Tesla (TSLA.US) shares are trading down more than 6% after results that disappointed negatively. After initial gains after the market close, investors ultimately view the report negatively. Margins came under pressure in the face of lower model prices. A massive drop in free cash flow of less than $850 million put a question mark over the giant's market capitalization of nearly $760 billion. For the first time since 2019, the company disappointed Wall Street negatively in both earnings per share and revenue.

- Revenue: $23.4 billion vs. $24.06 billion forecasts

- Earnings per share (EPS): $0.66 vs $0.74 expectations

- Free cash flow: $848 million vs. $2.59 billion forecasts

- Gross margin: 17.9% vs 18% forecasts and 18.2% previously

- Deliveries: 435,059 vehicles vs. 456,722 forecasts (7% lower than Q2)

- Research and development (R&D) expenses: $1.16 billion vs. $733 million in Q3 2022

The company maintained its annual deliveries forecast at $1.8 million - if expectations are not met (which would mean that there will not be a massive surge in deliveries in the last quarter of the year) there is a chance for a negative disappointment in the next quarter. The market expected that Tesla Cybertruck would manage to improve the company's performance faster but Elon Musk warned that it would take between a year and 18 months before production of 'cybertrucks' would positively impact free cash flow. Deliveries are scheduled to begin November 30, this year.

Musk sees slowdown on the horizon?

-

At the CEO conference, Elon Musk indicated that Tesla is not going to increase advertising spending because investing in presenting people with products they can't afford would not be a smart business move

-

Musk sees the macro landscape largely affecting consumers and higher interest rates making people calculate more. Musk is concerned that demand for cars may wane and suggested that the company will continue its policy of reducing costs and prices of cars to make them more affordable to buy

- This does not appear to be positive news for investors because on the one hand we have a warning of a slowdown, and on the other hand the prospect of further pressure on margins. Cost of models sold per vehicle fell to $37,500 in the third quarter

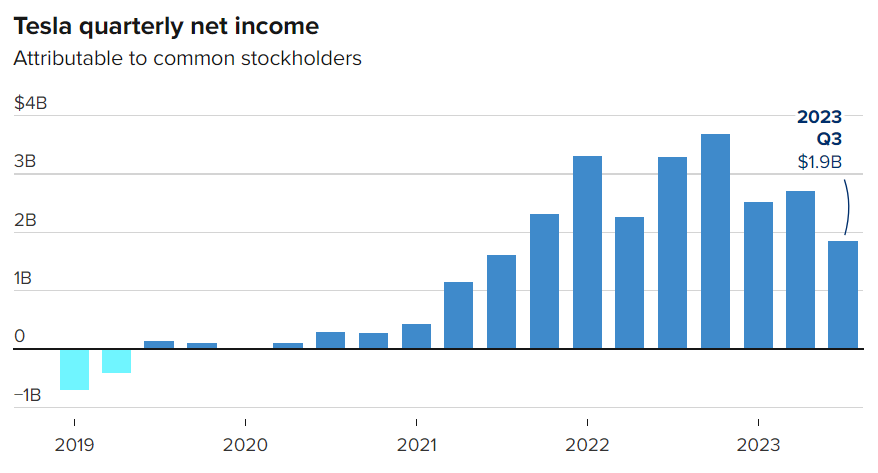

Tesla's revenue and profits on a historical basis

Source: CNBC

Tesla stock chart (TSLA.US, D1 interval)

Tesla shares opened US session with a nearly 7% downward gap near the 38.2 Fibonacci retracement of the upward wave from the fall of 2022. The local peaks of February 2023 and the price bottom of August 2023 (gray circles) are also in the area. Source: xStation5

