Starting from Friday, March 22, Tesla (TSLA.US) will increase the prices of Model Y cars in Europe and from April 1 in the USA. Prices in the USA will be raised by an average of 1000 dollars, and in Europe by about 2100 dollars.

Regarding sales policy in China, the company is offering discounts worth nearly 1500 dollars for on hande available models.

However, on the other hand, bank analysts argue that given the company's overall very high inventory levels, the implemented program of price increases may not permanently help the company, as it will not combat the low demand prevailing in the market.

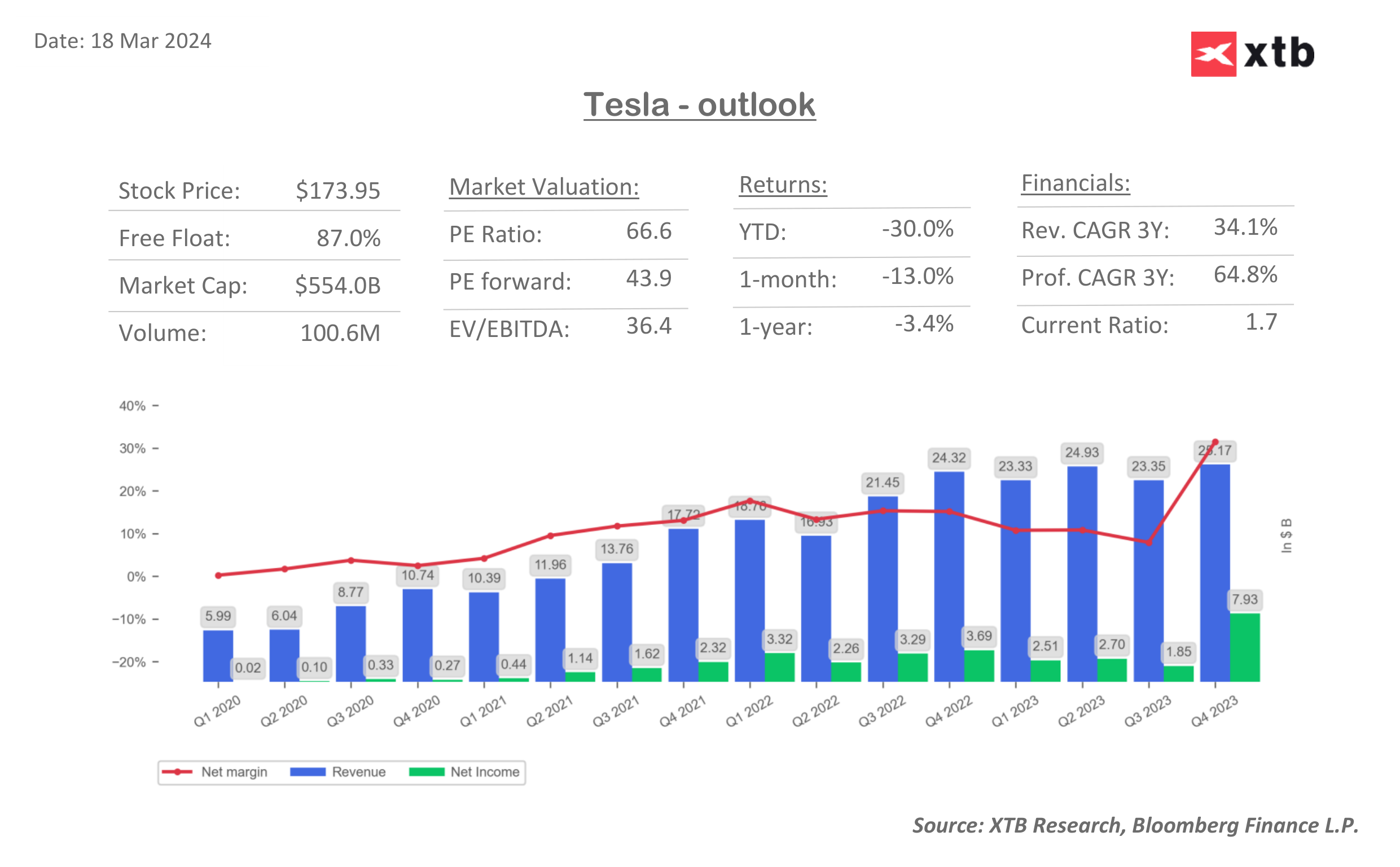

Since the beginning of the year, the company's shares have already lost about 30%. The company's shares are currently trading at local lows, which are located in the zone of the lowest levels observed since April-May 2023. During today's session, the company's shares are gaining 5.77% in intraday terms.

Source: xStation

📈 Boeing ปรับตัวขึ้น ท่ามกลางข่าว คำสั่งซื้อ 737 MAX ขนาดใหญ่จากจีนที่อาจเกิดขึ้น

หุ้น Ryanair กดดันจากความตึงเครียดในตะวันออกกลาง 📉

Stock of the Week: Broadcom ขับเคลื่อนโดย AI ทำสถิติใหม่ 🚀

Market Wrap: ดัชนีหุ้นพยายามยืนรีบาวด์ แม้ราคาน้ำมันปรับตัวสูงขึ้น 🗽 หุ้น Broadcom พุ่งแรง หลังผลประกอบการและแนวโน้มธุรกิจ AI เกินคาด