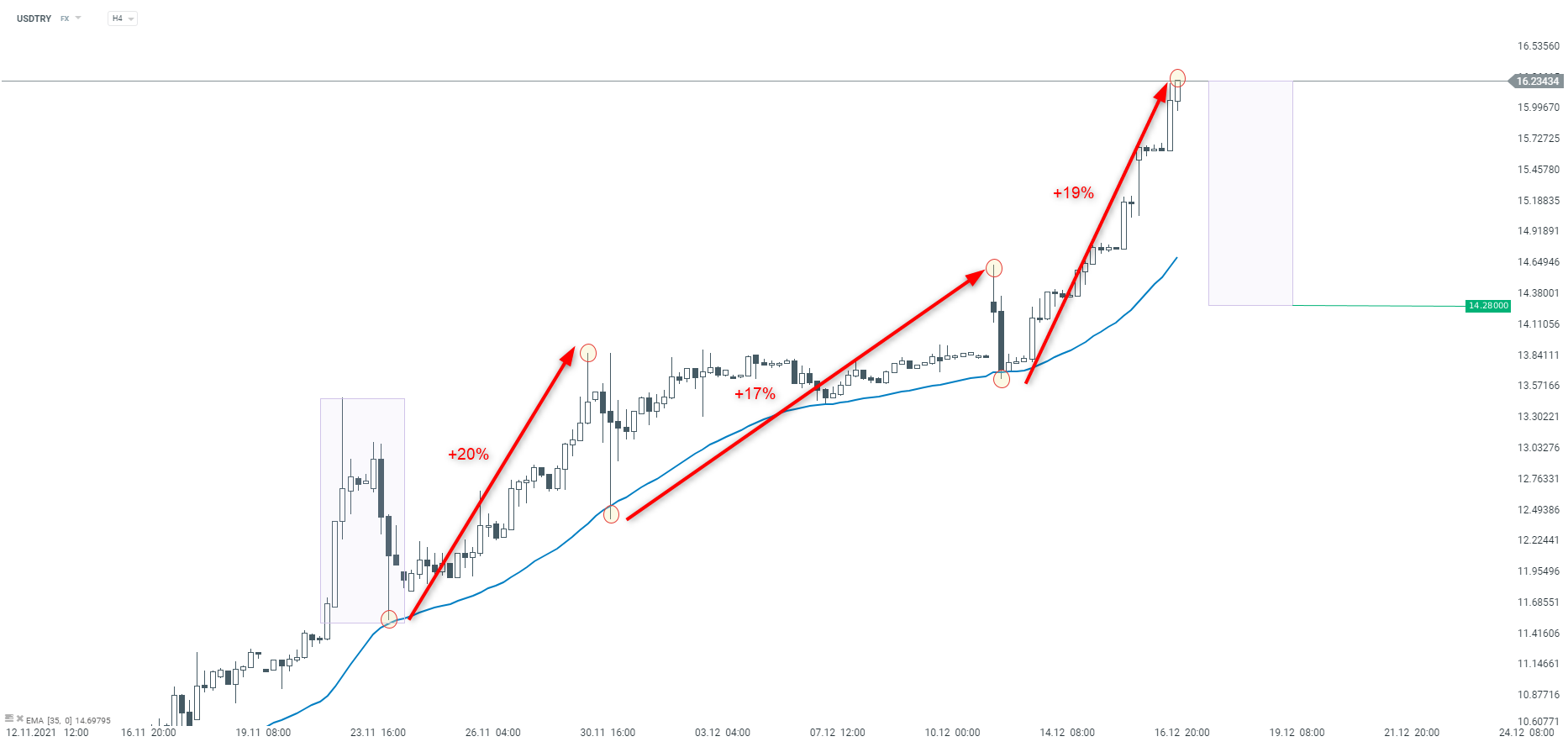

Collapse of the Turkish lira continues. Central Bank of the Republic of Turkey lowered 1-week repo rate by another 100 basis points yesterday sending lira to new record lows. While CBRT said that room for rate cuts has been used it did little to help the currency. Neither did later announcement from Erdogan that minimum wage will be increase by 50% to preserve currency value and help stabilize the economy. USDTRY jumped this morning above 16.20 while EURTRY tested 18.40.

The upward move on USDTRY is very strong and has solid fundamental backing. However, taking a look at the we can see that steep, short-term downward correction (7-10%) occurred on the pair after moves of similar size as current upward impulse. Market has quickly returned to the upward move later however.

Source: xStation5

Source: xStation5

📉 Market Wrap: เงินทุนไหลออกจากยุโรป 🇪🇺

สรุปข่าวเช้า 6 มี.ค.

ตลาดเด่นวันนี้: EURUSD

สรุปข่าวเช้า 5 มี.ค.