After yesterday's sharp declines, today's Wall Street opening brings a slight recovery. The main spot indices are gaining 0.60-0.70%, and futures on these indices are rebounding by over 2.00% due to contract rollovers. The dollar is slightly weakening but remains significantly above yesterday's pre-FOMC conference levels. Meanwhile, U.S. bond yields continue to rise. The strong upward trend is particularly evident in 10-year yields, which are approaching 4.56%.

US500

The US500 index lost nearly 3.00% after yesterday's Federal Reserve decision, marking its biggest one-day loss since August this year following the release of NFP data. The chart shows a precarious ascending triangle technical pattern, which typically signals a trend reversal. Yesterday's strong breakout below the lower support line may potentially indicate such a scenario is materializing. If this is the case, continued selling pressure should be expected. On the other hand, bulls are making an effort to defend the support level above 5930 points.

Source: xStation 5

Company Highlights

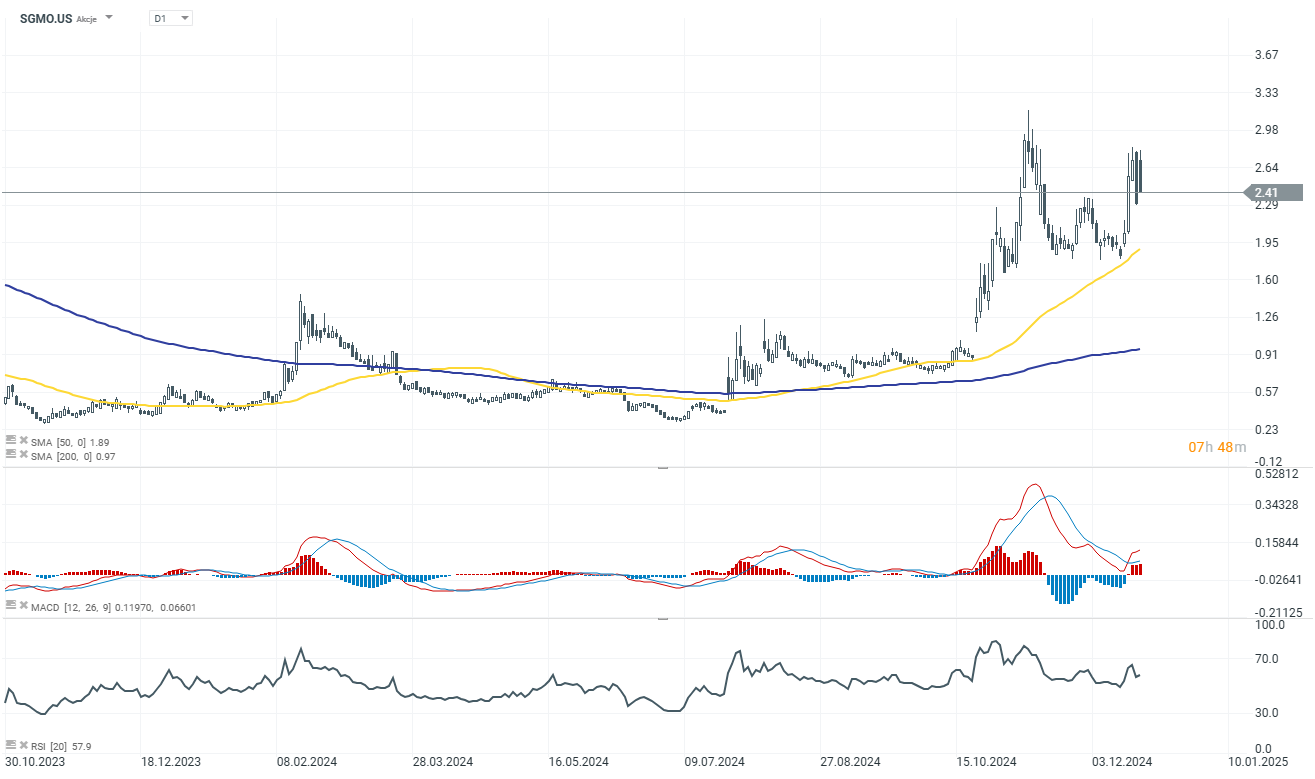

Sangamo Therapeutics (SGMO.US): Shares gained 4.30% after licensing its STAC-BBB capsid technology to Astellas Pharma for $20M upfront, up to $1.3B in milestones, and royalties, targeting neurological diseases.

