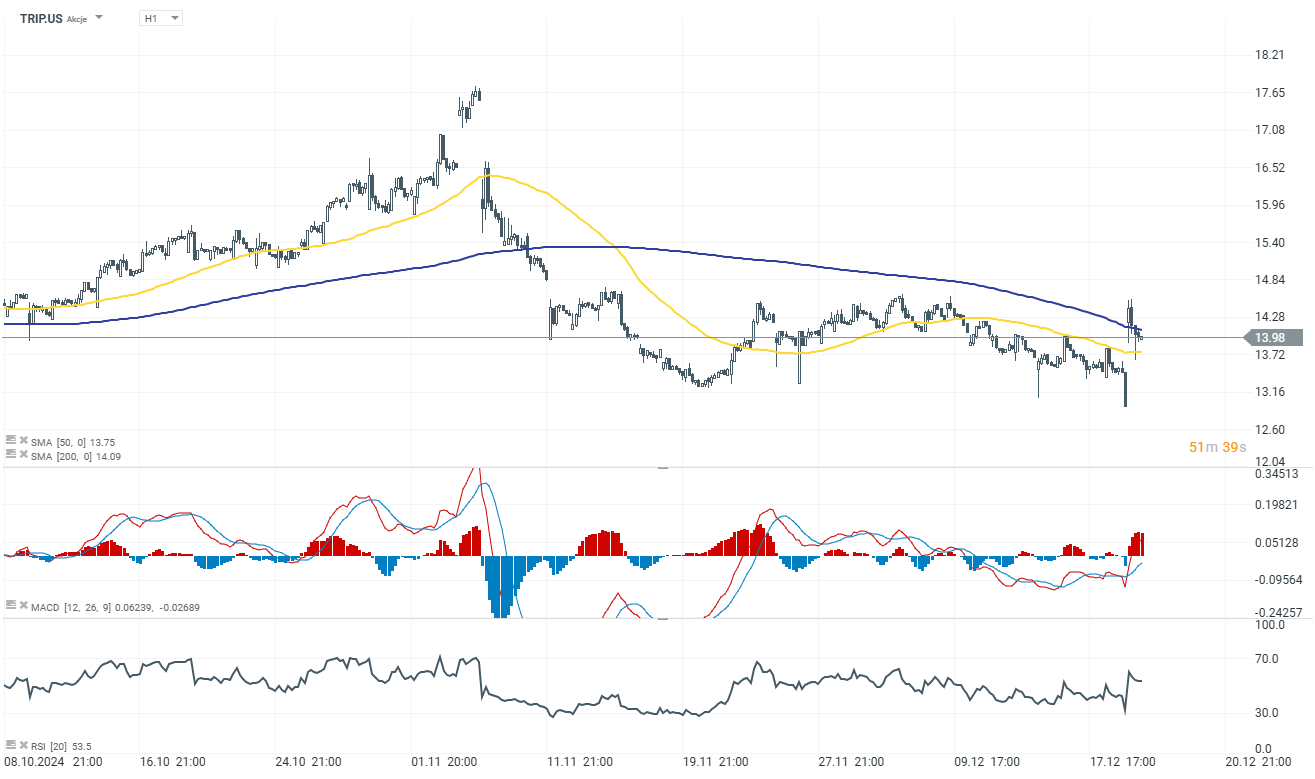

Tripadvisor has announced a $435 million deal to acquire Liberty TripAdvisor Holdings, aiming to simplify its capital structure by repaying debt, issuing stock, and making cash payments.

The transaction includes $42.5 million in cash and 3.04 million Tripadvisor shares for Series A preferred shareholders and $20 million in cash for Liberty stakeholders, while retiring $330 million in debt and about 27 million Tripadvisor shares owned by Liberty. At a purchase price of $16.21 per share, reflecting a 16% premium, the deal is expected to close in Q2 2025, pending approvals. Once finalized, Tripadvisor will operate under a single class of shares with no controlling shareholder, enhancing strategic focus.

Source: xStation 5

หุ้น Ryanair กดดันจากความตึงเครียดในตะวันออกกลาง 📉

Stock of the Week: Broadcom ขับเคลื่อนโดย AI ทำสถิติใหม่ 🚀

Market Wrap: ดัชนีหุ้นพยายามยืนรีบาวด์ แม้ราคาน้ำมันปรับตัวสูงขึ้น 🗽 หุ้น Broadcom พุ่งแรง หลังผลประกอบการและแนวโน้มธุรกิจ AI เกินคาด

📀 Coinbase และ MicroStrategy พุ่งแรง หลังทรัมป์ท้าทายธนาคารบนวอลล์สตรีท