analysts estimated -3.68%

- Comparable digital sales +1.4% vs. -3.4% y/y, analysts estimated -0.73%

- Sales $24.14 billion, -3.2% y/y, analysts estimated $24.13 billion

- Gross margin 27.7% vs. 26.3% y/y, analysts estimated 27.4%

- Ebit $1.33 billion, -1.9% y/y

- Ebitda $2.04 billion, +1.2% y/y, analysts estimated $1.97 billion

- Customer transactions -1.9% vs. +0.9% y/y

- Average transaction amount -1.9% vs. -0.9% y/y, analysts estimated -1.9%

- Total stores 1,963, +0.5% y/y, analysts estimated 1,966

- Operating margin 5.3% vs. 5.2% y/y, analysts estimated 5.34%

- SG&A expenses $5.17 billion, +2.8% y/y, analysts estimated $5.07 billion

- Comparable store sales -4.8% vs. +0.7% y/y, analysts estimated -4.65%

- Same-store sales 81.7% vs. 82.5% y/y, analysts estimated 81%

- Adjusted EPS $2.03 vs. $2.05 y/y, analysts estimated $2.05

- Operating profit $1.30 billion, -2.4% y/y, analysts' estimate $1.3 billion

Shares of Target (TGT.US) are losing nearly 7% before the opening of the session following the release of results. Source: xStation 5

Stock of the Week: Broadcom ขับเคลื่อนโดย AI ทำสถิติใหม่ 🚀

Market Wrap: ดัชนีหุ้นพยายามยืนรีบาวด์ แม้ราคาน้ำมันปรับตัวสูงขึ้น 🗽 หุ้น Broadcom พุ่งแรง หลังผลประกอบการและแนวโน้มธุรกิจ AI เกินคาด

📀 Coinbase และ MicroStrategy พุ่งแรง หลังทรัมป์ท้าทายธนาคารบนวอลล์สตรีท

สรุปตลาด: หุ้นยุโรปและสหรัฐพยายามรีบาวด์ฟื้นตัว 📈