Accenture (ACN.US) gains 0.70% as FQ1 results beat expectations, FY2025 revenue growth outlook was raised to 4%-7%, and plans to return $8.3B to shareholders boosted confidence.

Micron Technology (MU.US) dips 15% due to weak FQ2 guidance, with earnings ($1.33–$1.53/share) and revenue ($7.7B–$8.1B) below consensus, despite optimism for AI-driven growth.

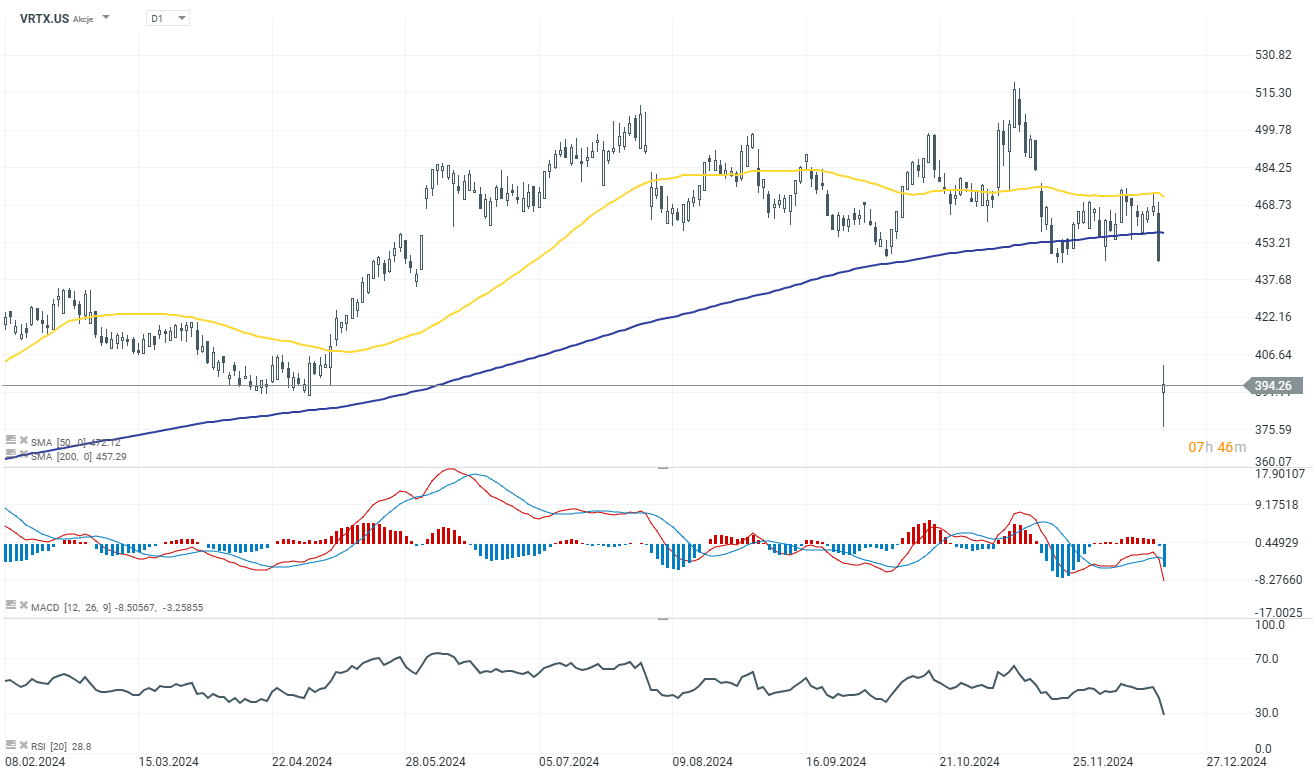

Vertex Pharmaceuticals (VRTX.US) dropped 11.85% after trial results for its pain drug suzetrigine showed similar efficacy to placebo (-1.98 vs. -2.02), raising concerns despite plans for pivotal trials.

US100 ร่วง 1.5% 📉

ข่าวเด่นวันนี้

การขายทำกำไรในปัจจุบันหมายถึงจุดจบของบริษัทควอนตัมหรือไม่?

Howmet Aerospace พุ่ง 10% หลังประกาศผลกำไร ทำมูลค่าบริษัททะลุ 100 พันล้านดอลลาร์ 📈