-

US indices trade flat after first hour of final pre-Christmas session

-

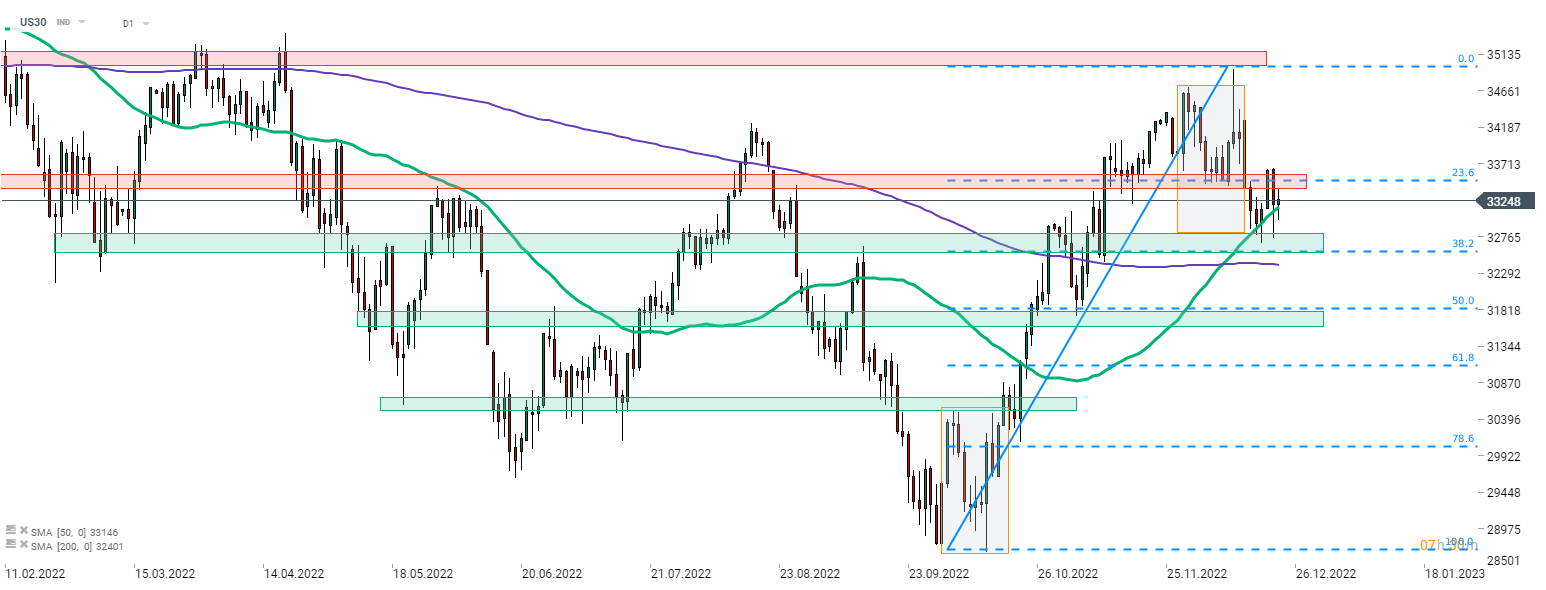

Dow Jones bounces off 50-session moving average

-

US PCE core inflation slows less than expected

US indices launched the final pre-Christmas session lower, with Nasdaq opening with the biggest bearish price gap (-0.36%). Indices dropped further after opening of the session and are now all trading 0.4-0.8% lower. Release of University of Michigan data at 3:00 pm GMT did not trigger major market moves as it was a revision to December's report. However, it is noteworthy that the headline index was revised higher from 59.1 to 59.7.

On the other hand, US index futures saw some wild moves after release of PCE inflation data for November at 1:30 pm GMT. Report showed a slowdown in headline and core price growth but it was smaller than expected. Key core PCE slowed from 5.0% to 4.7% YoY (exp. 4.6% YoY) while the headline slowed from 6.1% to 5.5% YoY. This reading, combined with yesterday's upward revision to US Q3 GDP, signals that there is still some room to tighten monetary policy further. US500 dropped 0.9% after the release before jumping 1.3%. However, this gain was also erased later on.

Dow Jones (US30) bounced off the support zone, ranging between the lower limit of the Overbalance structure and 38.2% retracement of recent upward impulse. Index launched recovery move and 50-session moving average (green line) is acting as the nearest support. Breaking and close daily candlestick below would make technical outlook more bearish. In case a deeper drop follows, 50% retracement in the 31,800 pts area will be the next support level to watch. Source: xStation5

Dow Jones (US30) bounced off the support zone, ranging between the lower limit of the Overbalance structure and 38.2% retracement of recent upward impulse. Index launched recovery move and 50-session moving average (green line) is acting as the nearest support. Breaking and close daily candlestick below would make technical outlook more bearish. In case a deeper drop follows, 50% retracement in the 31,800 pts area will be the next support level to watch. Source: xStation5

ข่าวเด่นวันนี้

US2000 ใกล้ระดับสูงสุดเป็นประวัติการณ์ 🗽 ข้อมูล NFIB แสดงอะไรบ้าง?

กราฟวันนี้ 🗽 US100 ฟื้นตัวต่อเนื่อง หลังฤดูกาลประกาศผลกำไรสหรัฐฯ

Wall Street ปรับตัวขึ้นต่อเนื่อง; ดัชนี US100 รีบาวด์มากกว่า 1% 📈