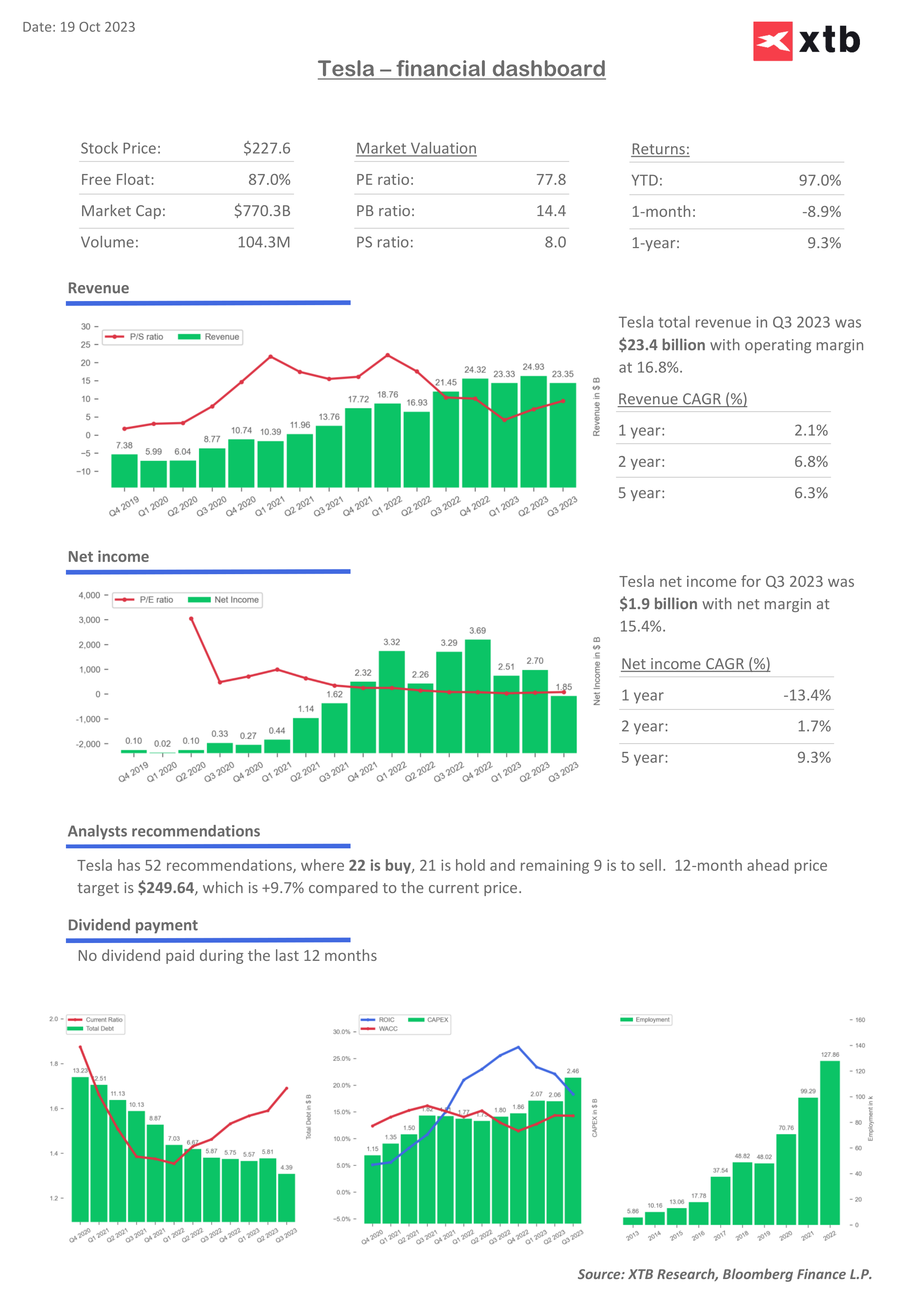

Tesla expectations and valuation

Source: XTB Research, Bloomberg Finance LP

Source: XTB Research, Bloomberg Finance LP

หุ้น Ryanair กดดันจากความตึงเครียดในตะวันออกกลาง 📉

Stock of the Week: Broadcom ขับเคลื่อนโดย AI ทำสถิติใหม่ 🚀

Market Wrap: ดัชนีหุ้นพยายามยืนรีบาวด์ แม้ราคาน้ำมันปรับตัวสูงขึ้น 🗽 หุ้น Broadcom พุ่งแรง หลังผลประกอบการและแนวโน้มธุรกิจ AI เกินคาด

📀 Coinbase และ MicroStrategy พุ่งแรง หลังทรัมป์ท้าทายธนาคารบนวอลล์สตรีท